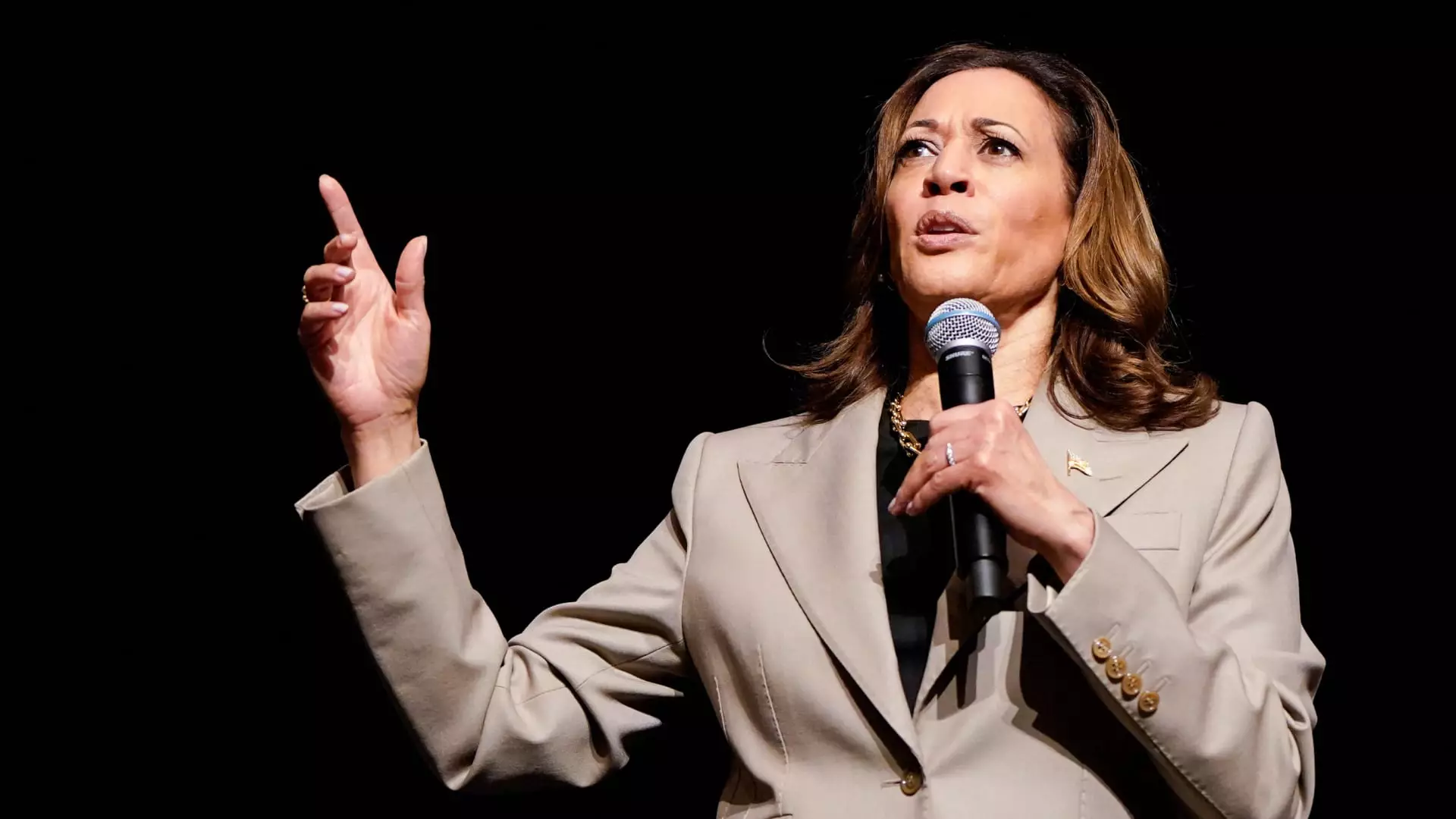

Vice President Kamala Harris recently introduced an economic plan that includes an expanded child tax credit offering up to $6,000 in total tax relief for families with newborn children. This plan seeks to reinstate the higher child tax credit that was implemented through the American Rescue Plan in 2021, providing a maximum credit of up to $3,600 per child. The proposed tax break is aimed at benefiting middle- to lower-income families for the first year after a child’s birth.

The unveiling of Harris’ economic plan comes on the heels of a similar proposal by Sen. JD Vance, who suggested a $5,000 child tax credit. While Harris appears to be following in President Joe Biden’s footsteps, the $2,400 bonus for newborns is seen as a unique response to Vance’s proposal. However, the Harris campaign has yet to respond to inquiries about the motivation behind this specific aspect of the plan.

Despite the bipartisan momentum behind expanding the child tax credit, Senate Republicans recently blocked an expanded version that had received overwhelming approval in the House. The future of the child tax credit expansion will depend heavily on the outcome of the upcoming elections and which party controls the White House and Congress. It is expected that Republican lawmakers will revisit the issue post-election, but the size and scope of the expansion remain uncertain.

Budgetary Considerations and Fiscal Responsibility

One of the major obstacles to expanding the child tax credit is the significant cost associated with such a move. Lawmakers are already grappling with expiring tax cuts amounting to trillions of dollars, and expanding the credit to $3,000 or $3,600 could add another $1.1 trillion over a decade to the federal budget. While Harris’ proposal to increase the credit to $6,000 for newborns may be more feasible in terms of cost, it could still amount to $100 billion.

Vice President Kamala Harris’ economic plan, especially the proposed child tax credit expansion, has sparked both support and skepticism within the political landscape. While there is undeniable merit in providing financial assistance to families with newborn children, the feasibility and cost of such a plan remain major points of contention. As the debate over the child tax credit continues to unfold, it is crucial for policymakers to strike a balance between meeting the needs of families and maintaining fiscal responsibility.

Leave a Reply