The financial landscape of startup investments is undergoing significant transformation, propelled by the increasing engagement of family offices. These private investment entities, closely held and typically run by wealthy families, have emerged as formidable players in venture capital, often overshadowing traditional investment channels. Recent analyses reveal that a select group of family offices is leading the charge, strategically diversifying their portfolios across various sectors such as biotechnology, energy, and artificial intelligence. This article explores the implications of this trend, highlighting notable family offices and their investment strategies.

In 2024, a comprehensive analysis by CNBC and Fintrx identified the top ten family offices that have taken notable strides in startup investments. Collectively, these entities have made over 150 investments, signifying an unprecedented level of activity within this discreet yet influential sector. Among these, Maelstrom, the family office founded by Arthur Hayes, co-founder of the cryptocurrency exchange BitMEX, stands out as the most active. With 22 investments primarily in blockchain technology, Maelstrom underscores the growing appetite for digital assets among family offices. The nature of these investments—focused on innovative startups within the blockchain sphere—suggests a calculated approach to capitalize on the expanding digital economy.

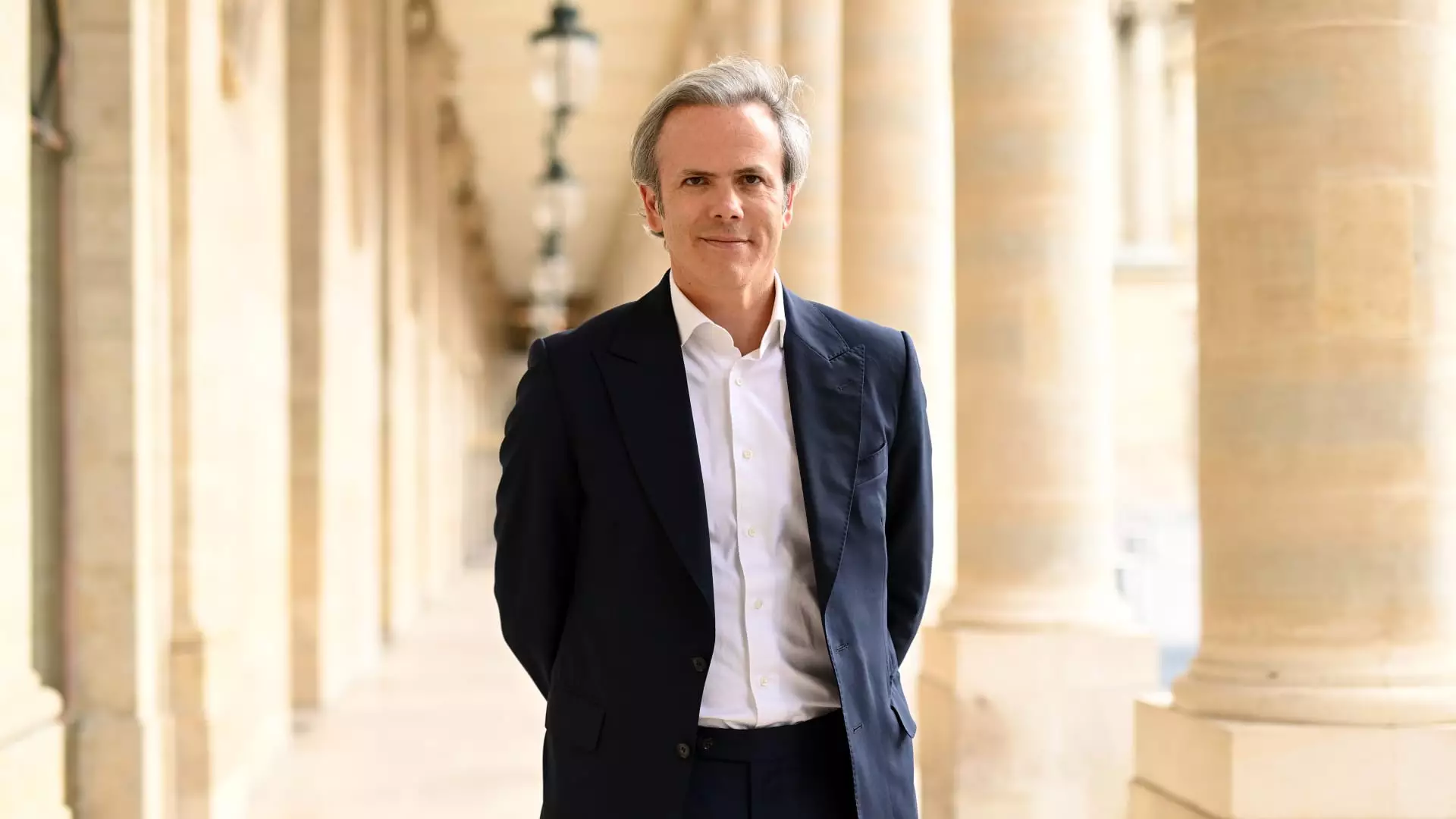

Ranked closely behind Maelstrom is Motier Ventures, helmed by Guillaume Houzé, a member of the renowned French dynasty associated with Galeries Lafayette. Motier’s investment strategy emphasizes technology-focused startups, particularly in artificial intelligence and blockchain. Noteworthy investments include Vibe.co and Holistic AI, marking a trend where family offices are not merely passive investors but active participants in shaping the future of technological advancement. This proactive stance enhances their strategic positioning in the rapidly evolving market landscape.

What the analysis finds striking is the shift in family offices towards sectors traditionally dominated by venture capital firms. The report indicates that a significant portion of their startup capital is now focused on artificial intelligence, a dominant theme for the year and likely beyond. This inclination aligns with findings from the UBS Global Family Office Report, which states that 78% of family offices plan to invest in AI technologies in the coming years. The investment choices of noted family offices such as Aglaé Ventures and Bezos Expeditions further reinforce this trend, highlighting the overwhelming confidence in AI as a leading sector.

Family offices control significant wealth, which allows them to venture into high-risk, high-reward investments typically considered by venture capitalists. They often view these investments as both a financial opportunity and a learning platform—a way to gain insights into cutting-edge technologies that can inform their broader business strategies. This dual motive is evident in Eric Schmidt’s Hillspire, which has made numerous investments in AI, contributing to his larger vision of integrating energy solutions with advanced computing technologies.

Despite their increasing footprint in the venture capital realm, family offices face unique challenges as they navigate the complexities of startup investments. The past year has seen a downturn in the stock market and the valuation of tech startups, leading to a landscape filled with uncertainties. Nico Mizrahi, co-founder of Pattern Ventures, indicates that some family offices may have overextended themselves, drawn into the venture frenzy without adequate discipline or expertise. This miscalculation can lead to greater risks, including unsustainable paper losses and difficulties in exiting investments, particularly when initial public offerings (IPOs) become scarce.

Mizrahi advocates for smaller family offices to collaborate with seasoned investment managers, highlighting that the nuanced understanding of the tech startup ecosystem is crucial in securing the best deals and optimizing returns. As family offices evolve from traditional wealth management toward proactive investment strategies, their success will largely depend on their ability to adapt and align with experts in the volatile world of tech investments.

The growing influence of family offices on startup investments signals a pivotal shift in the financial ecosystem. As these entities leverage their wealth and strategic insights to influence innovation, they are redefining what it means to be a player in the venture capital space. While challenges abound, the proactive approaches adopted by the leading family offices illustrate a robust understanding of market dynamics, allowing them to capitalize on emerging sectors poised for growth. The trajectory of family offices in startup investments not only reflects their increasing sophistication but also their potential to shape the future landscape of venture capital amidst a backdrop of technological evolution.

Leave a Reply