Oracle Corporation, a leading player in the database software market, recently witnessed a remarkable surge in its stock value, climbing approximately 6% in after-hours trading. This uptick followed the company’s decision to raise its revenue forecast for the fiscal year 2026 and unveil ambitious projections for fiscal 2029. The rise in stock is a reflection of both investor optimism and the company’s strategic vision, particularly revealed during the Oracle CloudWorld conference held in Las Vegas.

Revised Revenue Expectations

During its analyst meeting, Oracle announced a new projected revenue of at least $66 billion for fiscal year 2026, outpacing analyst expectations that averaged around $64.5 billion according to LSEG. This upward revision demonstrates Oracle’s resilience and ability to capitalize on current market trends. In what has already been a robust week for the tech giant, the shares have surged nearly 15% over three trading days, establishing a new record high after exceptional quarterly financial results exceeded anticipations.

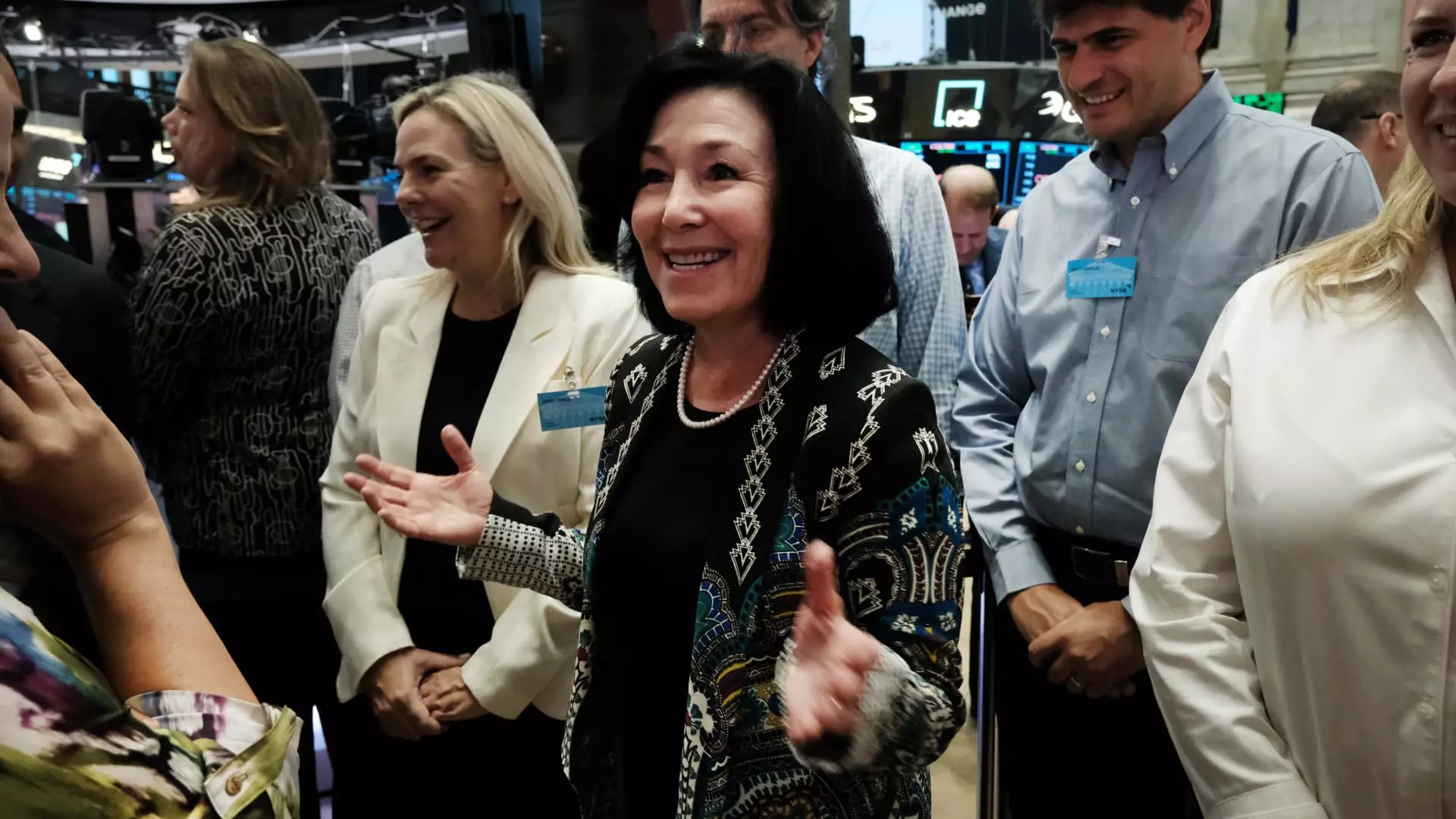

In addition to the immediate fiscal projections, Oracle’s management offered insights into longer-term financial forecasts. The company anticipates revenues exceeding $104 billion for fiscal 2029, predicting an impressive 20% year-over-year growth in earnings per share. Safra Catz, Oracle’s CEO, expressed confidence in these figures, suggesting that achieving these goals should be well within reach. This bold outlook indicates a strategic focus on sustainable growth, positioning Oracle favorably in the competitive tech landscape.

A notable factor behind Oracle’s optimistic projections is the company’s strategic partnerships with leading cloud service providers such as Amazon, Google, and Microsoft. These collaborations, which Oracle highlighted during the event, will allow businesses to seamlessly integrate Oracle’s formidable database solutions into existing cloud infrastructures. The recent announcement of a partnership with Amazon marks a significant milestone, reinforcing Oracle’s commitment to expanding its market reach.

Cloud Revenue Growth and AI Potential

Oracle’s cloud infrastructure revenue has surged by an impressive 45% in the last quarter, outpacing the growth rates of major competitors like Amazon, Google, and Microsoft. This robust performance stems from a growing trend of organizations migrating workloads from on-premises data centers to the cloud. Furthermore, Oracle’s foray into artificial intelligence with the announcement of a new line of advanced “Blackwell” graphics processing units positions the company for substantial growth in this rapidly evolving sector.

Future Investment Plans

As Oracle sets its sights on achieving its revenue targets, Catz has indicated a significant increase in capital expenditures, with plans to double investments in the current fiscal year 2025. This investment strategy signals Oracle’s commitment to innovation and expansion, positioning itself as a formidable competitor in the booming market for both cloud services and AI technologies.

Oracle’s ascending trajectory is a testament to its strategic acumen and timely adaptation to industry trends. With an invigorated focus on cloud services, AI, and essential partnerships, the company is not only enhancing its revenue prospects but is also reinforcing its status as a leading player in the tech industry. Investors and stakeholders alike will be keenly watching Oracle as it continues to navigate the challenges and opportunities that lie ahead.

Leave a Reply