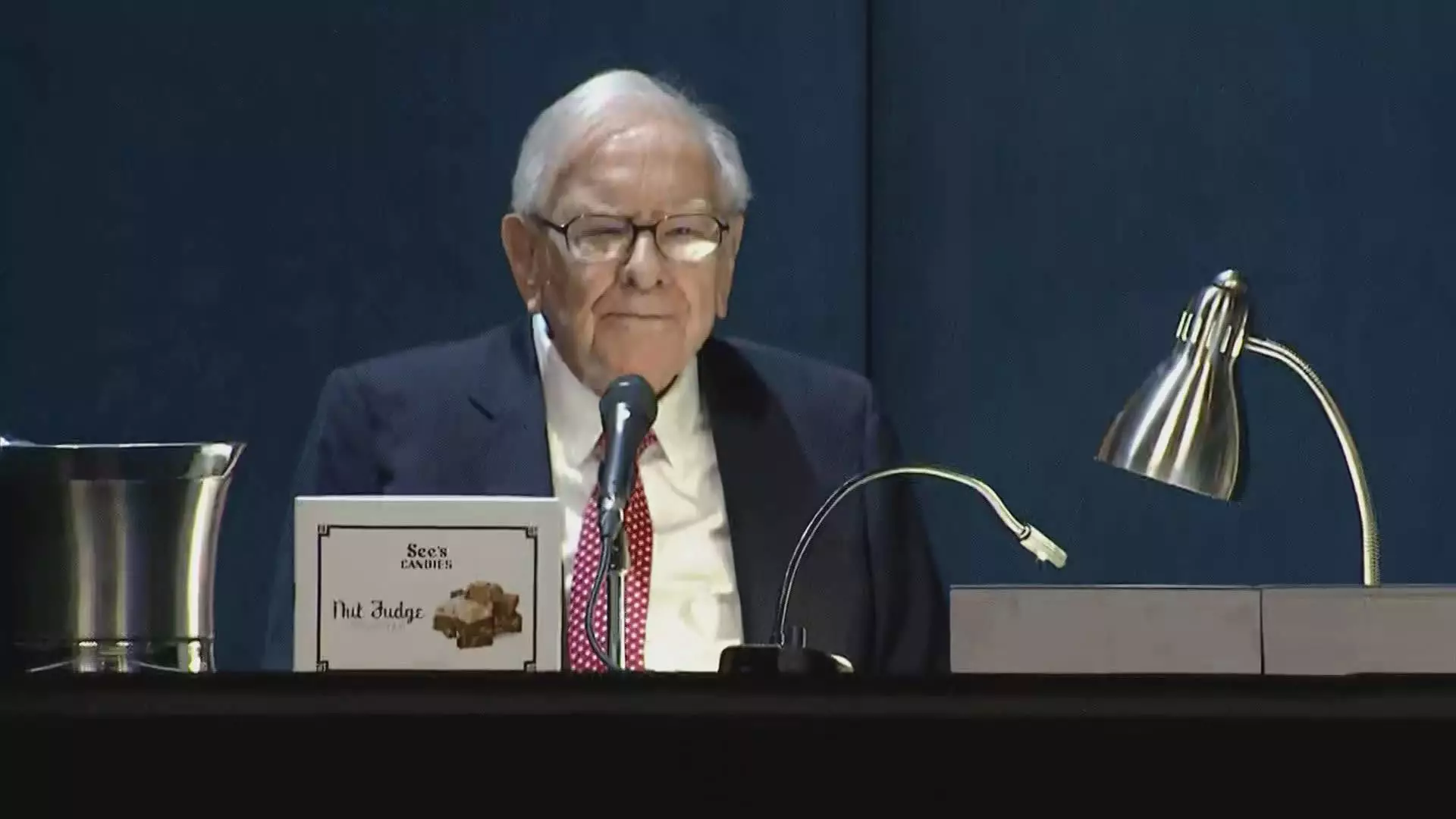

Warren Buffett, revered as one of the most successful investors in history, has made headlines yet again by significantly reducing Berkshire Hathaway’s investment in Apple. For four consecutive quarters, this renowned investor has been scaling back on what was once his largest equity position. As reported in Berkshire’s third-quarter earnings, Buffett now possesses approximately $69.9 billion worth of Apple shares, indicating that he has divested about a quarter of his total stakes, leaving him with around 300 million shares.

This recent divestment starkly contrasts with the previous year, where Berkshire’s Apple stakes stood robust at the end of the third quarter, showcasing a dramatic 67.2% decrease. Such a profound reduction signifies not merely a tactical maneuver but could reflect a broader reevaluation of investment strategy within the company.

Buffett’s consistent offloading of Apple shares since late 2023 raises questions about the underlying motivations for these transactions. Market analysts propose several hypotheses, ranging from the potential of inflated valuations to a strategic imperative for risk diversification. Berkshire Hathaway’s once-massive holdings in Apple were so substantial that they represented half of its equity investments—an unhealthy concentration that typically warrants adjustment.

During the 2023 Berkshire annual meeting, Buffett insinuated that the selling could, in part, be preemptive action regarding potential tax reforms that might elevate capital gains taxes, suggesting a calculated approach to mitigate financial liabilities in the future. Nevertheless, given the scale of his sales, there is a prevailing debate among stakeholders whether there are additional catalysts triggering this retreat from a company that had previously captured Buffett’s admiration for its customer loyalty and innovative technology.

Warren Buffett’s relationship with technology companies has historically been cautious. For decades, he avoided the tech sector entirely, suggesting that it lay beyond his realm of expertise. However, his investment in Apple marked a significant pivot—one that ventured into a domain that had previously seemed daunting. The decision to invest in Apple wasn’t just a whimsically adopted trend; rather, it stemmed from Buffett’s recognition of the brand’s stellar market positioning and consistent consumer demand.

Following this massive exit from Apple, questions arise regarding whether Buffett’s retreat signals a broader withdrawal from technology altogether or simply a realignment of portfolio priorities. A noteworthy point is that while Buffett has reduced his stake significantly, Apple’s stock performance remains positive, with an increase of 16% over the year. This rise, however, does not meet the S&P 500’s robust 20% gains, which might reinforce feelings of apprehension about sustained investment prospects.

In light of this ongoing reduction in the tech giant’s shares, it’s essential to recognize that Berkshire Hathaway’s cash reserves have swelled to a historic peak of $325.2 billion during the same quarter. This cash hoard armors the conglomerate against economic fluctuations but also raises eyebrows regarding potential future investments or strategic acquisitions. Concurrently, the pause in stock buybacks illustrates a cautious approach by Buffett as he navigates challenging market dynamics.

Warren Buffett’s recent decisions concerning Apple underscore an intricate blend of strategic foresight, market awareness, and a willingness to pivot his investment tactics. As investors continue to watch this narrative unfold, the implications of Buffett’s actions will undoubtedly ripple throughout the investment community.

Leave a Reply