Costco, a longstanding giant in the wholesale retail sector, is making significant inroads into the lucrative precious metals market. With its latest addition of Swiss-made platinum bars, the retailer is diversifying its bullion offerings, placing its gold and silver products alongside platinum options. This strategic move has elucidated Costco’s ambition to attract both seasoned investors and casual consumers who are increasingly interested in tangible assets, especially amid fluctuating economic climates.

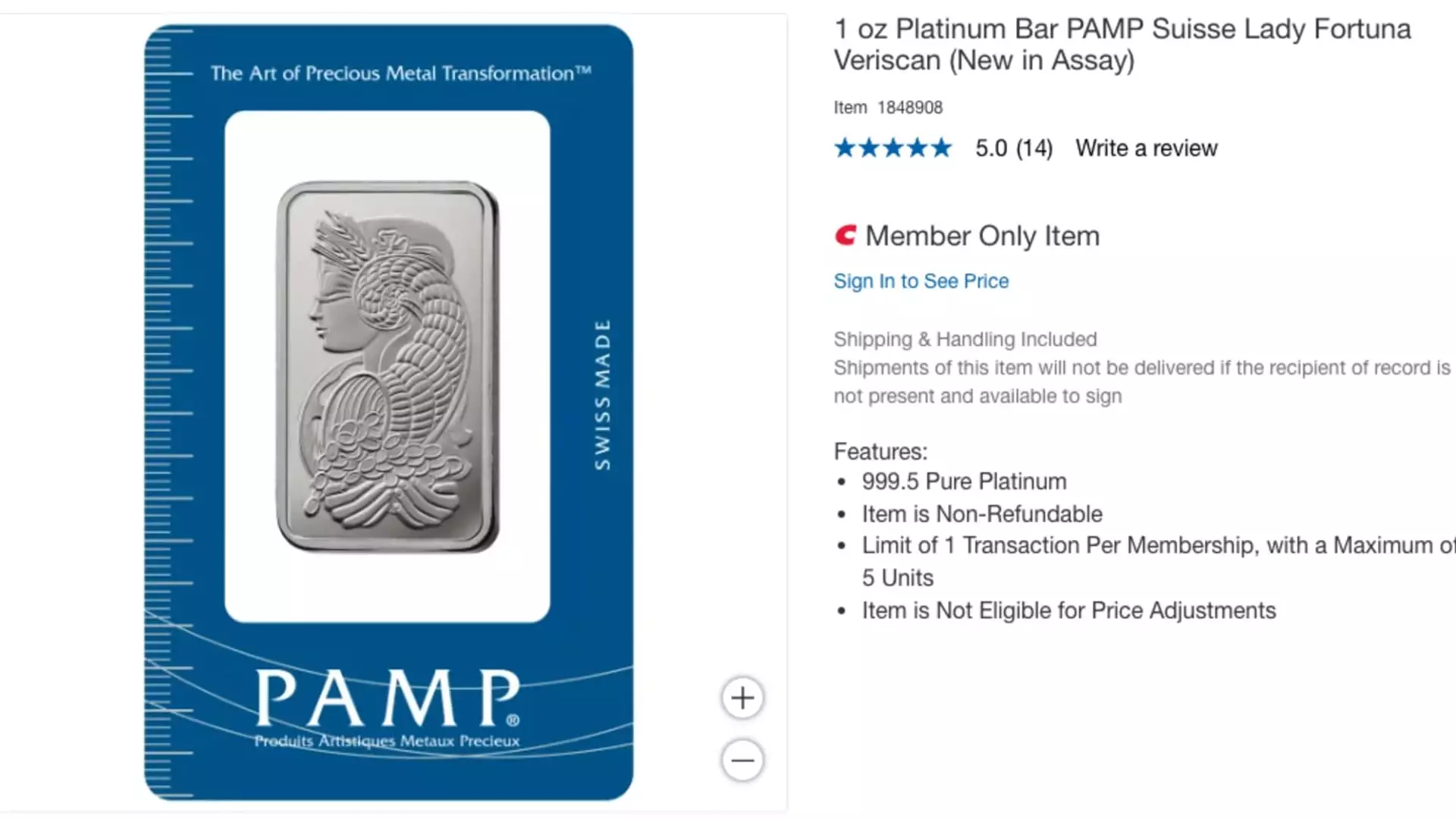

On a recent Wednesday, Costco announced the availability of 1-ounce platinum bars priced at $1,089.99, emphasizing exclusivity as these items are only to be purchased online. However, potential buyers face the constraint of regional limitations, as shipping is not available to states like Louisiana, Nevada, or Puerto Rico. Moreover, a Costco membership—ranging from $65 to $130 annually—is mandatory for any transaction. This exclusivity may foster a sense of urgency, while also catering to a consumer base already inclined toward premium purchases.

The company’s entry into platinum follows its successful introduction of gold bars in August 2023. The gold bars quickly gained attention, often selling out within hours upon restock. Analysts have noted that Costco’s gold sales have skyrocketed, with estimates suggesting the company is moving approximately $200 million of gold bars each month. Richard Galanti, Costco’s previous CFO, highlighted the popularity of these offerings during an earnings call, indicating robust demand and limited supply as factors propelling sales.

Gold and platinum have distinct market dynamics, though both serve as attractive investment options for those looking to hedge against inflation and economic instability. Over the last year, the value of gold has surged by over 40%, with a remarkable increase of more than 70% in the past five years. In contrast, the trajectory of platinum has been more volatile; it gained roughly 15% in the past year but has seen a decline of over 8% since peaking just above $1,100 earlier in 2024. This stark contrast shows the challenges and opportunities within the precious metals market that Costco is navigating.

With its successful foray into the precious metals domain, Costco might just be at the forefront of a growing trend among retailers. The strategic pivot suggests that the wholesaler understands the changing consumer behavior towards tangibles. As more individuals seek to invest in durable assets amidst market uncertainties, Costco’s premium selections could reshape how consumers perceive wholesale shopping. Moreover, as the company continues to expand its offerings, it may catalyze a shift in the traditional investment landscape, attracting both experienced investors and novices alike.

Costco’s foray into platinum is not merely a new sales opportunity but a reflection of a significant shift in consumer investment patterns. By harnessing the allure of precious metals, Costco is poised to augment its market dominance while satisfying an increasing appetite for alternative investments. The unique combination of high-quality products and membership exclusivity could very well redefine the retail experience, highlighting Costco’s adaptability in a rapidly evolving economic landscape. In the coming months, it will be interesting to observe how this trend unfolds and whether Costco will expand its offerings further or establish itself as a staple provider in the precious metals arena.

Leave a Reply