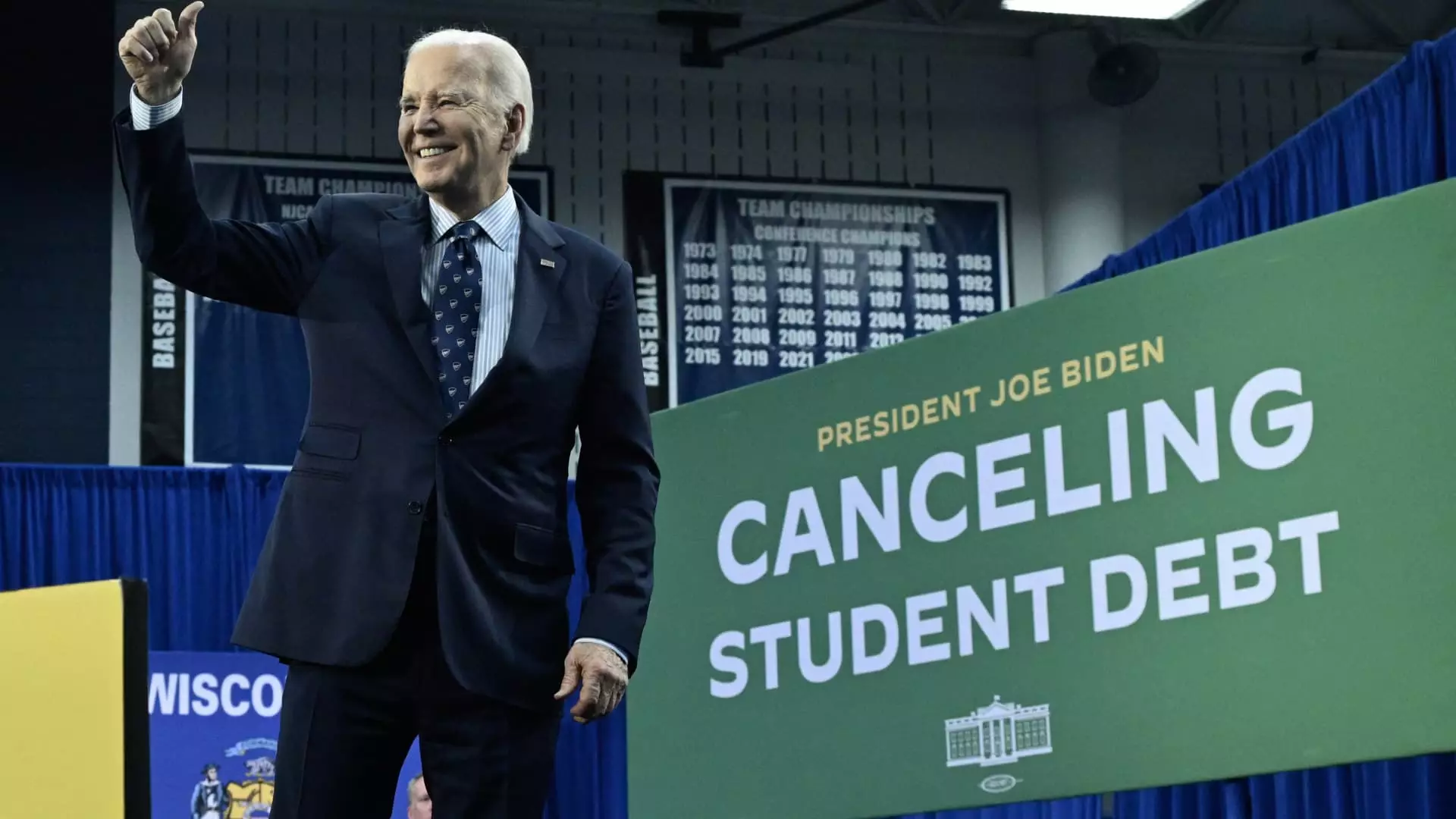

President Joe Biden is aiming to initiate the forgiveness of student loans for millions of Americans ahead of the November presidential election. However, before this plan can be put into action, his administration must carefully review the public comments submitted by individuals regarding his debt relief proposal. These comments were made available in the Federal Register in April, and the 30-day public comment period has already seen an overwhelming response, with over 34,000 feedback submissions. This high number of comments is said to be a record, particularly in comparison to previous comment counts on student aid regulations. According to higher education expert Mark Kantrowitz, controversial and polarizing topics tend to attract more public comments, which may explain the substantial feedback received regarding the student loan forgiveness proposal.

The proposed student loan forgiveness plan by President Biden is focused and specific compared to his previous attempt, which was blocked by the Supreme Court last year. Despite the targeted nature of the new plan, the potential beneficiaries still amount to tens of millions of borrowers. Individuals have taken to expressing their opinions on Biden’s Plan B for student loan forgiveness, with a range of perspectives and sentiments being shared through public submissions on Regulations.gov. While the names of the commenters have been withheld, the essence of their feedback sheds light on the diverse viewpoints regarding the proposed student loan forgiveness initiative.

Several individuals have voiced their support for the student loan forgiveness proposal, citing reasons such as the economic benefits it could bring. One commenter highlighted that forgiving student debt would not only ease the financial burden on individuals but also stimulate local economies by increasing spending, particularly in small businesses. Moreover, it was suggested that such a measure could potentially influence voters favorably during election periods, indicating a long-term positive impact.

Conversely, there are those who oppose the idea of widespread student loan forgiveness. One commenter criticized the proposal as an unjust imposition on Americans who never attended college or who have already paid off their student loans. This individual argued against using taxpayer money to fund the cancellation of student debt, pointing out that individuals should take personal responsibility for their educational choices. There was a clear sentiment that personal accountability should not be shifted to taxpayers at large.

Another viewpoint expressed in the public comments is that of supporting student loan debt relief as a means of addressing historical and systemic disparities, especially within marginalized communities. An African American millennial highlighted the impact of student debt on individuals from underprivileged backgrounds, emphasizing the necessity of such measures to level the playing field. The commenter discussed how student debt often hinders financial progress and community investment, positioning student loan relief as a step towards rectifying long-standing economic inequities.

On the other hand, there are those who believe in the importance of personal responsibility when it comes to financing one’s education. One commenter shared their journey of working to pay for their undergraduate and graduate degrees, emphasizing the personal sacrifices and decisions that accompanied their educational pursuits. The sentiment expressed was that individuals should bear the consequences of their choices without burdening taxpayers with the responsibility of student loan debt repayment.

There are also accounts of individuals who feel disillusioned by the promise of higher education as a gateway to the American Dream. Some commenters, particularly from working-class backgrounds, shared their struggles with student loan debt and the impact it has had on their financial well-being. From navigating complex repayment systems to trying to shield their children from similar financial burdens, these voices underscore the challenges faced by many Americans in managing student debt alongside other financial obligations.

The debate surrounding President Biden’s proposal to forgive student loans before the election reflects a range of perspectives and experiences. While some view it as a necessary step towards addressing economic disparities and empowering individuals and communities, others caution against the implications of widespread debt forgiveness on personal responsibility and taxpayer burden. The diversity of opinions expressed in the public comments showcases the complexity of the issue and the importance of considering the various stakeholders involved in shaping the future of student loan policy in the United States.

Leave a Reply