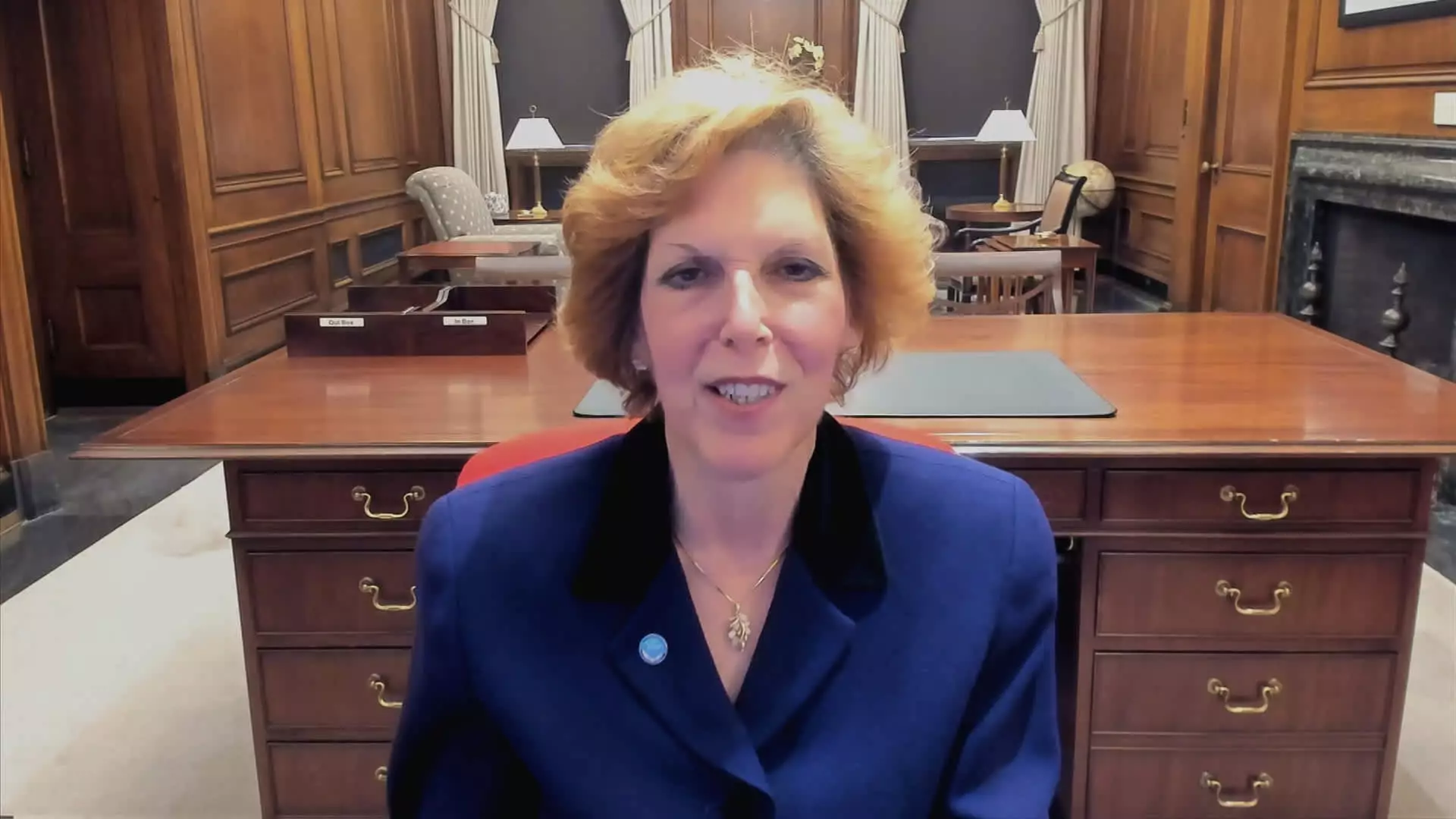

Cleveland Federal Reserve President Loretta Mester recently expressed her belief in the possibility of interest rate cuts within the year. She pointed out that the long-term trajectory for interest rates is higher than previously anticipated, indicating a potential shift in the policy direction. However, Mester did not provide any specific guidance on the timing or extent of these rate cuts.

Inflation and Economic Growth

Mester highlighted the progress made in terms of inflation and acknowledged the continuous growth of the economy. She emphasized the importance of ongoing data analysis to assess whether inflation is moving towards the 2% target over time. Additionally, she mentioned the need for more evidence to determine whether the recent data points indicating higher inflation are temporary fluctuations or signs of stagnation.

Decision on Policy Meeting

Despite her expectations of interest rate cuts, Mester ruled out the possibility of a cut at the upcoming policy meeting in May. She emphasized the need for further information and data analysis before making any decisions regarding rate adjustments. This cautious approach reflects a desire for a more comprehensive understanding of the economic landscape before initiating any policy changes.

Looking ahead, Mester anticipates a higher long-run federal funds rate than the previously anticipated 2.5%. She identified the neutral rate (r*) at 3%, signifying a level where policy is neither restrictive nor stimulative. This indicates a shift towards a more proactive approach to monetary policy to address economic developments effectively.

Market Expectations

While Mester’s comments suggest a conservative outlook on rate cuts, market expectations and futures traders predict a different scenario. There is a consensus among traders that the Fed will begin easing in June and may reduce rates by three-quarters of a percentage point by the end of the year. This discrepancy between market forecasts and Mester’s projections highlights the uncertainty surrounding future monetary policy decisions.

Cleveland Federal Reserve President Loretta Mester’s recent comments underscore the challenges and complexities associated with interest rate policy decisions. While she acknowledges the possibility of rate cuts in the future, Mester prioritizes data analysis and evidence-based decision-making. The divergence between market expectations and her projections reflects the uncertainty in predicting the future trajectory of interest rates. As the Federal Reserve continues to monitor economic developments, the path to interest rate adjustments remains subject to ongoing evaluation and analysis.

Leave a Reply