AppLovin, a key player in the online gaming and advertising sector, witnessed a staggering 45% increase in its share price on Thursday, propelling its valuation beyond $80 billion. This impressive rise was catalyzed by the company’s robust earnings report and optimistic revenue forecasts that exceeded analysts’ expectations. The shares shot up to over $245 in afternoon trading, and with a remarkable year-to-date increase of 515%, AppLovin is now surpassing all other tech firms with valuations of $5 billion or more. Such numbers reveal the intense market interest in the company’s dual focus on gaming and advertising alongside a disruptive technological edge.

In its third-quarter results, AppLovin posted a 39% increase in revenue, amounting to $1.2 billion and eclipsing the $1.13 billion consensus estimate. Furthermore, the company reported an earnings per share of $1.25, significantly higher than the anticipated 92 cents. Looking forward, AppLovin has set its sights on a fourth-quarter revenue range of $1.24 billion to $1.26 billion, representing a midpoint growth of approximately 31%, which again outpaces analysts’ expectations of around $1.18 billion. This consistent financial strength indicates that AppLovin’s business model is not only sustainable but also increasingly profitable.

While AppLovin’s gaming segment may be experiencing slower growth compared to its advertising division, it is the latter that is truly revolutionizing the company’s fortunes. The successful deployment of the AXON artificial intelligence advertising engine, especially in its updated 2.0 version, has been pivotal. This technology facilitates more effective ad placements within AppLovin’s mobile gaming applications, as well as for other studios utilizing the platform. In the recent quarter, revenue from the software platform surged by 66% to $835 million, a clear testament to the efficacy of AXON’s improved models in optimizing ad performance and, ultimately, generating revenue.

A key takeaway from AppLovin’s most recent financial results is the company’s impressive profitability metrics. With a net income increase of 300%—from $108.6 million a year earlier to $434.4 million—or $1.25 per share, the company is not only growing but doing so efficiently. The software platform’s adjusted profit margin stands at an impressive 78%. Analysts have taken notice, with firms like Wedbush upgrading their ratings and price targets, reflecting confidence in AppLovin’s trajectory.

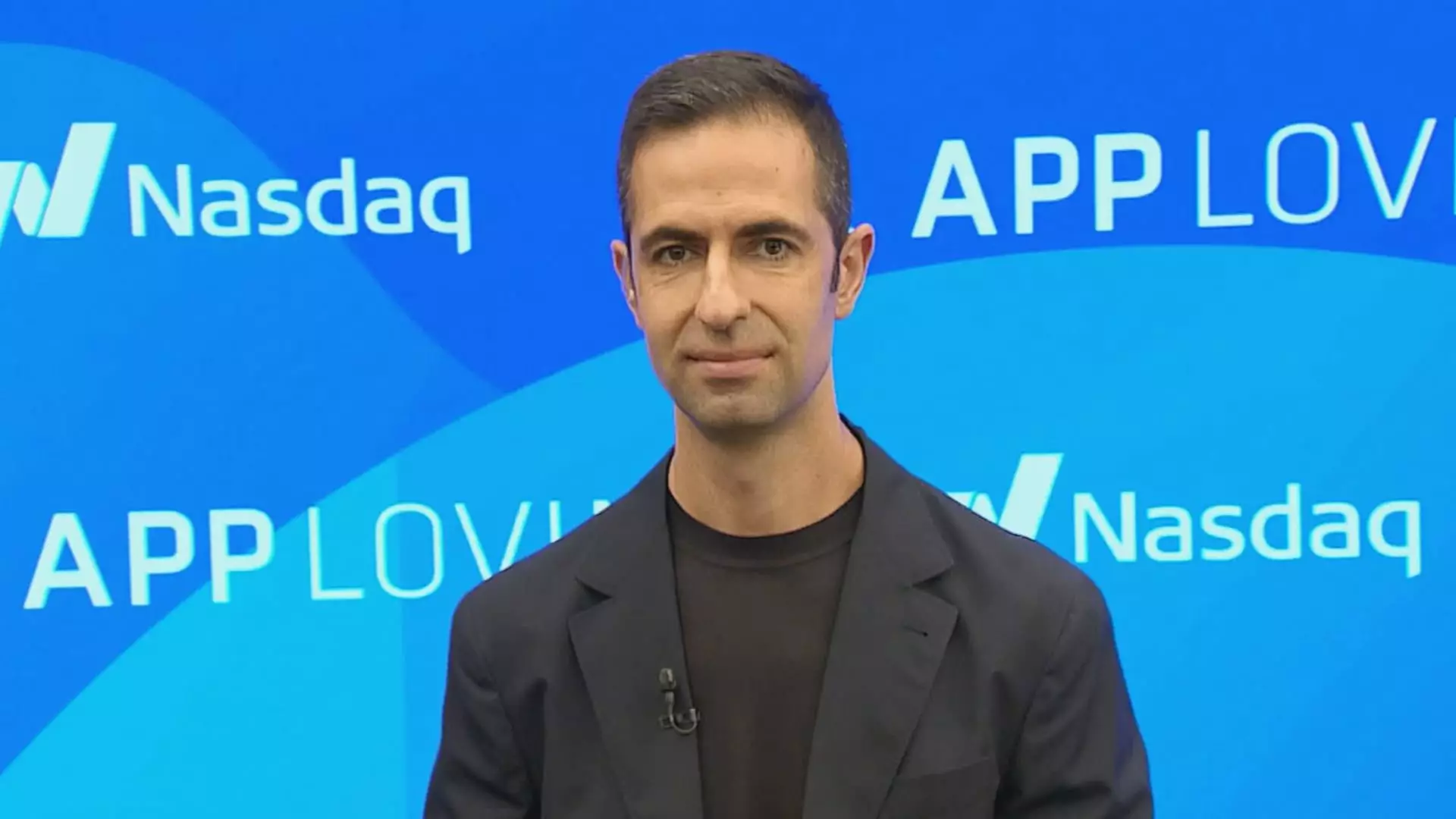

CEO Adam Foroughi has also offered insights into ongoing innovations, including a pilot e-commerce project that aims to blend targeted advertising seamlessly within gaming experiences. His optimism is palpable; stating, “In all my years, it’s the best product I’ve ever seen released by us, fastest growing, but it’s still in pilot.” This forward-looking sentiment suggests that AppLovin is not resting on its laurels but is actively exploring new growth avenues that could redefine the gaming and advertising landscape.

AppLovin’s recent performance isn’t merely a blip in the market; it’s indicative of a strategic pivot that leverages AI and innovative technology to drive significant growth. As such, both investors and industry watchers should keep a close eye on this dynamic company as it continues to expand its influence in the gaming and advertising sectors.

Leave a Reply