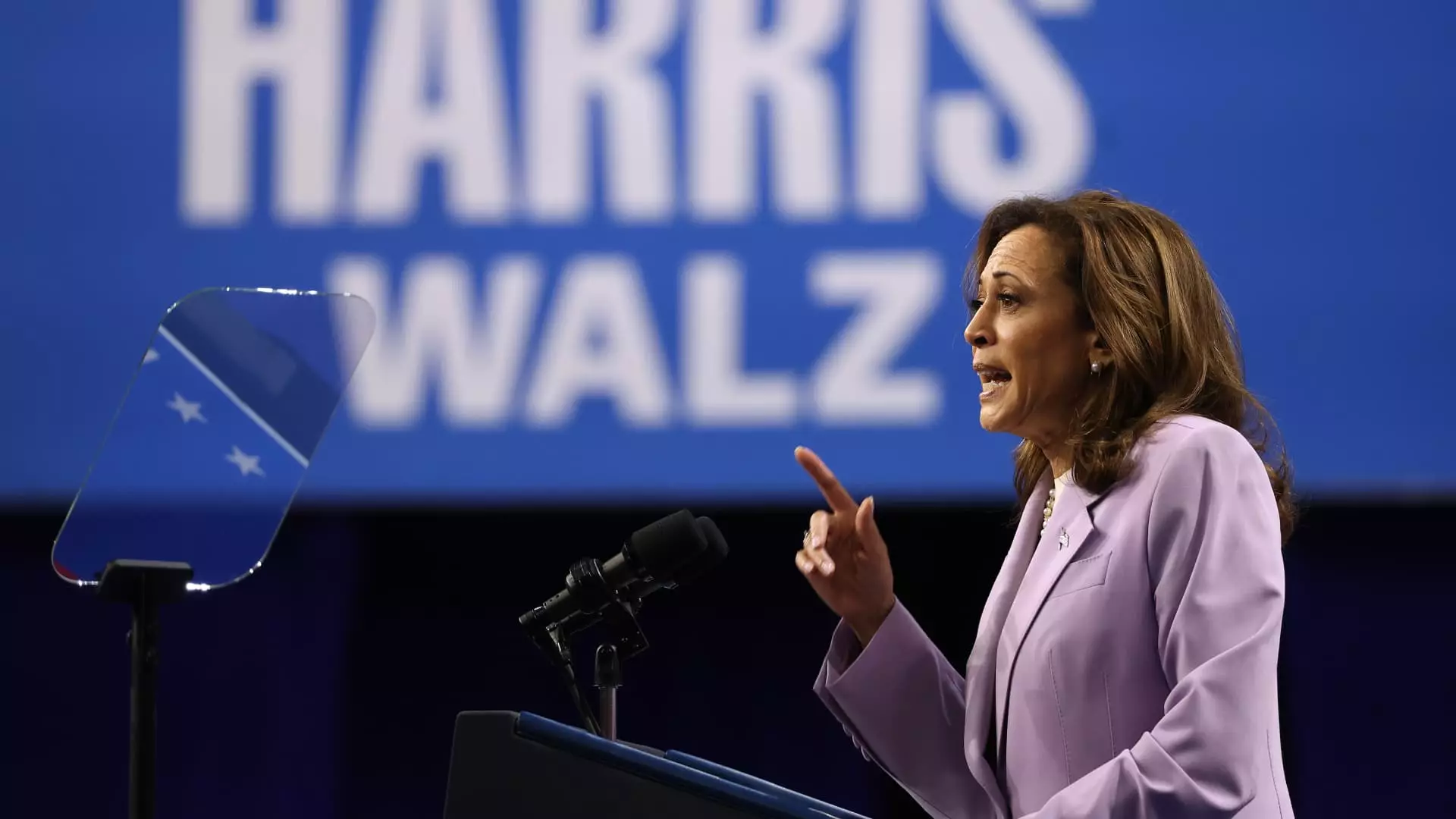

Affordable housing plays a vital role in the vision of an “opportunity economy” outlined by Vice President Kamala Harris. In a recent economic policy pitch, Harris highlighted the need to lower the costs associated with both owning and renting a home in the United States. Emphasizing the importance of increasing affordability, Harris stated that efforts should be made to facilitate easier access to homeownership. One of the key proposals in her plan involves the construction of 3 million new housing units, designed for both rent and sale, within the next four years. This initiative has been met with enthusiasm by experts in the housing sector, who believe that boosting the housing supply is essential to addressing affordability issues.

The Impact of a Housing Shortage

The aftermath of the foreclosure crisis, a period marked by widespread property seizures between 2007 and 2010, has led to a significant decline in the construction of new single-family homes and multi-family rental buildings. As a result, there is an acute shortage of affordable housing in the market, affecting both renters in search of quality housing and first-time buyers. Recognizing this shortfall, Harris aims to introduce a “first-ever tax incentive” for homebuilders who sell starter homes to first-time buyers, thereby encouraging the creation of affordable housing units. This proposal aligns with bipartisan efforts to increase the housing supply and enhance affordability.

While Harris’ plan has garnered support from various quarters, some critics remain skeptical about its effectiveness. Edward Pinto, a senior fellow at the American Enterprise Institute, has expressed reservations about the proposal, arguing that it may not address the underlying challenges in the housing market. Pinto believes that demand-driven initiatives would be more effective in boosting homebuying activity, as opposed to purely focusing on the supply side. His concerns highlight the diverse perspectives within the housing policy landscape, underscoring the complexity of addressing affordability issues.

One of the key challenges in Harris’ housing plan is defining what constitutes a “starter home.” James Tobin, CEO of the National Association of Home Builders, has pointed out the difficulties in establishing a clear definition due to the varying costs associated with home construction. Factors such as labor expenses, land prices, borrowing costs, and material costs contribute to the complexity of building affordable homes. Moreover, the definition of a starter home may vary significantly across different regions, with prices ranging from $250,000 in some areas to $800,000 in others. Addressing these disparities will be crucial in ensuring the success of Harris’ proposals.

The Role of Local Innovation in Housing Solutions

Harris’ plan includes a $40 billion innovation fund aimed at empowering local governments to develop housing solutions tailored to their communities. While the fund seeks to drive innovation at the local level, some experts question its effectiveness in achieving the desired outcomes. Daryl Fairweather of Redfin highlights the limited authority of the federal government over local planning decisions, suggesting that incentives alone may not stimulate the creation of more housing. Additionally, the high cost of the innovation fund raises concerns about its feasibility and bipartisan support, with critics pointing out the potential challenges of securing funding approval in Congress.

Ensuring Equitable Access to Homeownership

In a bid to support first-time homebuyers, Harris has proposed offering $25,000 in down-payment assistance to individuals who have maintained a timely rent payment record for two years. This initiative aims to expand access to homeownership, particularly for first-generation buyers and qualifying applicants. However, the lack of bipartisan support for such programs poses a significant obstacle to their implementation. Sen. Tim Scott has raised concerns about the potential impact of increased demand on housing prices, urging policymakers to embed financial literacy components in assistance programs to prevent defaults and ensure sustainable homeownership.

Legislative Initiatives to Address Rental Housing Concerns

In addition to proposals focused on homeownership, Harris has called for legislative action to protect renters from predatory practices. Two pending bills, the Stop Predatory Investing Act and the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, seek to address issues related to large-scale property investment and price manipulation in the rental market. By advocating for measures that safeguard renters’ rights and promote fair market practices, Harris aims to create a more equitable housing landscape for all Americans.

The quest for affordable housing remains a pressing issue in the U.S., with policymakers like Kamala Harris striving to enact reforms that prioritize accessibility and affordability. While Harris’ proposals have sparked debate and raised valid concerns, they underscore the urgent need for comprehensive housing policies that address the diverse needs of individuals and communities nationwide. By engaging in constructive dialogue and exploring innovative solutions, legislators can work towards creating a more inclusive and sustainable housing environment for all.

Leave a Reply