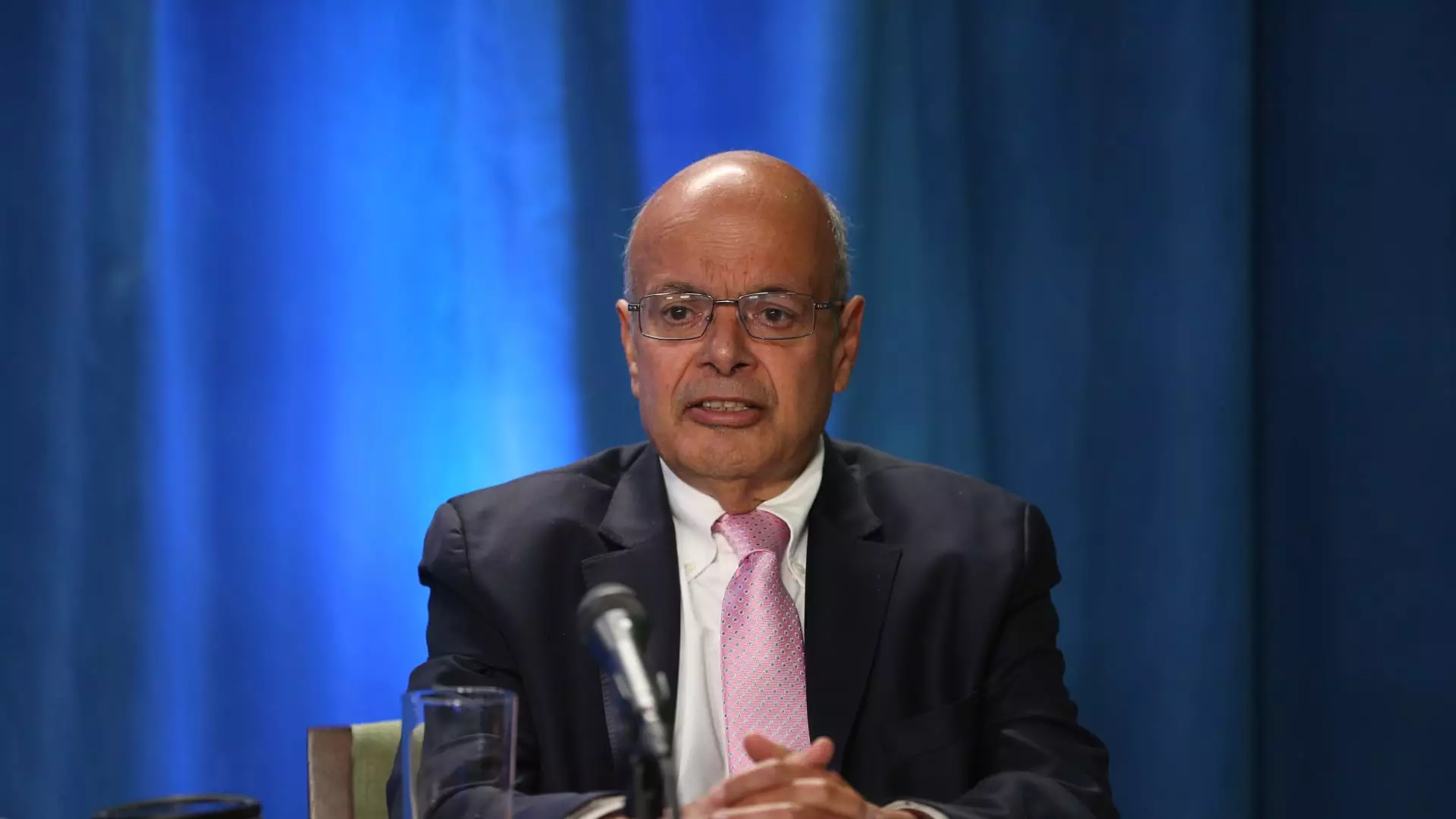

In a surprising turn of events, Ajit Jain, vice chairman of insurance operations at Berkshire Hathaway, has sold a substantial portion of his shares in the conglomerate. This decision has raised eyebrows in the investment community and sparked discussions about the motivations and implications behind such a move. On a recent Monday, Jain relinquished 200 shares of Berkshire Class A stock, earning approximately $139 million at an average selling price of $695,418 each. Following this transaction, Jain’s personal holdings dwindled to 61 shares, while family trusts and his nonprofit, the Jain Foundation, possess 105 additional shares combined.

This marked a staggering 55% decrease in Jain’s total stake, making it the largest reduction in his 37-year tenure with Berkshire. Such a significant sale from such a high-ranking executive is rare, prompting speculation about whether this reflects Jain’s assessment of the company’s current valuation or broader market conditions.

The backdrop of Jain’s sale is set against Berkshire Hathaway’s recent performance in the stock market. In August, the conglomerate crossed a remarkable $1 trillion in market capitalization, driven by share prices that surpassed $700,000, a notable high watermark for the company. Observers such as David Kass, a finance professor at the University of Maryland, have interpreted Jain’s sale as an indication he believes Berkshire’s shares may now be overvalued. This notion aligns with the observed slowdown in Berkshire’s stock buyback activity. In the second quarter, buybacks totaled only $345 million, a stark contrast to the over $2 billion repurchased in the preceding quarters.

Bill Stone, the Chief Investment Officer at Glenview Trust Company and a stakeholder in Berkshire, echoed these sentiments, remarking that the shares, currently trading at 1.6 times book value, suggest a valuation that is consistent with Buffett’s conservative estimates of intrinsic value. Investors are generally wary of companies trading at elevated valuations, and Jain’s actions may reflect a prudent strategy of taking profits while the market remains robust.

Ajit Jain is a pivotal figure in Berkshire Hathaway’s operations and reputation, contributing significantly to its dominance within the insurance and reinsurance sectors. Since joining the company in 1986, Jain has driven Berkshire’s expansion into reinsurance markets and has been instrumental in the remarkable revival of Geico, which remains one of the company’s key assets. His promotion to vice chairman of insurance operations in 2018 underscored his invaluable role within the organization. Warren Buffett, the company’s legendary CEO, has publicly acknowledged Jain’s immense contributions, stating that he has generated tens of billions of dollars in value for shareholders.

Given Jain’s proven track record, his recent share sale has compelled many to ponder whether it may signal a shift in view concerning the company’s long-term strategies, particularly regarding its insurance division. With Berkshire Hathaway experiencing operational success under Jain’s leadership, any significant alteration in his financial commitment could suggest a complex calculus regarding future business prospects.

Speculation surrounding Berkshire’s leadership has often included the eventual roles Jain and fellow vice chairman Greg Abel may play in the future. There were whispers that Jain could potentially assume the top role in a post-Buffett scenario. However, Buffett himself has dispelled these rumors, confirming that Jain has no desire to steer the company. This clarification reinforces Jain’s commitment to driving value within the bounds of his current role, ensuring the company’s legacy while preparing for a prolonged transition of leadership.

As Berkshire Hathaway navigates its course in an evolving economic landscape, it remains essential for shareholders and analysts alike to keep a watchful eye on substantial movements such as Jain’s sell-off. The insights gleaned from such actions can serve as valuable indicators of broader market trends or emerging company sentiments, particularly as a venerable figure like Ajit Jain recalibrates his stake in one of the most respected investment portfolios in the world. Ultimately, Jain’s sale may be less a sign of declining confidence and more a calculated response to a market environment that has, to put it mildly, entered a new phase.

Leave a Reply