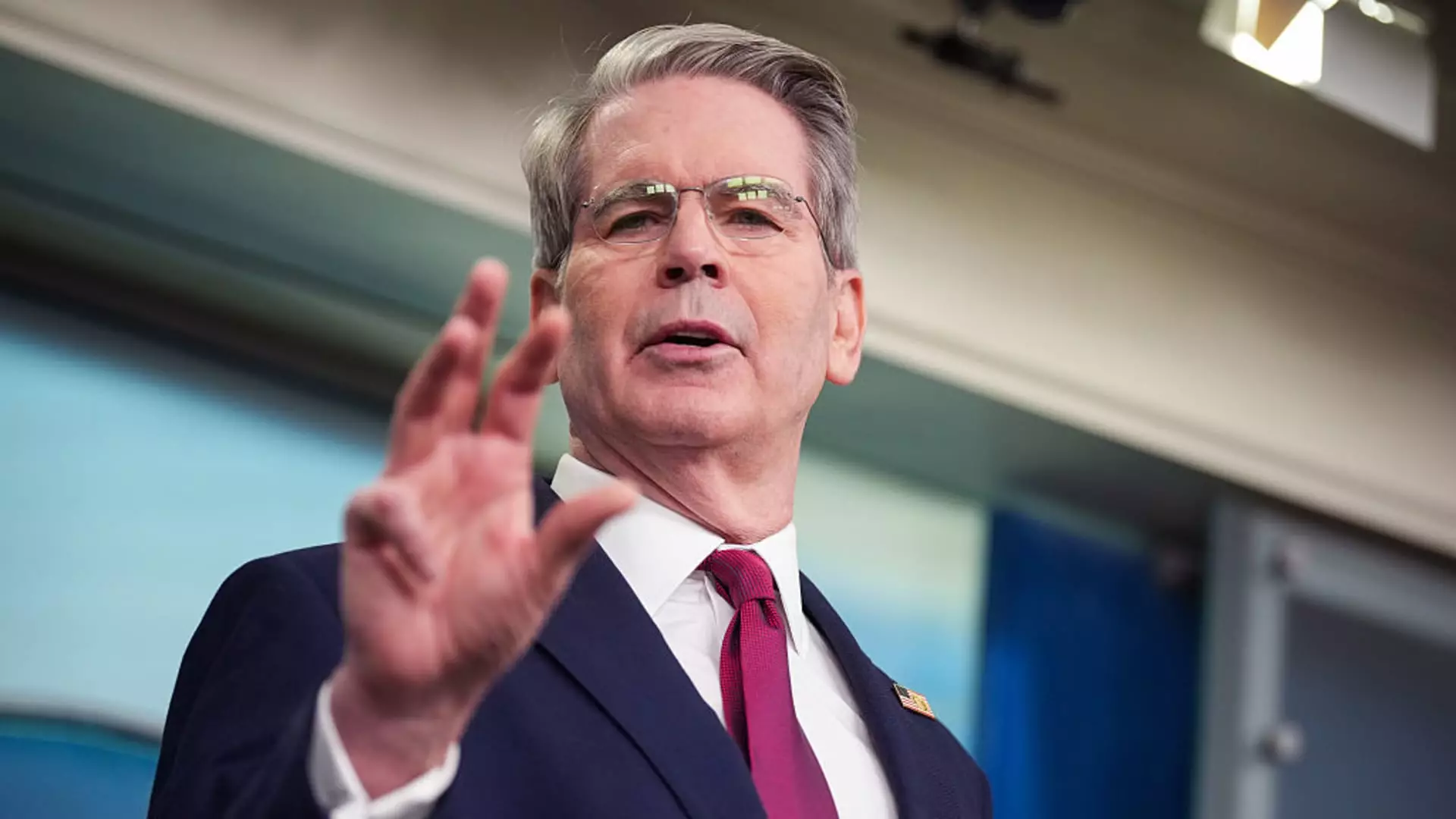

In a climate of economic uncertainty, it is astonishing to witness such stark divergence in investor behavior. As turmoil swirls around the stock market, Treasury Secretary Scott Bessent recently highlighted a remarkable trend: individual investors, as a collective group, have demonstrated steadfastness in their financial decisions. According to Bessent, a striking 97% of individual investors have refrained from making trades in the past 100 days. This statistic not only underscores a peculiar confidence but also raises questions about the rationality of such faith during turbulent times. Are individual investors genuinely optimistic about President Trump’s tariff policies, or is there a more complex psychological mechanism at play?

The Tariff Policy Dilemma

President Trump’s aggressive tariff policies represent a double-edged sword, promising to protect domestic industries while simultaneously threatening to disrupt supply chains and increase consumer prices. The recent suspension of scheduled tariff increases—the most severe in generations—sparked significant volatility, pushing the S&P 500 into bear territory for a fleeting moment. Yet, while institutional investors panicked, retail investors seemed undeterred, stepping in to buy up equities at decreased valuations. This phenomenon raises urgent questions about the nature of trust and perceived value in the current market. Individual investors may be betting on a rebound, reflecting not just faith in Trump’s policies, but perhaps an underlying belief in the enduring strength of the American economy.

Institutional Skepticism and Economic Fears

Contrasting the optimism among individual investors, institutional players are burdened with a heavier sense of dread. Their flight from the stock market and the growing trend of bearish positions suggest an informed caution driven by the tangible risks posed by Trump’s trade policies. Economists like Torsten Slok predict that the cumulative effects of tariffs could precipitate a recession by this summer, as consumers face heightened prices and diminished choices on store shelves. The looming specter of economic downturn poses not just a risk to profits but a threat to the very fabric of consumer confidence, which is the lifeblood of any capitalist economy.

The Fragile Market Ecosystem

Furthermore, the sentiments expressed by Ken Griffin, the founder of Citadel, illuminate another troubling facet of this economic saga: the potential damage to the U.S. Treasury’s reputation. When trust in government policy erodes, so too does confidence in the instruments that underpin our financial systems. Global markets thrive on predictability, and a prolonged trade war could taint the allure of U.S. debt, undermining its standing as a safe haven for international investors.

What we are witnessing is a precarious balancing act: individual investors, perhaps buoyed by a blend of optimism and ignorance, versus a more cautious institutional sector grappling with the tangible consequences of a trade policy that risks deeper ramifications for the economy. The future of this dichotomy remains uncertain; however, the implications of this economic tug-of-war reverberate far beyond stock prices.

Leave a Reply