Nvidia is set to release its fiscal third-quarter earnings on Wednesday, and the financial community is buzzing with anticipation. Market analysts, particularly those using LSEG consensus estimates, are predicting revenue of approximately $33.16 billion for the period and an adjusted earnings per share (EPS) of 75 cents. This earnings report will be crucial not only for assessing past performance but also for setting the tone for future growth in an evolving market landscape focused on artificial intelligence (AI).

As Nvidia enters a critical phase in its quarterly reporting, the focus will be on its capacity to sustain growth amidst a thriving AI sector that is now entering its third year. Expectations from Wall Street indicate a forecasted EPS of 82 cents on revenues projecting to reach $37.08 billion for the upcoming quarter. The spotlight will undoubtedly be on Nvidia’s flagship products, particularly its Blackwell AI chip, which is anticipated to drive much of the company’s future growth. With significant partnerships established with tech giants such as Microsoft, Google, and Oracle, the pressure is on Nvidia to deliver solid results that match market sentiments.

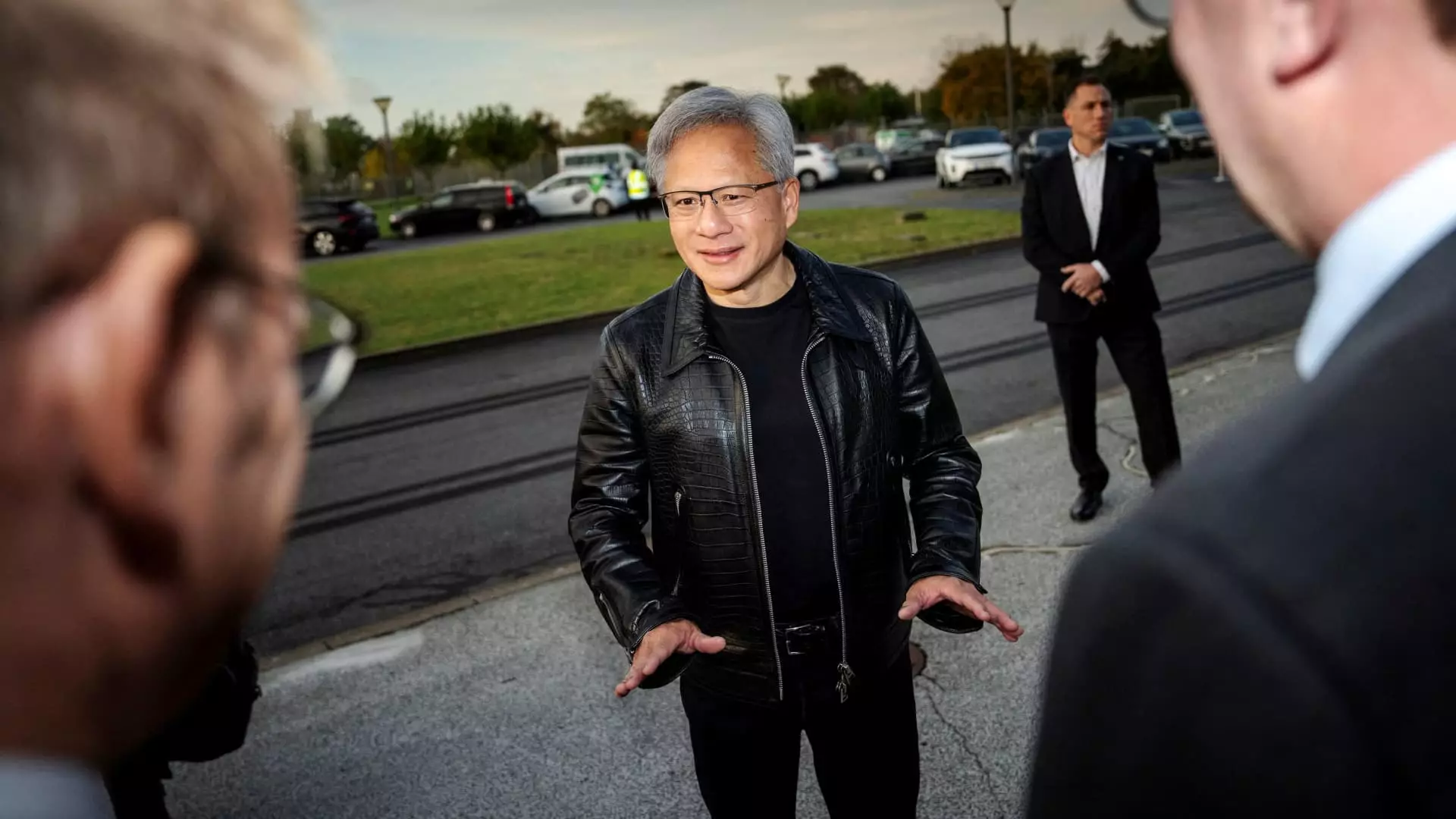

Investors will be paying close attention to insights provided by Nvidia’s CEO Jensen Huang regarding the demand for the Blackwell chip. As its next-generation chip for data centers, Blackwell holds the promise of spearheading growth in a sector poised for expansion. However, reports have surfaced indicating potential overheating issues within some systems utilizing Blackwell technology. This presents a risk for Nvidia, as product reliability often translates into consumer trust and long-term profitability. It remains to be seen how the company will convey its strategy for tackling these challenges in the earnings call, which will be critical for maintaining investor confidence.

Since the beginning of 2024, Nvidia’s stock has notably tripled, a striking indicator of robust investor optimism. However, this impressive performance stands in contrast to recent sales growth metrics. The company reported a staggering 122% growth in sales for the last quarter; however, this marks a significant slowdown from the 262% growth it achieved the previous April and the 265% year-over-year growth recorded in January. This decline raises questions about whether the lightning-fast pace of growth can be sustained or if Nvidia is entering a new phase of maturation in its business trajectory.

As the earnings report approaches, the broader implications for Nvidia and the semiconductor market will come into sharper focus. The ability of Nvidia to maintain its growth momentum, navigate potential product issues, and sustain investor confidence will ideally depend on its execution in the upcoming quarter. With a keen eye on both current performance and future projections, stakeholders will be eager to draw insights into the company’s strategic direction in what has become a fiercely competitive industry landscape.

Leave a Reply