The past week saw all three major averages close higher, influenced by softer retail sales and consumer price data for April. Despite the weaker-than-expected reports, Wall Street embraced the news as it hinted towards further disinflation. This outcome is crucial for any possibility of the Federal Reserve reducing interest rates by the year 2024. The fact that two more reports supported the notion that the central bank’s battle against inflation is effective is a positive sign. Notably, U.S. single-family homebuilding and permits experienced a decline in April after an unexpected increase in the previous month. Additionally, industrial production came in below expectations, further indicating a slowdown in certain sectors of the economy.

Despite some positive indicators, there was enough negative news to drive stocks higher. The S&P 500 reached a historic high by closing above 5,300 for the first time ever. The Dow Jones also made history by surpassing 40,000 and ending the week above that milestone. This marked the Dow’s fifth consecutive weekly gain. The S&P 500 rose by 1.5%, while the Nasdaq climbed by 2.1%. Within the S&P 500, the technology sector led the way, followed by real estate and health care. On the other hand, industrials and consumer discretionary sectors experienced a decline during the week.

The earnings season for the second quarter is coming to an end, with approximately 93% of S&P 500 companies having reported their earnings. The data indicates that 78% of companies reported a positive earnings surprise, while 60% delivered a positive sales surprise. This trend suggests that the majority of companies have performed well in terms of their financial results. Moving forward, investors will be closely monitoring the remaining earnings reports to gauge the overall health of the market.

Looking ahead, the next week is expected to be slower in terms of economic data releases, apart from two significant housing reports. Investors will also be focusing on earnings reports from three portfolio companies, including one of the “own, don’t trade” stocks. The state of the housing market will be a key focal point, as the April existing home sales and new home sales reports are set to be released. The housing market has been a concern for the Federal Reserve due to its strong performance amid higher interest rates. The reports will shed light on whether the housing market continues to put pressure on inflation.

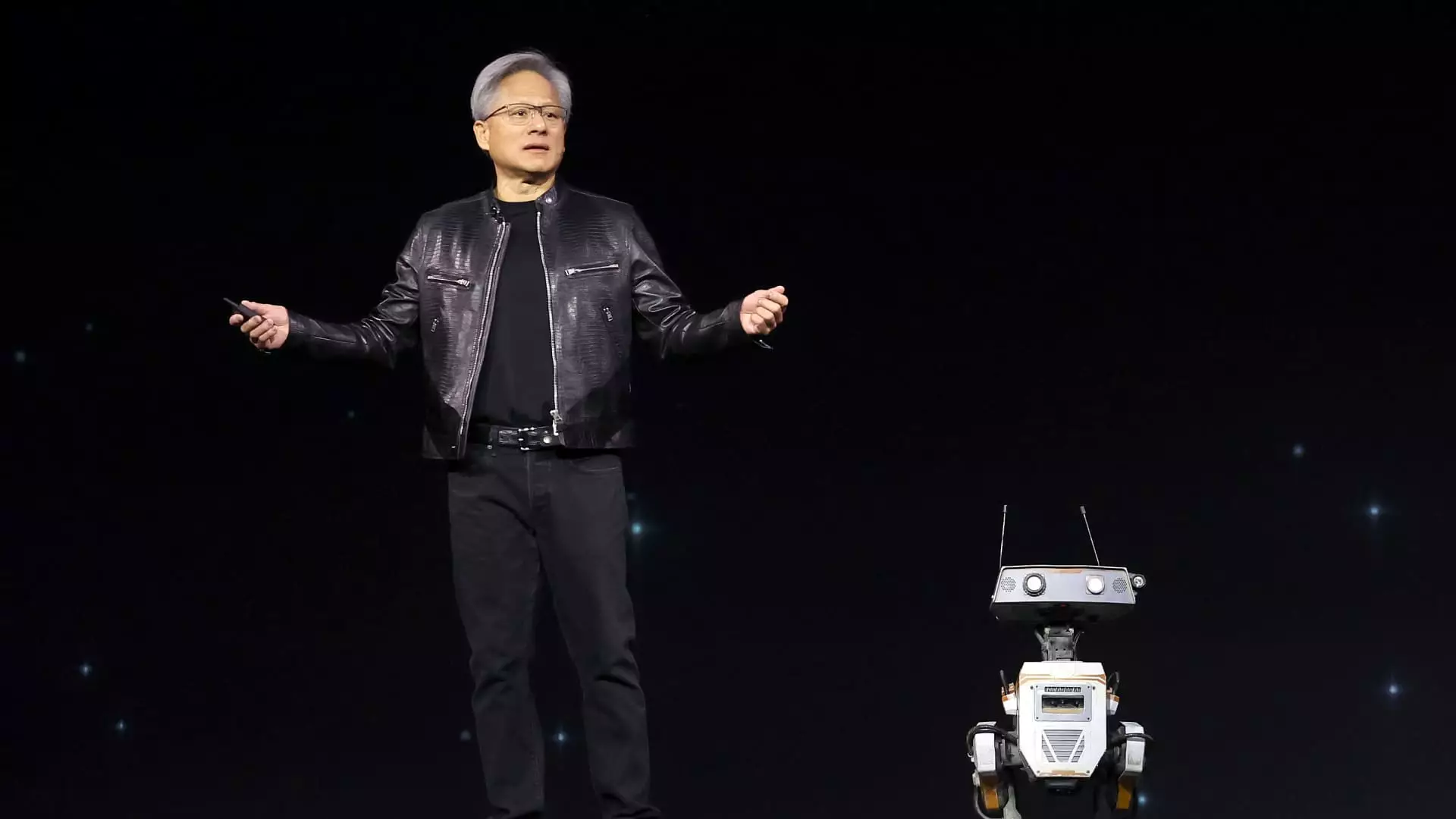

In terms of company-specific news, three portfolio companies are expected to report their results in the upcoming week. Palo Alto Networks aims to bounce back from a challenging period and accelerate growth through a revised strategy. TJX Companies, an off-price retailer, is poised to benefit from consumer behavior in response to prolonged inflation. Chipmaker Nvidia is anticipated to deliver strong results and provide insights into the demand for its products. These individual company updates will play a crucial role in determining market sentiment in the coming days.

The week ahead is filled with key dates to watch, including earnings releases and economic data reports. It is essential for investors to stay informed and analyze the implications of these developments on the overall market trends. By closely monitoring the market dynamics and company-specific news, investors can make well-informed decisions regarding their investment strategies.

The recent market trends and developments suggest a mixed outlook for the economy. While there are positive indicators such as record-high stock prices and strong earnings reports, there are also concerns regarding inflation and the housing market. It is imperative for investors to stay vigilant and adapt to the changing market conditions to optimize their investment portfolios. By conducting thorough research and analysis, investors can navigate the complex financial landscape with confidence and precision.

Leave a Reply