MongoDB saw a significant increase in its shares, rising up to 16% in extended trading following the release of their fiscal second-quarter earnings report. The company reported adjusted earnings per share of 70 cents, surpassing analysts’ expectations of 49 cents per share. Additionally, MongoDB’s revenue for the quarter reached $478.1 million, slightly exceeding the projected $464.1 million. The 13% year-over-year revenue growth demonstrates the company’s strong performance in the database software market.

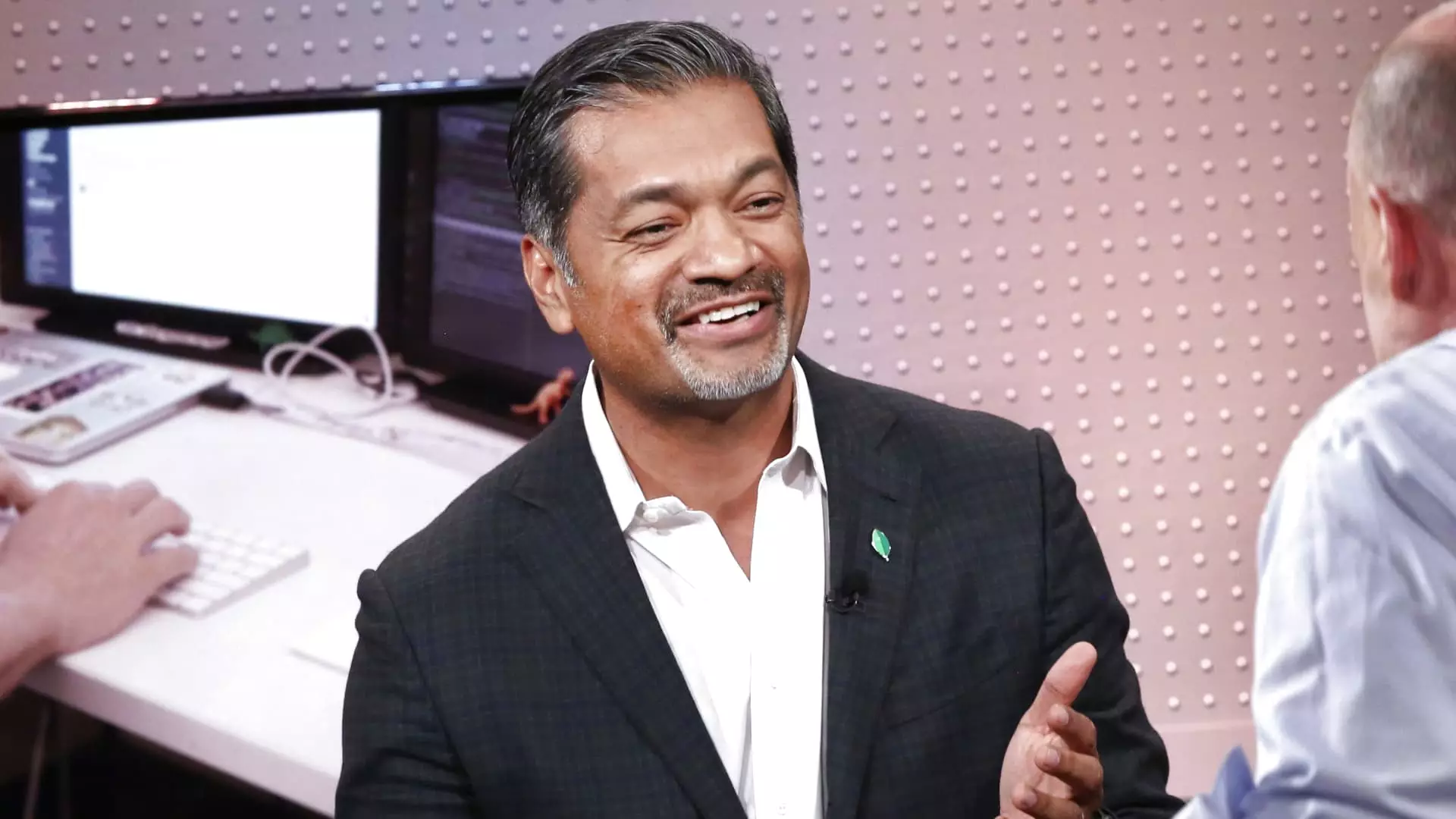

CEO Dev Ittycheria expressed confidence in MongoDB’s ability to assist customers in integrating generative AI into their businesses and modernizing their legacy application estate. The positive outlook on the company’s Atlas cloud database service, with better consumption rates than anticipated, showcases MongoDB’s commitment to meet and exceed customer expectations. Ittycheria’s remarks on the company’s ability to secure new business amidst challenging economic conditions demonstrate MongoDB’s resilience in the market.

Comparative Analysis with Elastic

In contrast to MongoDB’s positive earnings report, search software maker Elastic faced challenges in closing client commitments during its fiscal first quarter, resulting in a 23% drop in its stock price after hours. MongoDB’s mention of helping companies transition from Elastic products highlights its competitive edge and market positioning. The company’s ability to outperform competitors and continue to grow its client base is a testament to its strategic approach and robust offerings.

MongoDB’s upward revision of its full-year guidance further reinforces its strong financial performance. The company raised its fiscal 2025 forecast, now anticipating adjusted earnings per share of $2.33 to $2.47 and revenue of $1.92 billion to $1.93 billion. This adjustment, up from the previous guidance of $2.15 to $2.30 in adjusted earnings per share and $1.88 billion to $1.90 billion in revenue, indicates MongoDB’s continuous growth and market expansion. Analysts’ predictions align with MongoDB’s optimistic outlook, with expectations of $2.26 per share in earnings and $1.90 billion in revenue

Concluding Remarks

Despite seeing a decline in its shares earlier in the year, MongoDB’s strong fiscal second-quarter earnings report and revised full-year guidance demonstrate the company’s resilience and growth potential in the competitive database software market. With a focus on innovation, customer satisfaction, and strategic positioning against competitors like Elastic, MongoDB remains a key player to watch in the tech industry.

Leave a Reply