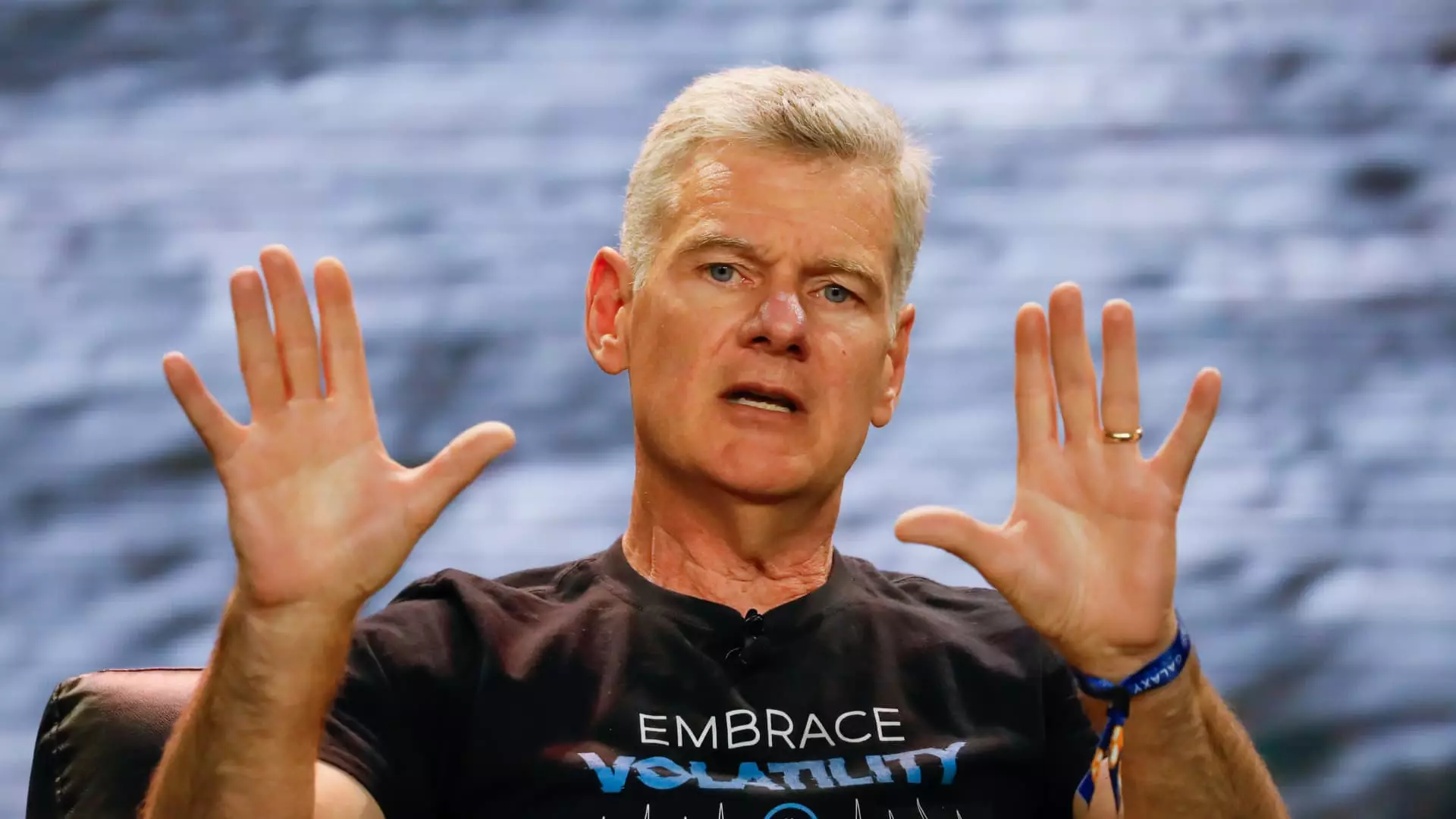

Mark Yusko, a hedge fund manager and the CEO of Morgan Creek Capital Management, recently made a bold prediction regarding the future price of Bitcoin. Yusko suggested that Bitcoin could more than double in value this year, reaching an impressive $150,000. This forecast has garnered attention from investors and cryptocurrency enthusiasts alike.

Yusko advocates for investors to “get off zero” and consider allocating at least 1% to 3% of their portfolios to Bitcoin. He argues that Bitcoin holds a unique position as the dominant token in the cryptocurrency market and presents itself as a superior alternative to gold. With Bitcoin seeing a 159% increase in value over the past year, Yusko’s prediction may not seem entirely far-fetched.

Yusko points to a few key factors that he believes will contribute to Bitcoin’s upward trajectory. One major driver he mentions is the recent launch of Bitcoin exchange-traded funds, which have introduced more accessibility and legitimacy to the cryptocurrency. Additionally, the upcoming Bitcoin halving, scheduled for late April, is expected to create a supply shock that could fuel further price increases.

Yusko remains optimistic about Bitcoin’s long-term prospects, suggesting that the cryptocurrency could see a tenfold increase in value over the next decade. He anticipates that the price will continue to rise post-halving, potentially reaching a peak toward the end of the year. Yusko’s firm has also invested in Coinbase, a popular crypto trading platform, further indicating his confidence in the future of the cryptocurrency market.

While Mark Yusko’s prediction of Bitcoin reaching $150,000 may seem ambitious, it is backed by his belief in the long-term potential of the cryptocurrency. As Bitcoin continues to gain mainstream acceptance and adoption, its price trajectory remains a topic of interest and speculation among investors. Only time will tell whether Yusko’s forecast proves to be accurate, but for now, it has certainly generated buzz and discussion within the financial community.

Leave a Reply