Wall Street has never been a place for the faint-hearted, but the recent tumultuous week revealed just how quickly market sentiment can shift, primarily due to external factors like the ongoing U.S.-China trade war. The stakes stay high as tensions continue to rise, with the White House expressing an optimistic view that China might be inclined to negotiate. However, beneath this hopeful veneer lies a reality characterized by retaliatory tariff hikes that have escalated to levels as high as 125% on U.S. imports. This precarious tug-of-war between economic powerhouses creates an unpredictable environment for investors.

In one day, we witnessed the S&P 500 amass significant gains, only to shed much of it the very next. This volatility is not merely statistical; it’s indicative of a broader economic uncertainty that gnaws at the market’s stability, reflecting the delicate balance investors must navigate. The S&P 500 managed to clock a nearly 5% increase for the week— a welcome gain, especially for those who have weathered the storm of declining stocks in recent times. But is that progress, or just a temporary respite?

The Impact on Major Financial Institutions

In the midst of stock fluctuations, larger financial institutions like Wells Fargo and BlackRock showcased the duality of market performance. On the one hand, Wells Fargo stumbled, facing a drop in share prices following disappointing quarterly earnings, making investors question the bank’s ability to weather economic downturns. Conversely, BlackRock celebrated solid earnings resulting in a stock uptick. Their contrasting performances indicate a competitive landscape where even giants can falter while others seize opportunities. It’s a clear reminder that no entity is impervious to the whims of market forces.

Despite these swings, the overarching sentiment remains largely unchanged regarding the financial sector. Investors may find solace in BlackRock’s triumph, but one must also recognize that such circumstances can quickly turn unfavorable. For those heavily invested, these dips can feel painful, reinforcing the anxiety dominating investor psychology in such volatile times. It begs the question: is holding onto these stocks still a path to prosperity, or merely a gamble in uncertain waters?

Chipmakers: The Silver Linings of a Dark Week

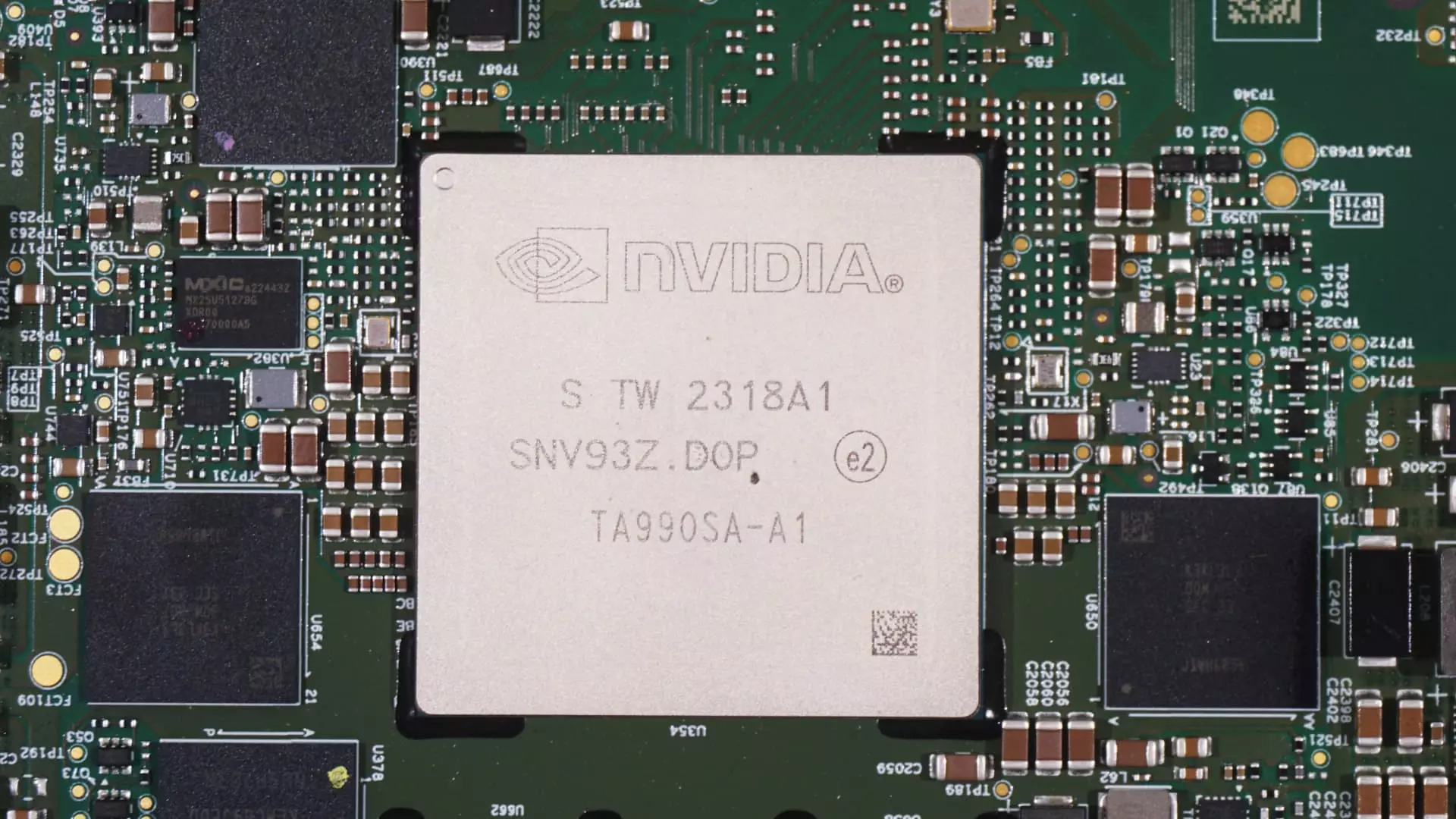

Amid the frenzy and fear, a beacon of hope emerged from an unexpected sector: semiconductor companies. Broadcom and Nvidia have exhibited resilience, significantly outperforming their peers during this chaotic week. Their substantial gains suggest a unique market dynamic that favors recovery for the hardest-hit sectors when faced with equally formidable pressures. The sheer percentage increases—22% for Broadcom and 17% for Nvidia—serve as a testament to their robustness and adaptability.

However, these companies are not immune to the harsh realities of trade policies. Both experienced a nasty hit during previous tariff announcements but rebounded swiftly when signs of negotiation emerged. Reports indicating China’s more nuanced approach to tariffs on chips based on their manufacturing locations rather than shipping origins offer a flicker of light amidst this regulation-induced gloom. It’s a glimpse into the complexities of international trade and the nuanced relationships between technological advancement and geopolitical maneuvers, where every tariff can radically shift the strategic landscape.

Market Expectations Amidst Uncertainty

As the week progresses, other earnings are yet to be announced, including those from industry stalwarts like Goldman Sachs and Abbott Labs. Analysts’ predictions and consumer data are set to significantly affect stock movements, reinforcing the erratic nature of market responses that many investors are growing weary of.

Furthermore, economic indicators such as import and export price indexes and retail sales figures will amplify the market’s inherent volatility. The anticipation of these reports is palpable, suggesting that many are holding their breath, waiting for confirmation of overall consumer health amidst economic turmoil. It creates an ironic sentiment: the very data that one would expect to provide clarity is likely to exacerbate confusion and unpredictability, leaving investors hanging on every word from the Bureau of Labor Statistics.

Navigating these waters requires strategy and keen market insight, and those partaking in the CNBC Investing Club are increasingly aware of the intertwining fates of economic indicators and stock performance. The ethos surrounding financial decision-making is shifting quickly; understanding the narratives driving price actions may become as important, if not more so, than simply evaluating historical performance. This reflective juxtaposition demands not only a traditional approach to investing but also an appreciation for the storytelling in the marketplace.

Overall, we’re witnessing a striking moment in the financial world where the intersection of policy, economic data, and market psychology reigns supreme. As uncertainty drips from each headline, smart investors will divert their gaze from mere statistics to the deeper implications those numbers represent.

Leave a Reply