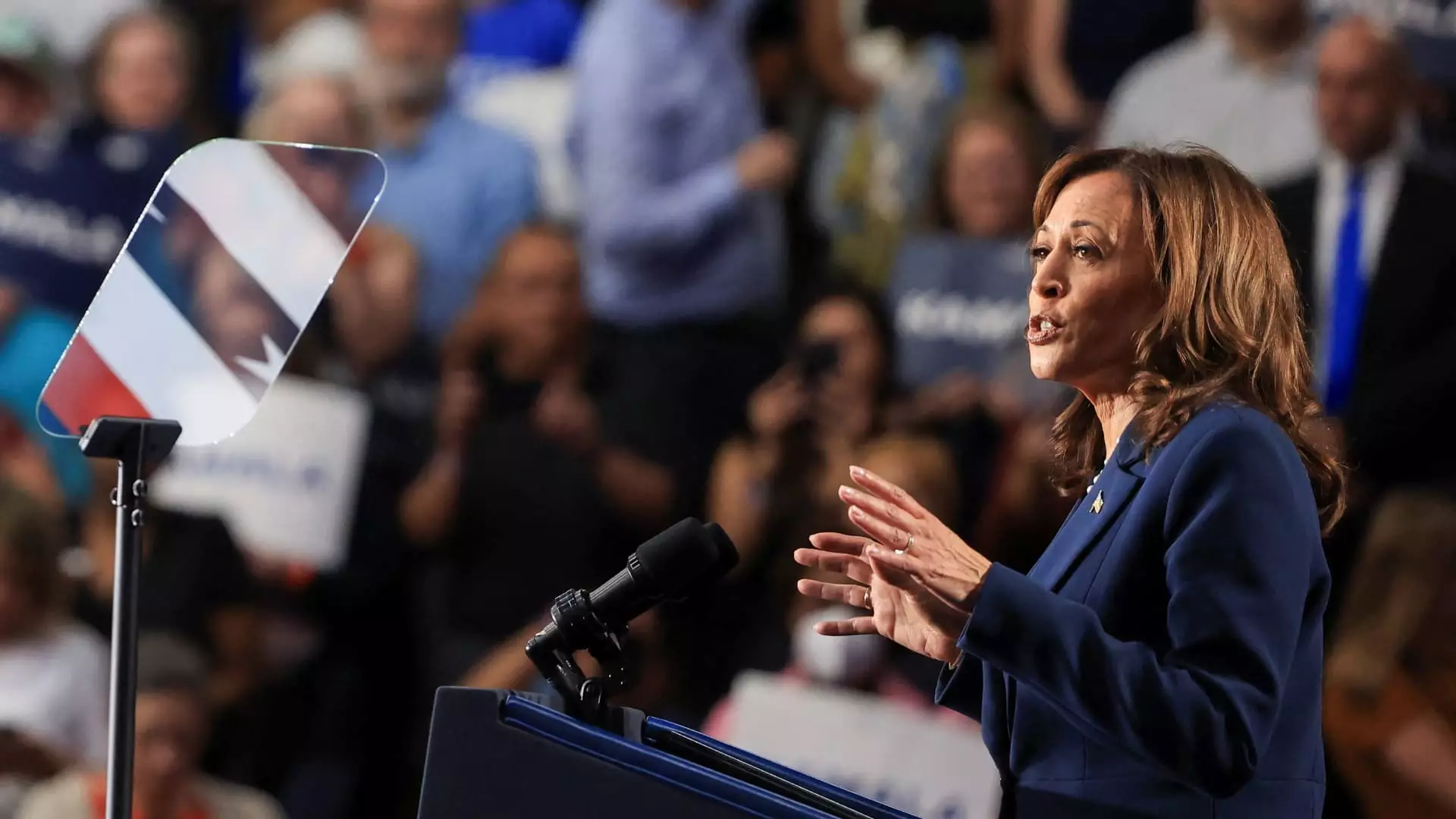

In a recent address in West Allis, Wisconsin, Vice President Kamala Harris identified the revitalization of the middle class as a central pillar of her potential presidential campaign. As she emerges as a leading contender for the Democratic nomination, her focus on economic equity comes at a critical time when many Americans grapple with a widening wealth gap. “When our middle class is strong, America is strong,” Harris proclaimed, reiterating a principle that has been a cornerstone of her political philosophy. This emphasis on the middle class underscores the need for policies that directly address economic disparities impacting working families today.

Harris’s commitment to strengthening the middle class is not just a campaign slogan; it has roots in her legislative history. During her tenure as a senator, she introduced the LIFT the Middle Class Act, which aimed to provide significant tax relief to low- and middle-income workers through annual tax credits. This proposal reflects her recognition of the financial struggles faced by many Americans, particularly during a period characterized by inflation and rising costs.

One of the hallmark features of the LIFT Act is its potential to deliver up to $6,000 in tax credits for households, with the intent of easing the financial burdens of working-class families. According to experts, such a measure could prove more advantageous for renters than current proposals, such as the 5% rent cap introduced by President Biden. While the rent cap aims to moderate rent increases for larger landlords, it may inadvertently lead to negative consequences, including a decrease in rental properties as landlords opt out of the market. Harris’s LIFT tax credit directly targets the challenge renters face in an inflationary environment, offering a financial cushion without distorting market dynamics.

Francesco D’Acunto, a finance professor at Georgetown University, notes that the LIFT Act could effectively address rental burdens, promoting a more stable living situation for countless families. Unlike the proposed rent cap, which has potential implications for landlords and housing availability, Harris’s tax credit approach focuses on providing immediate fiscal assistance to those most in need.

As the cost of living continues to surge, particularly following the economic upheaval of the COVID-19 pandemic, many working-class Americans report stagnant or declining real incomes. The financial anxiety felt by this demographic has been exacerbated by concerns regarding job security, particularly in the face of advancing automation and artificial intelligence. Laura Veldkamp, an economist at Columbia University, pointed out that the potential obsolescence of certain jobs necessitates enhanced social insurance mechanisms. Harris’s revival of the LIFT tax credit aligns with this urgent need, providing a structured response to the evolving labor market.

However, implementing such a policy is not without challenges. Experts have raised concerns about the significant financial implications of the LIFT tax credit, particularly in light of unsustainable federal budget deficits. Funding would require a reevaluation of existing tax structures, especially provisions enacted under the Tax Cuts and Jobs Act affecting higher-income earners. Given the fiscal realities, it remains to be seen how Harris plans to navigate these hurdles while maintaining the integrity of her economic proposals.

Interestingly, the political landscape has shifted considerably since the introduction of Harris’s LIFT proposal. The enhanced child tax credit, expanded during the pandemic, emerged as a pivotal form of economic relief, significantly reducing child poverty rates. The American Rescue Plan’s temporary increase in the child tax credit demonstrated the capacity for fiscal policies to positively impact vulnerable populations. With its success, focus may shift from the LIFT Act back to the child tax credit as a more immediate priority.

Garrett Watson, a senior analyst at the Tax Foundation, emphasizes the Democratic Party’s commitment to childcare-related tax policies as crucial for future electoral success. As Harris shapes her campaign, a decision must be made on whether to continue advocating for the LIFT initiative or to channel energies toward the child tax credit, both of which aim to bolster economic stability but differ in their mechanics and target demographics.

As Vice President Harris gears up for a potential presidential run, her economic agenda seeks to address the pressing issues of inequality and insecurity facing millions of Americans. While she has shown a willingness to adapt her policy platforms in response to contemporary challenges, the core principles of supporting the middle class and ensuring economic equity remain at the forefront. Whether through the LIFT tax credit or a renewed focus on enhancing the child tax credit, Harris’s ability to articulate a clear and compelling vision for America’s economic future will be paramount as she navigates the complexities of the contemporary political landscape.

Harris’s commitment to rebuilding the middle class speaks to a broader desire for equitable economic growth. As the nation continues to recover from the pandemic and address systemic inequalities, the question remains: Can Harris translate her ambitious vision into actionable policy that resonates with voters seeking real change? The upcoming campaign will test her ability to balance competing priorities while remaining steadfast in her pursuit of a fairer economic landscape for all Americans.

Leave a Reply