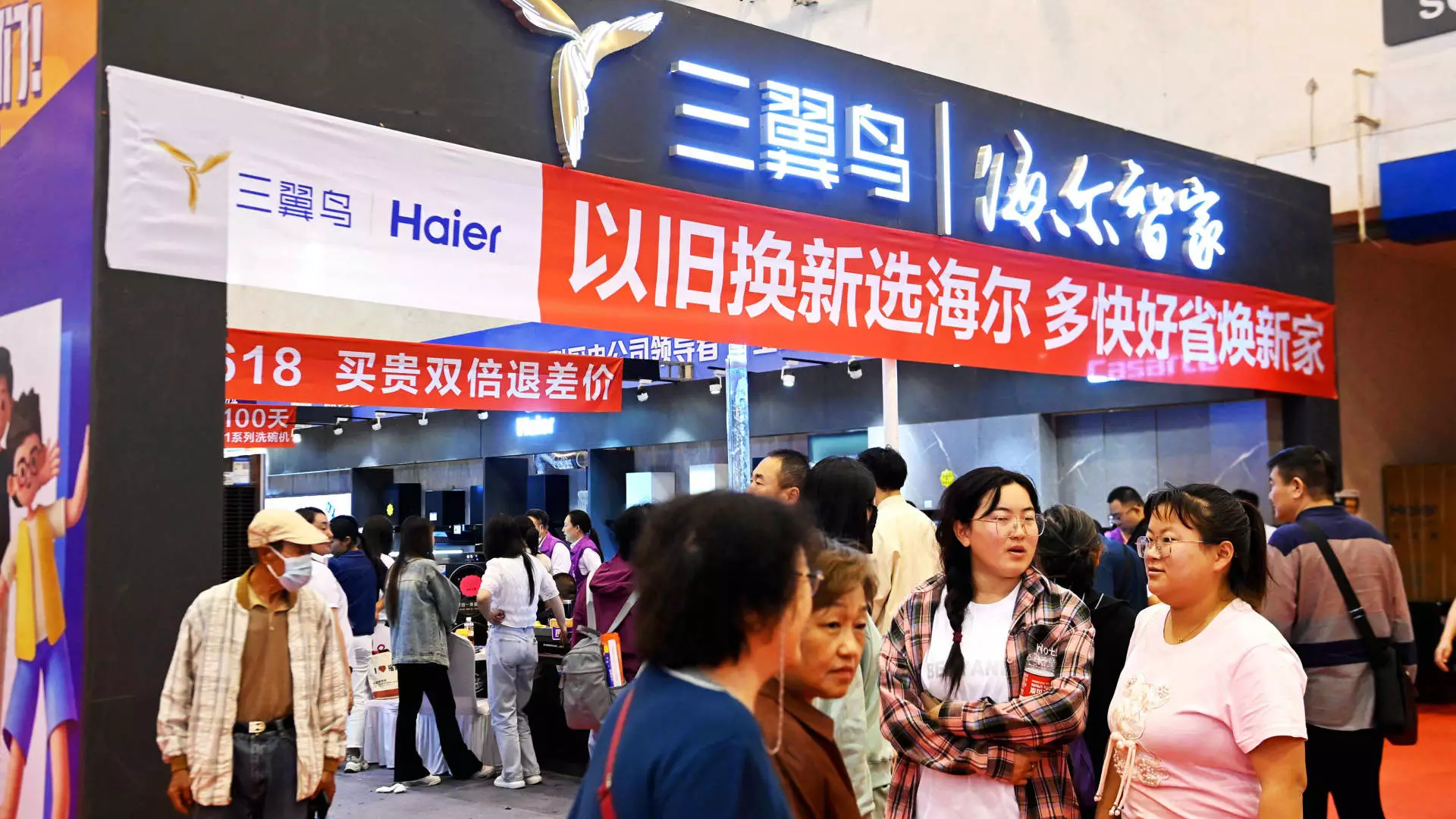

In an effort to revitalize its economy, particularly the consumer sector, China has implemented a trade-in policy aimed at encouraging citizens to upgrade their vehicles and home appliances. Announced in July, this ambitious program involves a staggering allocation of 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds. This funding is strategically divided; 150 billion yuan is designated for subsidies on the trade-ins of cars and larger consumer goods, while the remainder is focused on upgrading substantial equipment like elevators. Yet, despite these grand intentions, businesses are reporting a notable lack of tangible results almost two months into the initiative.

While the trade-in policy was intended to stimulate consumer spending, it demands initial financial outlay from consumers, raising skepticism about its actual uptake. Jens Eskelund, president of the European Chamber of Commerce in China, articulated a shared concern: “We are not aware of companies that have seen this translate into concrete incentives on the ground.” While the Chinese government’s plan has surprised analysts, it seems to lack the execution needed to convert good intentions into measurable outcomes.

Reports have indicated the policy’s budget, which averages 210 yuan (about $29.50) per capita, is unlikely to significantly affect domestic consumption. Such meager allocations raise questions about the effectiveness of any government-led consumption initiative, especially when surrounding economic sentiments remain cautious.

The performance of retail sales provides critical context for evaluating the trade-in policy’s potential efficacy. In a climate where retail sales showed the slowest growth since the COVID-19 pandemic, rising just 2% in June and marginally improving to 2.7% in July, the question remains whether the trade-in initiative can spur demand. According to UBS Investment Bank, the trade-in program could broadly support retail sales by merely 0.3% in 2023—hardly a robust uptick in a wavering economy.

Interestingly, while the traditional car sales market remains sluggish, there has been a significant surge in new energy vehicle sales, highlighting a possible shift in consumer priorities. With the trade-in policy more than doubling existing subsidies for electric and fuel-powered vehicle purchases, it raises the question of whether the focus is sufficiently aligned with current consumer trends or merely a response to static market performance.

Challenges in Sector-Specific Implementation

The program’s rollout has faced serious challenges in specific sectors, particularly with larger equipment such as elevators. Executives from major foreign elevator companies have expressed uncertainty about the implementation, noting a delay in seeing new orders stemming from the trade-in policy. In a recent statement, Otis’s China operations president called the current stage of the program “very early,” reflecting a common sentiment among industry players regarding the lack of clarity in how government funding can be practically utilized.

Moreover, industry insights reveal that several local authorities are still finalizing their approach to the trade-ins, leading to potential inconsistencies in implementation across various regions. This further complicates the transition to real, impactful consumer uptake.

The Long-Term View: Optimism Amidst Uncertainty

Despite the short-term setbacks, there remains a glimmer of hope for the initiative’s long-term effects. Companies like Kone, a major player in the elevator industry, have noted the potential benefits of the trade-in program over time, particularly with energy-efficient new models offering both savings and sustainability incentives. Officials remain optimistic, emphasizing that ensuring effective funding deployment by local governments will be crucial to achieving success.

At the same time, ATRenew, a company focused on the second-hand goods market, expressed hope that the ultra-long bonds program will encourage the growth of consumer trade-in kiosks. They reported a notable increase in trade-in volumes for certain products, suggesting that in specific demographics, the government’s effort is yielding positive outcomes.

While China’s trade-in policy offers potential pathways to enhance consumer consumption and stimulate economic revival, numerous hurdles must be addressed. With consumer hesitancy, ambiguous implementation strategies, and sector-specific challenges remaining at the forefront, the government’s resolve to follow through and adapt its approach will be critical. It is this execution, paired with real-time consumer insights and regional collaboration, that could ultimately decide the fate of this ambitious economic strategy.

Leave a Reply