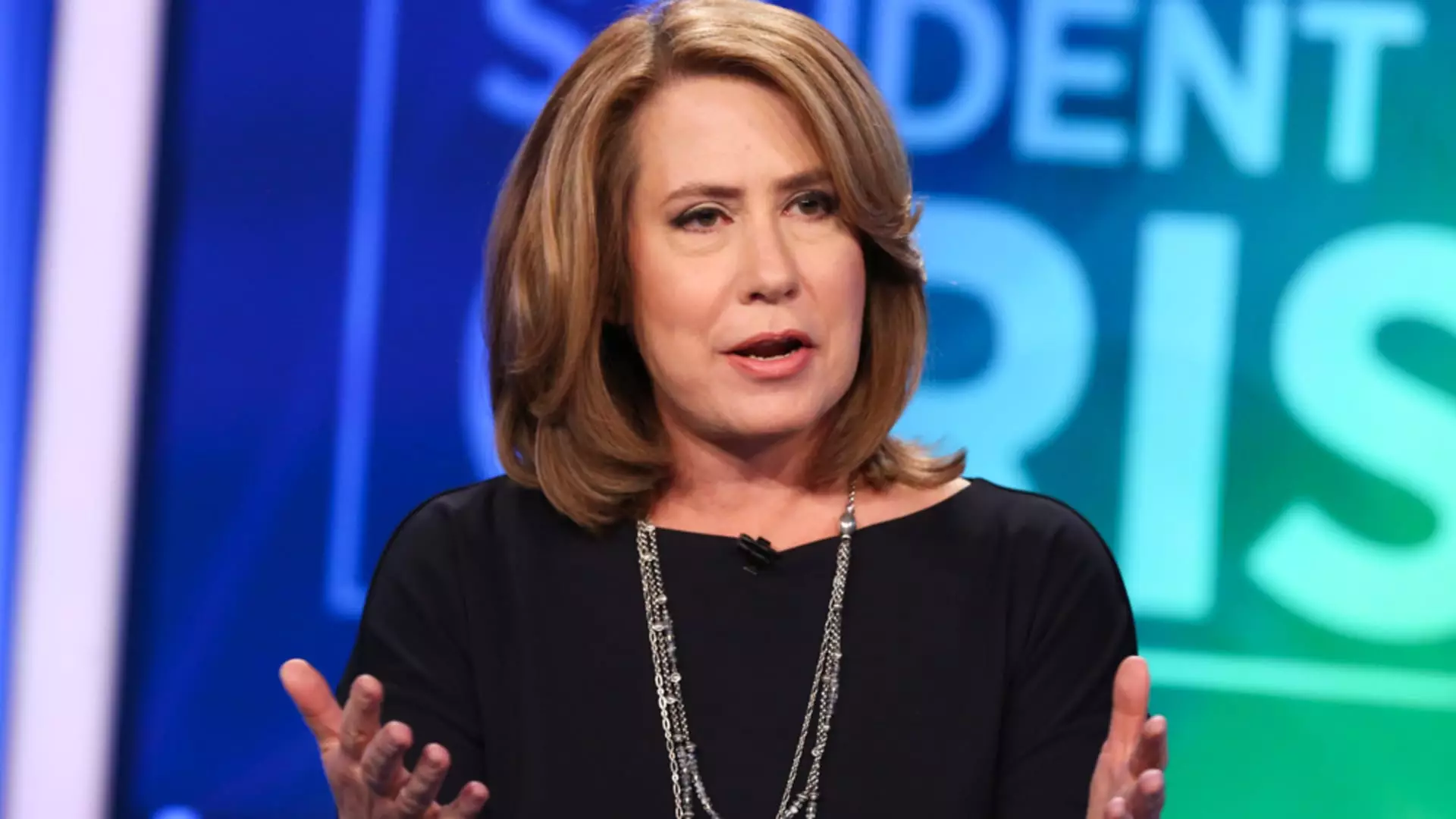

Recent regional bank earnings have raised concerns regarding the stability and vulnerabilities of these financial institutions. Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp, has expressed worries about the reliance on industry deposits and concentrated exposure to commercial real estate. She also highlighted the potential instability of uninsured deposits, even for healthy institutions, in the event of another bank failure.

Bair, who led the FDIC during the 2008 financial crisis, believes that the problems faced by regional banks in 2023 have not been fully resolved. She has called for the reinstatement of the FDIC’s transaction account guarantee authority to stabilize deposits. The uncertainty surrounding the regional banking sector remains a cause for concern, particularly with the potential for future bank failures.

Regional banks have experienced a challenging year so far, with the SPDR S&P Regional Bank ETF (KRE) declining by almost 13%. Only a few members of the ETF have managed to stay in positive territory for 2024. The sector’s performance has been marred by significant declines, with New York Community Bancorp leading the pack with a drop of over 71% this year.

The recent surge in the benchmark 10-year Treasury note yield, reaching over 4.6%, has added to the concerns surrounding regional banks. Bair highlighted the potential stress on commercial real estate borrowers due to higher yields, as well as the challenges posed by upcoming refinancing in the sector. The rising rates could lead to increased distress among borrowers, affecting their ability to make payments.

Despite the challenges faced by regional banks, Bair pointed out that their distress could actually benefit larger money-center banks. The vulnerabilities in the regional banking sector could potentially drive more business towards larger institutions, providing them with opportunities for growth and expansion.

The recent earnings reports from regional banks have exposed critical weaknesses and vulnerabilities within the sector. The concerns raised by Sheila Bair paint a worrying picture of the industry’s reliance on certain types of deposits, exposure to commercial real estate, and uncertainty around uninsured deposits. As the sector grapples with these challenges, it remains to be seen how regional banks will navigate the current economic landscape.

Leave a Reply