Nvidia, the chipmaker, saw its shares surpass $1,000 for the first time in extended trading following the release of its fiscal first-quarter results. The company exceeded analyst expectations with a significant increase in revenue, reporting earnings per share of $6.12 adjusted versus $5.59 adjusted. Additionally, Nvidia’s revenue came in at $26.04 billion, higher than the expected $24.65 billion.

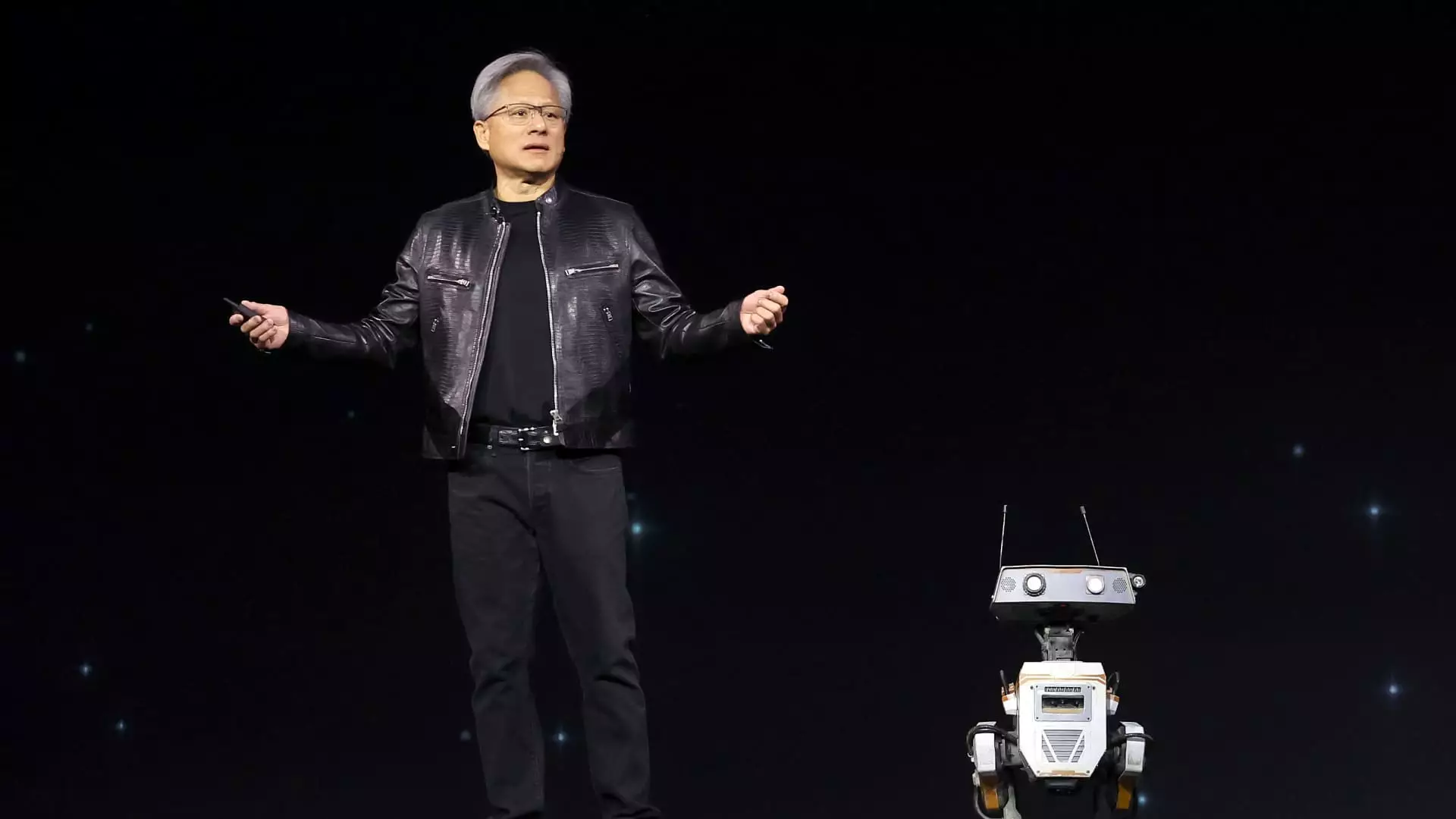

The AI boom has been a focal point for investors, with Nvidia at the forefront of this technological advancement. The demand for AI chips, such as those produced by Nvidia, remains robust, leading to a positive outlook for the company. CEO Jensen Huang mentioned that revenue from Nvidia’s next-generation AI chip, Blackwell, is expected later this year, further driving investor excitement.

Nvidia’s data center business, which includes AI chips and other essential components for running big AI servers, saw a significant increase in revenue. The company reported a 427% rise in the data center category, reaching $22.6 billion in revenue. This growth was attributed to the shipment of Hopper graphics processors and the increasing adoption of Nvidia’s technology by major cloud providers like Meta.

While Nvidia’s data center business remains a key driver of growth, the company has also made strides in other areas. Sales of networking parts, particularly InfiniBand products, saw a substantial increase, indicating the importance of connectivity in modern computing environments. Nvidia’s traditional gaming revenue also saw an 18% increase, driven by strong demand in the market.

In addition to its operational performance, Nvidia also focused on enhancing shareholder value through various financial initiatives. The company repurchased $7.7 billion worth of shares and paid $98 million in dividends during the quarter. Nvidia’s decision to split its stock 10 to 1 and increase its quarterly cash dividend to 10 cents per share demonstrates its commitment to rewarding shareholders.

Looking ahead, Nvidia’s CEO, Jensen Huang, expressed optimism about the company’s prospects, particularly with the launch of its next-generation AI GPU, Blackwell. The anticipation of increased revenue from Blackwell and further expansion in data center sales point towards sustained growth for Nvidia. With the company’s continued focus on innovation and strategic investments, investors are optimistic about Nvidia’s future performance.

Nvidia’s strong financial results, coupled with its focus on technological innovation and strategic growth initiatives, have positioned the company as a leader in the AI and data center markets. As the demand for AI chips and advanced computing solutions continues to rise, Nvidia remains well-positioned to capitalize on these trends and deliver value to its shareholders.

Leave a Reply