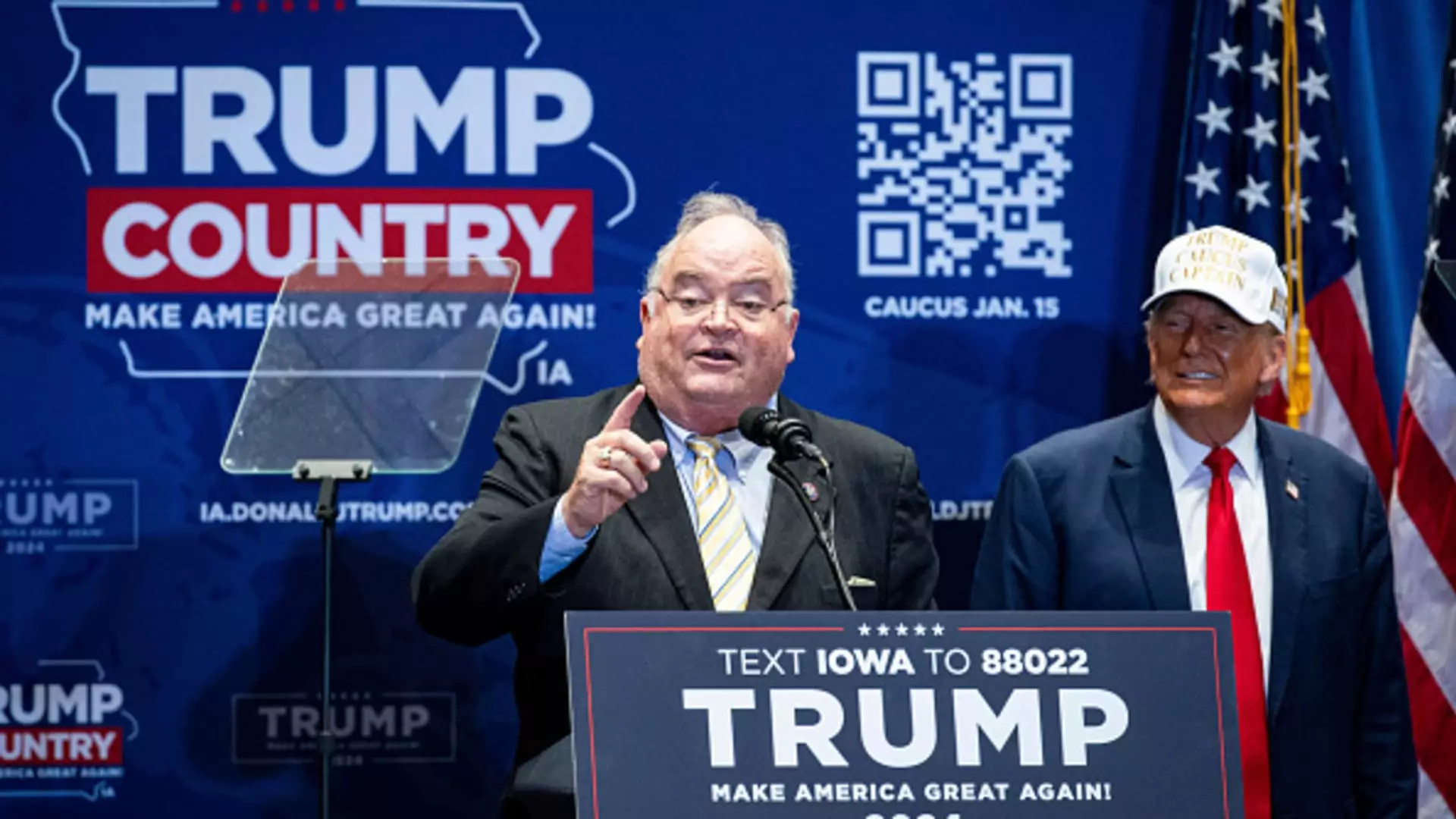

The announcement of former Missouri congressman Billy Long as President-elect Donald Trump’s pick to lead the Internal Revenue Service (IRS) has stirred debate, raising questions about the agency’s future direction and operational integrity. This move aligns with Trump’s broader agenda to reshape federal agencies according to conservative ideals, promising what many deem a drastic pivot for an institution that has not only handled tax collection but also undergone significant changes in recent years.

Long’s nomination emerges against a backdrop of considerable funding and reform aimed at improving the IRS. In 2022, Congress approved an infusion of nearly $80 billion for the agency, aimed primarily at enhancing customer service, modernizing technology, and addressing tax evasion among wealthier individuals and corporations. However, this funding, championed as crucial by fiscal watchdogs, could be threatened under Trump’s leadership, as Republicans often criticize such expenditures as wasteful government spending.

While Long’s prior experience as a business and tax advisor may suggest a potential for practical reform, his political record raises eyebrows. The former congressman has transitioned into the private sector, most notably into areas that have been described as “scam-plagued,” particularly regarding the controversial Employee Retention Credit (ERC). This pandemic-era tax break, designed to help small businesses survive during shutdowns, has been marred by reports of abuse and fraudulent claims, casting a shadow over Long’s acumen as a tax consultant.

Varied Reactions from Lawmakers

Responses from Senate leaders reflect a polarized view on Long’s qualifications. Republican Senator Mike Crapo lauds Long’s expertise, expressing optimism about his potential to address rampant problems within the IRS, ranging from taxpayer privacy breaches to operational inefficiencies. His support underscores a broader Republican agenda focused on reducing the perceived overreach of tax authorities.

Contrarily, Democrats voice reservations regarding Long’s suitability for the IRS leadership role. Senate Finance Committee Chair Ron Wyden explicitly characterized Long as an unusual and problematic candidate, bringing up his involvement with the ERC and suggesting a conflict of interests in his transition from a congressman to a figure in the very industry regulated by the IRS. Wyden’s comments signal a distrust among Democrats about Long’s ability to prioritize the needs of everyday taxpayers over those of powerful interests he may have encountered in the private sector.

Should Long be confirmed, the expectation is that he will aim to shift the focus of the IRS towards bolstering operational independence while still safeguarding taxpayer rights. Mark Everson, a former IRS commissioner, emphasized that Long’s congressional experience would lend credibility in interactions with lawmakers, potentially positioning him as a mediator between the agency and Congress. If he can assert himself successfully, he might champion policies that align with efficient tax collection and reinforce the government’s role in curbing tax evasion.

However, the road may be fraught with challenges. The IRS is currently under immense scrutiny, and any moves that seem to benefit wealthy individuals or corporations at the expense of average taxpayers could trigger backlash. There is a fine balance to be struck between optimizing agency efficiency and maintaining public trust, which has frequently eroded in an era of increased political polarization.

The Bigger Picture

Long’s nomination symbolizes more than just a personnel change—it represents a fundamental ideological clash regarding taxation and government oversight. The complexities surrounding tax policy, enforcement, and regulatory oversight are heightened in today’s divided political climate, making the IRS a critical battleground for broader fiscal debates.

As Long prepares for potential confirmation, all eyes will be on his plans to navigate this labyrinth of challenges. His ability to establish trust within the IRS while also fostering a cooperative relationship with Congress could determine the agency’s success—or failure—in the years ahead. Regardless of the outcome, Long’s candidacy opens a necessary dialogue about the role of the IRS in modern America and the agency’s future as a watchful steward of taxpayer interests.

Leave a Reply