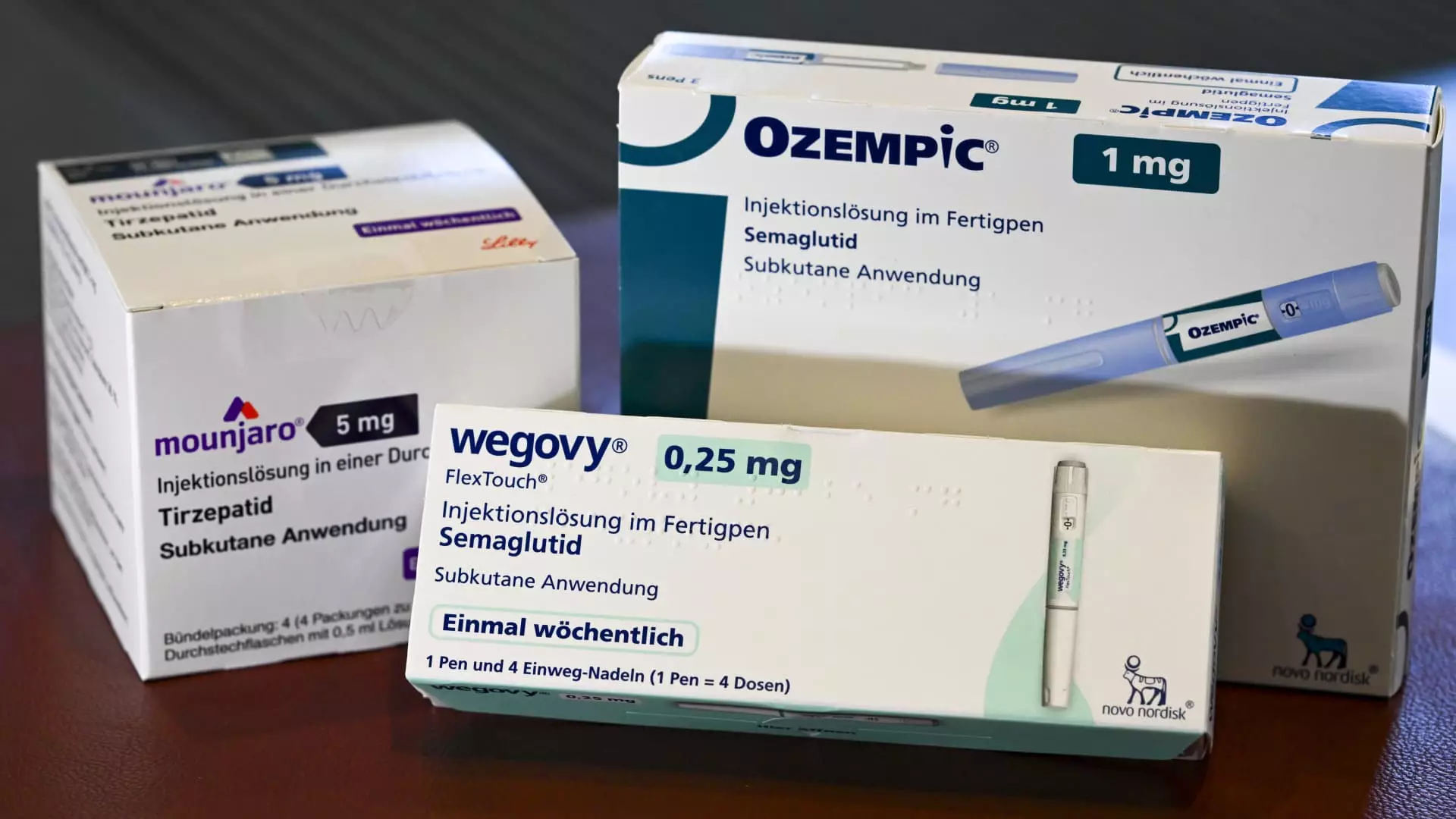

In recent years, the landscape of diabetes and weight management treatment has been dramatically reshaped by the introduction of GLP-1 medications such as Mounjaro, Ozempic, and Wegovy. While these drugs have shown significant promise in reducing health risks and improving overall well-being, they also come with exorbitant price tags that are forcing employers to reassess their healthcare spending. The pivotal question that employers face is whether the upfront investment in these costly medications will yield significant long-term savings by fostering a healthier workforce.

Greg Case, the CEO of Aon, has alluded to a remarkable decrease—in some instances up to 44%—in major cardiovascular events among those taking GLP-1 medications. While this data appears to paint a rosy picture, the initial financial burden of incorporating these treatments into employer-sponsored health plans is concerning. The reality is that in the first year, employees using these medications often have increased hospital visits, which adversely affects short-term financial metrics. This leads to a Burden of Costs that paradoxically contradicts the anticipated long-term health benefits.

Health Implications vs. Financial Realities

Initial findings from Aon’s research indicate that while patients taking GLP-1 medications experience significant health improvements, including reductions in osteoporosis and pneumonia, the short-term costs associated with their healthcare share a more complex narrative. The increasing number of doctor visits and medical interventions in the initial months can elevate employers’ healthcare costs, creating what might be termed a financial catch-22.

It is crucial to recognize that the financial implications of GLP-1 usage do not exist in a vacuum. Patients often utilize these medications as part of a broader health strategy that includes treatment for pre-existing conditions related to obesity. Hence, the upfront costs do not merely reflect the medications but also an array of associated healthcare services that can strain employer budgets before any significant health benefits are realized.

Long-Term Savings: A Glimmer of Hope

Despite the fog of initial costs, the analysis suggests a potential long-term reduction in overall healthcare expenses. Aon found that healthcare costs for those adhering rigorously to GLP-1 regimens could decrease by about 7% after two years in comparison to those who do not utilize these medications. The most revenue-saving victory lies in the drastic drop in cardiovascular incidents, which accounts for the majority of healthcare costs stemming from obesity-related ailments.

Moreover, for adherent patients, the savings extended even further, boasting reductions as high as 13%. These statistics reveal a significant opportunity for employers willing to take a risk on these medications, as the data suggests a favorable return on investment (ROI) once the initial costs begin to taper off. However, this potential ROI raises a fundamental ethical dilemma: Should employers invest in short-term financial burdens for the promise of long-term health benefits?

Employer Responsibility and Ethical Dilemmas

With Aon’s findings serving as a launchpad, companies must grapple not just with the economics but also with the ethical implications of providing coverage for groundbreaking yet costly medications. Is it right to push such financial responsibility onto employers? Shouldn’t there be more frameworks in place to support the cost-sharing burden, especially for medications with high upfront costs?

Aon’s efforts to establish a subsidized GLP-1 weight management program provides a glimpse into a more supportive approach for employers looking to manage costs. Incorporating wellness visits and blood testing not only aids adherence to prescribed regimens but also aligns financial incentives for employers and employees alike. Yet it highlights a key point: access to life-altering treatments should not be solely tethered to employer capacity to pay.

As the discourse around GLP-1 medications continues to evolve, it reflects larger societal issues surrounding healthcare access, equity, and responsibility. The initial high costs of GLP-1s may prove to be a bitter pill to swallow, yet the underlying potential for improved health outcomes cannot be discounted. However, we must ask: How do we equitably distribute both the risks and rewards inherent in such transformative therapies?

Leave a Reply