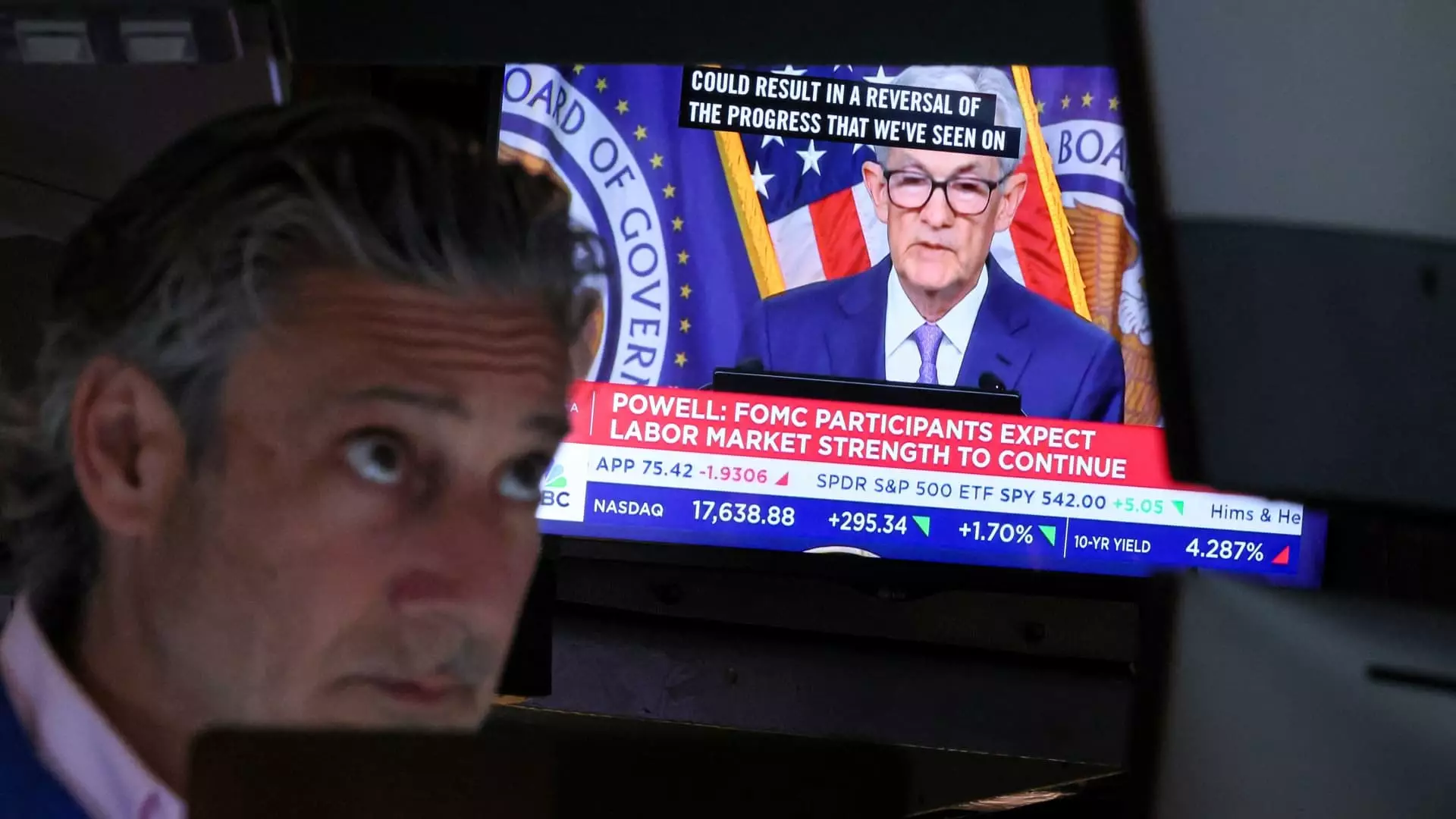

The stock market has experienced significant growth since the last monthly meeting in June, with the Federal Reserve’s potential interest rate cut contributing to new highs in various stock indices. The Dow Jones, S&P 500, and Nasdaq Composite all reached all-time highs recently, reflecting the bullish sentiment among traders. The probability of a rate cut by September is currently at 100%, as indicated by the CME FedWatch tool.

In response to the overbought market conditions, the CNBC Investing Club, led by Jim Cramer, made strategic trades to capitalize on the situation. The Club sold shares of TJX Companies to raise additional cash and locked in substantial gains by selling Meta Platforms and Palo Alto Networks. Additionally, the Club initiated a position in Advanced Micro Devices during the tech pullback, focusing on sectors outside of Big Tech that were showing strong performance.

One noticeable trend in the stock market is the rotation of investors towards sectors beyond Big Tech. This shift was evident in the significant performance of the Russell 2000 index, which outperformed the tech-heavy Nasdaq. Some of the Club’s top-performing stocks, such as Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover, represented diverse sectors that benefited from specific market conditions.

– **Ford Motor**: The company’s strong performance was driven by positive sentiment surrounding increasing sales and easing inflation, potentially leading to higher consumer demand.

– **Morgan Stanley**: Investors reacted positively to the prospects of a second term for former President Donald Trump, pushing the stock price to all-time highs after a better-than-expected second-quarter report.

– **Stanley Black & Decker**: The stock surged on expectations of monetary easing and increased housing market activity, benefiting the company’s product offerings.

– **Apple**: Apple reached record highs following a favorable outlook from Morgan Stanley, predicting a boost in iPhone sales due to the company’s AI initiatives.

– **Dover**: The industrial company saw significant gains as capital flowed into sectors favored by interest rate cuts, with a focus on the growing data center market.

Despite the overall market optimism, the Club experienced losses in some stocks, particularly those with significant ties to China. The examples of Wynn Resorts, Starbucks, and Estee Lauder illustrate the risks associated with international dependencies in today’s market environment. However, the diversification of the Club’s portfolio across different sectors helped mitigate potential losses and capitalize on emerging opportunities.

As the market continues to evolve, the Club’s strategy of identifying trends, monitoring performance, and executing timely trades has proven to be effective. By staying informed about market movements, economic indicators, and sector-specific developments, the Club can position itself to maximize returns and minimize risks in a dynamic trading environment.

The recent stock market trends highlighted the importance of adaptability and diversification in an ever-changing market landscape. By analyzing performance, identifying opportunities, and adjusting the portfolio accordingly, investors can navigate market fluctuations and capitalize on emerging trends for long-term success.

Leave a Reply