Nvidia, a leader in the semiconductor industry, showcased its dominance in the technology space as it reported its fiscal fourth-quarter earnings this past Wednesday. The results exceeded Wall Street’s forecasts, demonstrating not just resilience but an optimistic outlook for the company as it navigates the evolving landscape of artificial intelligence (AI). The reported earnings reveal a revenue of $39.33 billion, significantly higher than the anticipated $38.05 billion, and an adjusted earnings per share (EPS) of 89 cents, surpassing the expected 84 cents. This spirited performance underscores Nvidia’s ability to capitalize on the ever-growing demand for AI-related solutions.

Looking into the future, Nvidia’s forecast for the first quarter is equally promising. The company anticipates a revenue estimate of around $43 billion, a figure lying well beyond the average expectations of $41.78 billion. This projection suggests a striking year-over-year growth of approximately 65%, even as it marks a significant deceleration from the staggering 262% growth witnessed in the same quarter last year. Such variability raises questions regarding the sustainability of Nvidia’s growth momentum; however, the company is confident in a potential ‘significant ramp’ in sales targeted towards its next-generation AI chip, Blackwell.

Chief Financial Officer Colette Kress emphasized the impressive traction Blackwell is gaining, needed for the company to stay ahead in a fiercely competitive market fueled by AI demands. Despite reportedly lower gross margins due to complexities associated with new product lines, the evidence of booming demand in the data center segment remains enthusiastic.

Nvidia’s sales figures reflect a rapid ascent primarily driven by its data center segment, which has become the powerhouse for corporate revenue—accounting for a whopping 91% of total sales. With data center revenue soaring by 93% annually to reach $35.6 billion, Nvidia has managed to quadruple its revenue in this sector over two years. The momentum is reminiscent of a technological renaissance, with AI-centric applications forcing a shift in computational needs. Analysts estimate that data centers will continue to play a pivotal role in sustaining Nvidia’s revenue trajectory, a shift from traditional gaming-related hardware sales which reported a downturn.

The burgeoning AI market, characterized by rapid advancements in machine learning and deep learning, has seen Nvidia’s graphics processing units (GPUs) become indispensable. With powerful GPUs and innovative chip designs, Nvidia positions itself as the gold standard for companies venturing into AI software deployment. Unlike previous generations of chips focused chiefly on development and training, the new Blackwell chips are tailored for real-time delivery, also known as inference in AI parlance, further solidifying their role in next-generation applications.

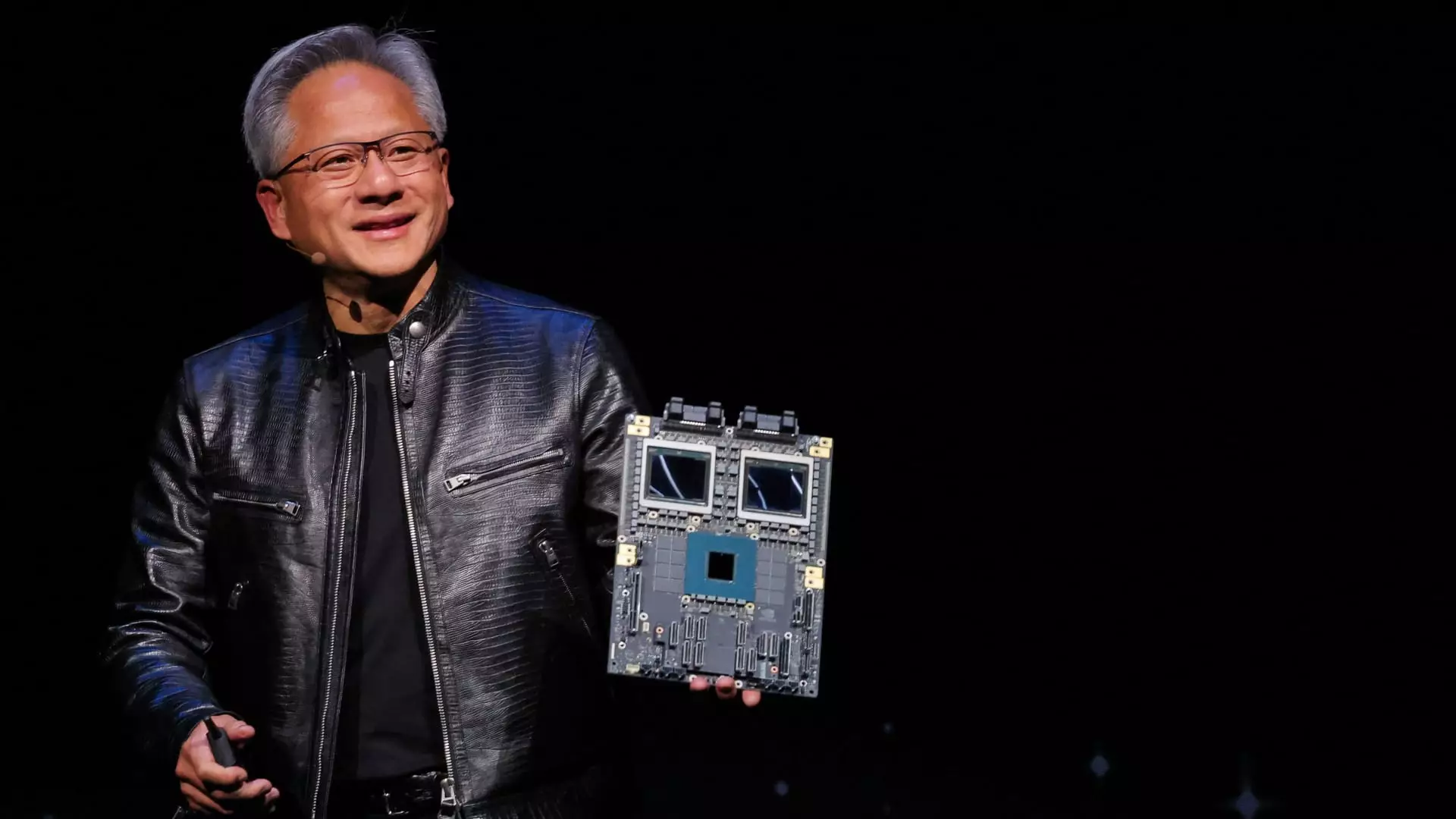

While the excitement surrounding AI propels Nvidia forward, looming competition from tech giants like Amazon, Microsoft, and Google poses potential challenges. The industry perception that custom chips can adequately substitute Nvidia’s market dominance raises concerns; however, Nvidia’s CEO Jensen Huang insists the mere design of a chip does not guarantee its deployment. This underscores the intricate relationship between product readiness and operational implementation in the fast-paced tech world.

Another area of concern is Nvidia’s networking business, which witnessed a decline of 9% from the previous year. While networking was previously touted as a growth avenue, the drop may warrant reevaluation of strategic priorities. This contraction, coupled with stagnant growth in consumer gaming parts, which recorded sales of $2.5 billion—below expectations—suggests a complex sentiment among gamers toward new graphics offerings.

In a bid to diversify its revenue stream, Nvidia is straddling both AI and the burgeoning market for automotive technologies. The company revealed $570 million in automotive sales, marking a breathtaking growth surge of 103% year-over-year, although it remains a minor segment relative to the colossal AI business. This diversification strategy reflects an understanding of future needs in autonomous vehicles and robotics, preparing Nvidia for plateauing growth in its traditional data center domains.

As Nvidia approaches a pivotal juncture in its growth trajectory, the strategic decision to invest $33.7 billion in share repurchases in fiscal 2025 illustrates the company’s confidence in its long-term value. This reallocation of resources could bolster shareholder confidence and offers a potential cushion against market volatility.

Nvidia’s fourth-quarter performance encapsulates a corporation at the intersection of rapid technological change and market expansion fueled by artificial intelligence. As the company navigates growing pains and external competition, its commitment to innovation and strategic agility will prove vital. Whether Nvidia can maintain its remarkable ascent, potentially grounding its future performance in a diversified portfolio, will be crucial to watch in the coming quarters. For stakeholders, the path ahead promises both challenges and opportunities, as Nvidia carves out its legacy in the tech domain.

Leave a Reply