The recent tumult surrounding Super Micro has sent shockwaves through the financial markets, with the company witnessing a staggering 22% decline in its stock price on Wednesday. The stock fell to $21.55, a stark reminder of the volatile nature of the tech industry and the inherent risks that come with significant market fluctuations. This sharp drop comes in the wake of disappointing unaudited financial disclosures, jeopardizing the company’s standing on the Nasdaq exchange and contributing to an alarming 82% decrease since its peak in March when shares hit $118.81.

The juxtaposition of Super Micro’s historical highs against its current lows is striking, as the firm reportedly lost approximately $57 billion in market capitalization in just a few months. This downturn is particularly notable given that the company had experienced unprecedented growth, with sales climbing 181% year-over-year. However, the elation of the past year has been overshadowed by a series of missteps and troubling revelations regarding its financial practices. The resignation of Ernst & Young, the firm’s auditor, adds another layer of complexity and concern, making it the second accounting firm to step away in less than two years.

This conflict has raised red flags among investors, particularly in light of claims regarding accounting irregularities and potentially illegal shipments of sensitive technology to nations under sanctions. Super Micro’s failure to provide specific timelines for filing audited financial results has ushered in fears of imminent delisting from Nasdaq, further exacerbating investor fears and uncertainty.

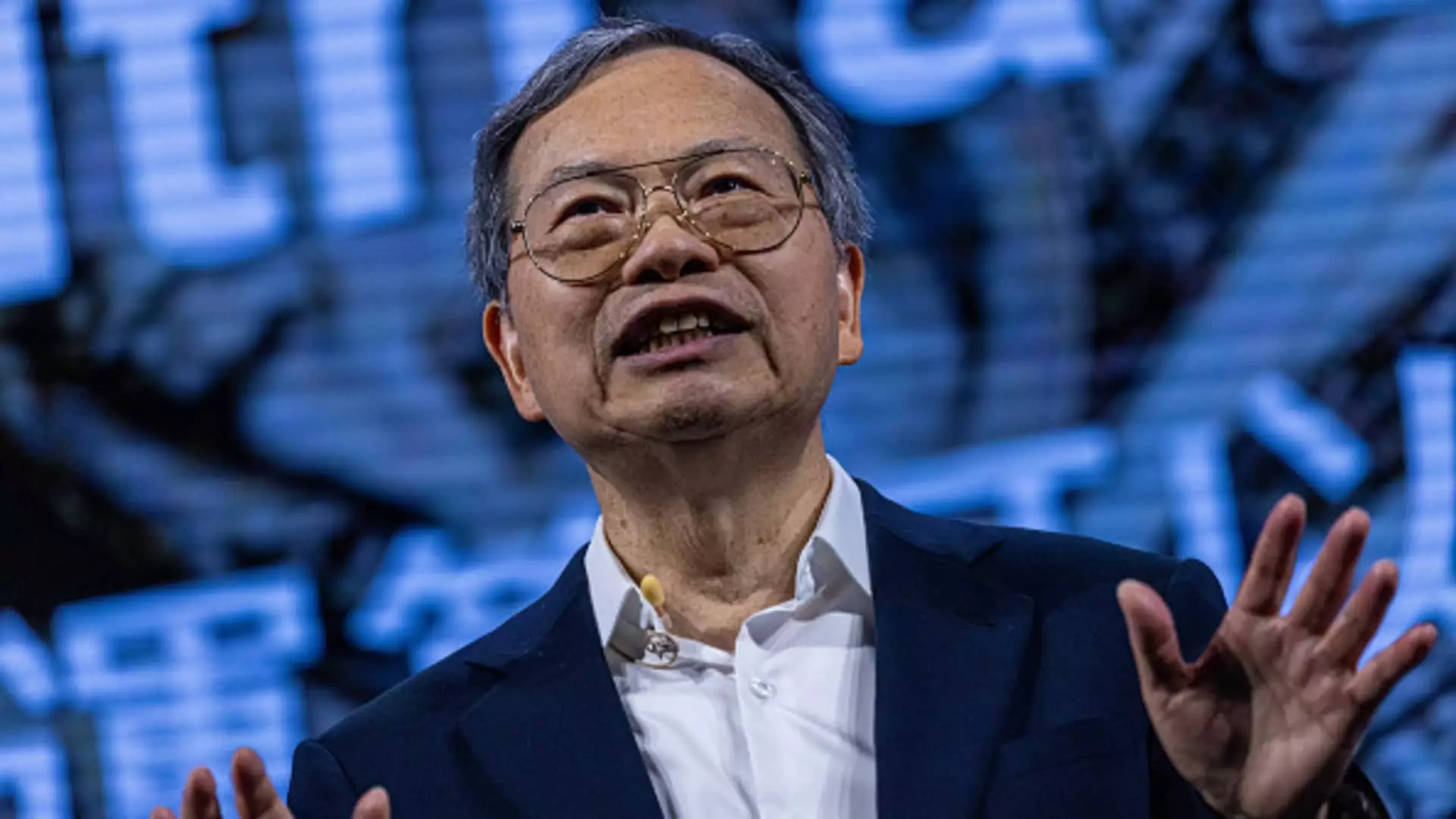

Amid these challenges, management’s responses have been less than reassuring. During a conference call, CEO Charles Liang was non-committal about when the company would be able to file its annual financials, offering half-hearted assurances regarding the timing of these disclosures. Super Micro’s lack of clarity over Ernst & Young’s resignation yielded deeper concerns among analysts, which led firms like Mizuho to suspend their coverage of the stock entirely. This unpredictability has left investors grappling with more questions than answers, creating a perfect storm of uncertainty that could potentially undermine the company’s future prospects.

The broader implications of these financial challenges cast a pall over the company’s recent achievements. Although Super Micro reported quarterly sales figures between $5.9 billion and $6 billion—below expectations but still reflecting robust year-over-year growth—strategic questions about the company’s governance linger. Analysts have expressed skepticism about Liang’s optimistic assertions regarding the firm’s operations, especially given the precarious situation at hand.

One of the fundamental pillars of Super Micro’s recent expansion has been its partnership with Nvidia, whose processors have been a cornerstone of the burgeoning AI server market. Liang noted an urgent demand for Nvidia’s latest GPU model, Blackwell, leading to speculation about how delays in supply could affect Super Micro’s capacity to deliver on its commitments. The CFO, David Weigand, emphasized their strong relationship with Nvidia, asserting that allocations had remained unchanged. Yet, until the chips are actually deployed, there remains a significant degree of risk surrounding the company’s operational capabilities.

The potential inability to fulfill contracts and generate expected revenue from these robust partnerships has serious ramifications. Investors are apprehensive, understanding that even strong client relationships may not be enough if fundamental operational issues are not addressed. Super Micro has asserted that a special committee is investigating Ernst & Young’s concerns, claiming a three-month investigation yielded no evidence of wrongdoing. However, these allegations alone will take time to resolve and do little to inspire confidence in the interim.

As Super Micro navigates this precarious juncture, the focus will undoubtedly shift to how effectively the management can rectify its financial transparency issues and restore investor confidence. The path to recovery is fraught with obstacles, but the company’s ability to regain compliance with Nasdaq requirements is paramount; failure to do could insidiously obliterate the once-promising trajectory visible just a few months ago.

With looming deadlines for financial disclosures and an urgent need to stabilize its operations, the stakes have never been higher for this beleaguered tech company. The market waits with bated breath to ascertain if Super Micro can convert its storied past and potential into a resilient future, or if it will remain mired in a quagmire of uncertainty and dwindling investor trust. Whatever path the company takes, it must decisively navigate toward clarity, accountability, and, above all, operational effectiveness—elements crucial for its renaissance in today’s demanding market landscape.

Leave a Reply