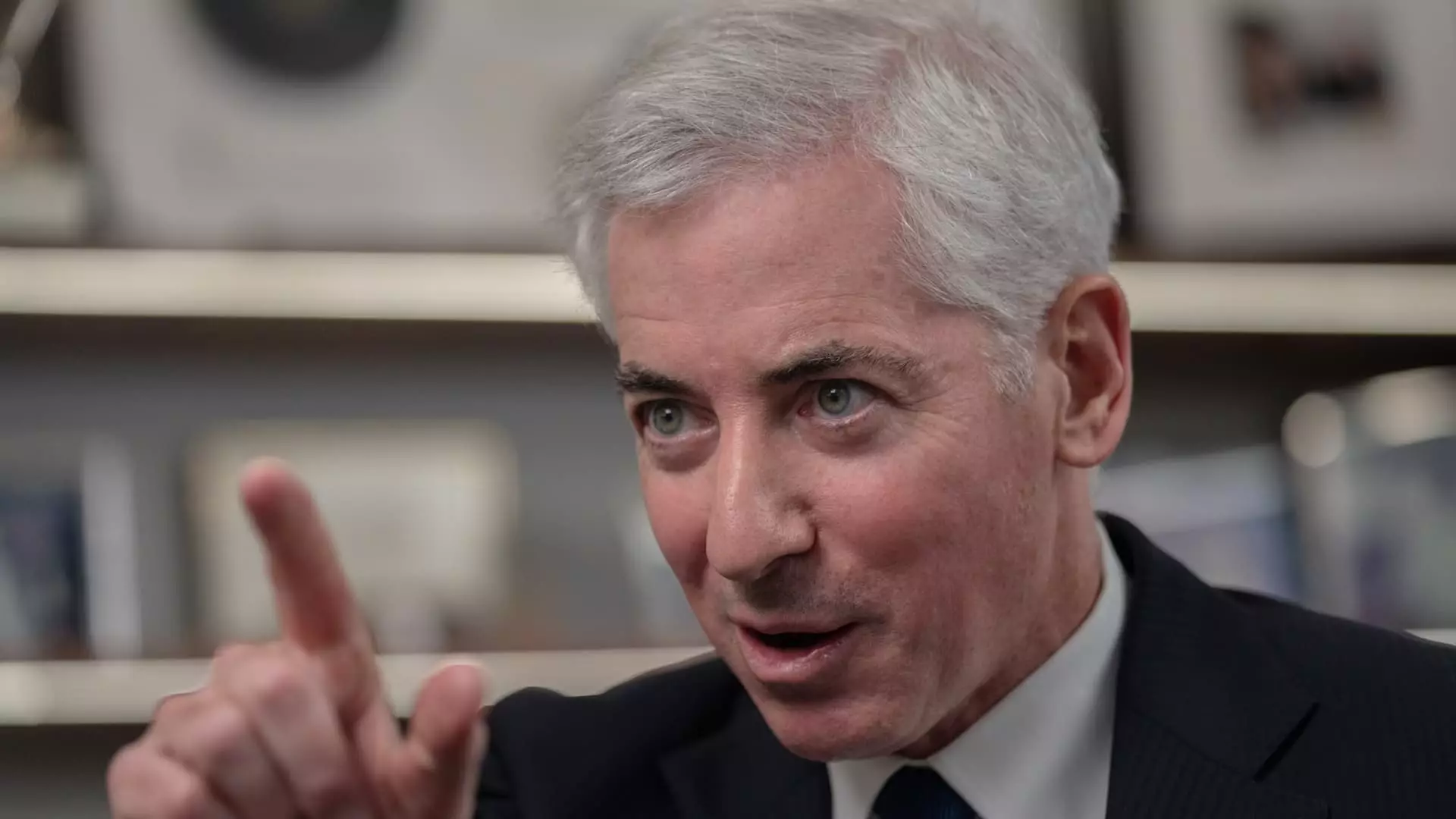

Bill Ackman’s Pershing Square USA recently made the decision to withdraw plans for an initial public offering after it became clear that investor demand was not as robust as originally anticipated. This move was unexpected, especially considering Ackman’s desire to model the offering after Berkshire Hathaway.

Despite the setback, Ackman remains undeterred and has stated that he will be back with a revised plan for the IPO in the future. Ackman’s initial goal was to raise $2 billion through the offering, a far cry from the previously speculated $25 billion. This change in plans comes shortly after a notice on the New York Stock Exchange’s website indicated a delay in the IPO process.

The decision to withdraw the IPO plans may have been influenced by Baupost Group’s choice to opt out of investing in the offering. This decision by the Boston-based hedge fund came after Ackman had mentioned Baupost Group’s participation in a letter to investors. With Pershing Square Holdings currently managing $18.7 billion in assets, the unexpected lack of investor interest presents a new challenge for Ackman.

Ackman’s decision to publicly list Pershing Square was likely motivated by a desire to capitalize on his growing popularity among retail investors. With over a million followers on social media, Ackman has been able to share his views on various topics, including the U.S. presidential election and antisemitism. However, the lackluster response to the IPO plans indicates that there may be more work to be done in order to attract investors.

While the decision to withdraw the IPO plans may have been a disappointment for Ackman and his team, it also presents an opportunity to reevaluate their strategy and come back stronger in the future. By revising their plans and addressing the challenges in fundraising, Pershing Square USA may still be able to achieve their goal of going public and expanding their investor base.

Leave a Reply