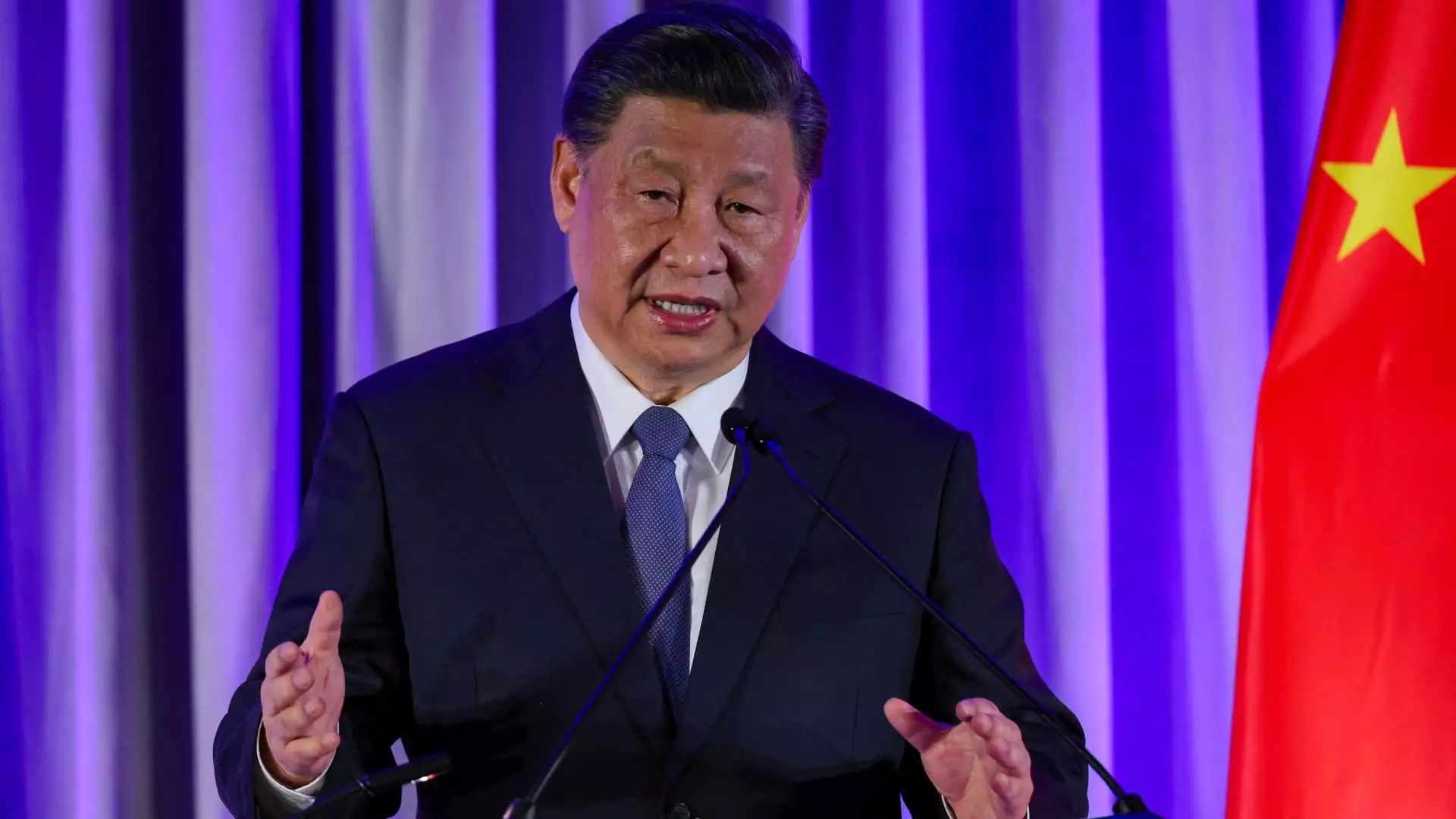

The health of China’s real estate sector is a critical talking point, not only for the country’s economy but also for its social stability. After years of rapid growth, the sector faces a downturn that has raised alarms among policymakers. Most recently, during a high-level Politburo meeting led by President Xi Jinping, the determination to combat this housing slump became abundantly clear. The meeting underscored a strategic pivot aimed at stabilizing and gradually rejuvenating the property market, highlighting the urgent need to address the economic challenges that stem from this vital sector.

Chinese leaders have indicated a range of measures aimed at reversing the declining trajectory of the real estate market. A readout from the Politburo meeting revealed that fiscal and monetary support mechanisms would be bolstered. This reiteration of policy commitment signifies an awareness of the ripple effects a stagnant property market has on local governments, household wealth, and broader economic indicators. Real estate once represented over a quarter of China’s GDP, and a contraction in this sector inevitably raises concerns about achieving the government’s overall economic growth target of around 5% for the year.

As markets globally react to shifts in polices, the Chinese stock market, particularly in real estate equities, has shown a positive response. A surge of nearly 12% in property stocks provides a temporary buffer against persisting investor fears. Analysts, however, caution against optimism, noting that actual recovery will depend on the timely implementation of effective fiscal measures. The recent trend of declining real estate sales is evident, with the value of new homes sold exhibiting a 23.6% decrease year-to-date. This sharp fall amplifies the urgency for policy interventions designed not merely to halt the downturn but to stimulate new activity.

The Politburo meeting also emphasized adjustments to interest rates and the facilitation of loans for selected projects, indicating a targeted approach towards revitalizing the market. With the People’s Bank of China poised to lower mortgage payments significantly, there could be a tangible easing of financial burdens for homeowners. Yet, the ultimate goal articulated by economic experts is not simply improving asset values but more significantly stimulating consumer activity in the housing sector.

Yue Su, a principal economist, highlighted that stabilizing the housing market is essential for encouraging consumer confidence, suggesting the importance of breaking the “wait-and-see” mindset of potential buyers. Limiting the growth in housing supply could, paradoxically, stabilize prices while still encouraging purchases, steering clear from creating an unsustainable wealth effect. These nuanced approaches indicate an increased focus on enabling sustainable growth by balancing immediate recovery with long-term structural reforms.

For years, the Chinese government has grappled with balancing high-speed economic growth with sustaining a manageable level of debt, particularly among property developers. The heavy-handed regulatory measures introduced in 2020 aimed to curtail excessive borrowing have subsequently stifled the real estate sector, challenging local government revenues and household equity. Emerging reports suggest that while year-on-year declines in home prices have improved slightly, the economic landscape remains challenging.

Policymakers face the difficult task of transitioning from an aggressive growth model to one anchored in higher-quality economic development. The Politburo’s action signals a readiness to adopt a more pragmatic approach—one that signifies acceptance of growth rates potentially falling below the 5% target as structural changes unfold. Analysts from various financial groups are adjusting their growth forecasts in light of the current economic climate, with estimates now reflecting a modest growth rate of approximately 4.7% in 2024.

The landscape of China’s real estate market is fraught with challenges, but recent meetings among top leaders reveal a commitment to reversing this trend. While the visual signals from stock markets appear encouraging, the underlying economic indicators suggest that substantial work remains to be done. The meeting highlighted the need for a balanced approach—integrating immediate stimulus efforts with longer-term strategies focused on economic quality rather than mere expansion. As China continues to navigate this turbulent economic terrain, its ability to implement adaptive and thoughtful economic policies will be crucial in shaping the future trajectory of its real estate market and overall economic health.

Leave a Reply