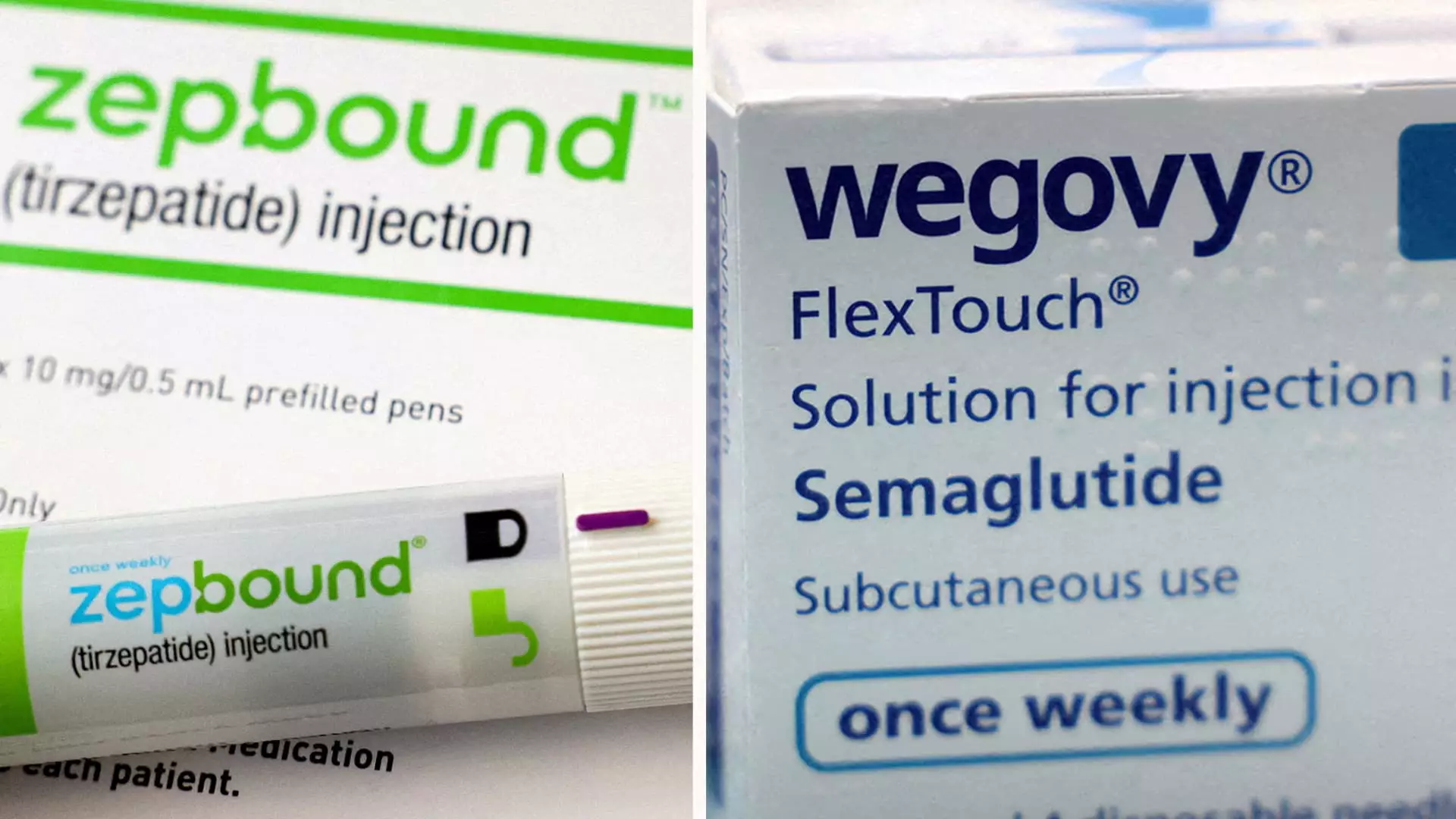

The pharmaceutical landscape is witnessing fierce competition in the sector of obesity treatment drugs, highlighted by the recent head-to-head clinical trial results of Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy. The results not only illuminate the effectiveness of these therapies but also indicate a potential shift in treatment paradigms for obesity management.

Eli Lilly announced that Zepbound has demonstrated remarkable weight loss results compared to Wegovy. The pivotal phase three trial involved 751 participants who were obese or overweight and had at least one weight-related medical condition, excluding diabetes. Patients treated with Zepbound lost an average of 20.2% of their body weight, equating to roughly 50 pounds, over a 72-week period. This figure starkly contrasts with Wegovy, where participants lost an average of only 13.7% of their weight, or about 33 pounds. Such significant disparities position Zepbound as a potentially superior treatment in the competitive obesity market.

Furthermore, the trial found that 31% of those on Zepbound achieved a minimum weight loss of 25% of their body weight, compared to just 16% of Wegovy users achieving similar results. These statistics indicate not only a higher efficacy in short-term weight loss but also suggest long-term benefits that could alter patient lifestyles and management strategies for obesity.

The findings from Eli Lilly’s trial are bolstered by previous studies that similarly suggested Zepbound’s superiority over Wegovy. Another late-stage study indicated that Zepbound could facilitate weight loss beyond 22% over 72 weeks, while Wegovy was recorded at 15% over a shorter, 68-week timeframe. The randomized nature of the most recent trial adds weight to the credibility of these results, making a stronger case for healthcare providers to consider Zepbound as a primary treatment option for obesity.

Dr. Leonard Glass from Eli Lilly highlighted the aim of their study: to provide healthcare providers and patients with reliable data to inform treatment decisions amidst growing interest in obesity medications. As obesity becomes a critical healthcare issue affecting millions, the implications of these findings might reshape treatment guidelines and patient access to more effective therapies.

As the market for weight loss drugs expands, analysts project that it could reach a staggering $150 billion by the early 2030s. Eli Lilly’s Zepbound, which received U.S. approval in late 2023, is now viewed as a potential game-changer, with projections estimating $27.2 billion in annual sales by 2030, in stark contrast to Wegovy’s anticipated $18.7 billion. The race for dominance between Eli Lilly and Novo Nordisk is now more critical than ever, with Zepbound being seen as a potential candidate for becoming the highest-grossing drug in history.

Despite these hopeful forecasts, both companies face significant challenges in meeting the surging demand for their products. Recent reports indicate that supply has struggled to keep pace, prompting both firms to invest heavily in increasing manufacturing capacity. Recent updates have shown that the FDA now lists all dosages of these medications as available, suggesting improvement in supply issues.

However, the price of these treatments remains a daunting hurdle for many patients. With Zepbound and Wegovy each costing around $1,000 per month without insurance, access to these potentially life-changing medications is obstructed for numerous individuals, particularly in the United States, where insurance coverage for obesity treatments varies widely.

The therapeutic mechanisms also differ between the two medications, with Zepbound utilizing two gut hormones—GIP and GLP-1—to suppress appetite and regulate blood sugar levels, whereas Wegovy activates only the GLP-1 hormone. This distinction may offer insights into why Zepbound appears to outperform Wegovy in terms of weight loss.

Eli Lilly plans to publish the complete trial results in a peer-reviewed journal and present findings at an upcoming medical meeting, paving the way for more informed dialog about obesity treatments. As pressure mounts to provide effective solutions for obesity, the healthcare community will eagerly await further data and developments surrounding Zepbound. With evidence mounting in its favor, Zepbound is poised to make a significant impact in the fight against obesity, potentially reshaping treatment approaches and offering millions a more effective path to weight loss.

Leave a Reply