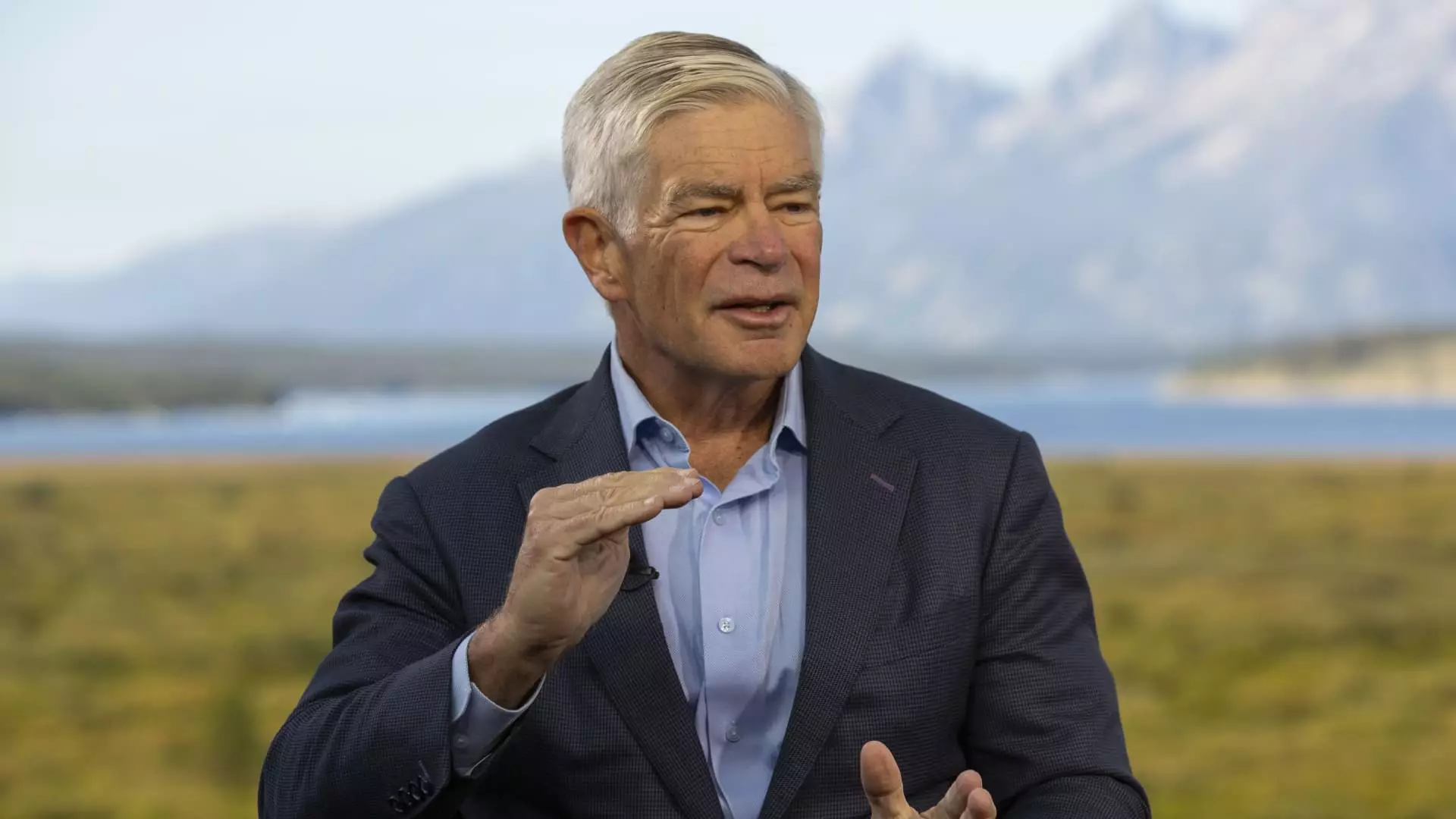

Philadelphia Federal Reserve President Patrick Harker has made it clear that he fully endorses the idea of an interest rate cut in September. His statement during a recent interview with CNBC at the Fed’s annual retreat in Jackson Hole, Wyoming, leaves no room for ambiguity. Harker’s views point towards a strong inclination towards monetary policy easing, with the likelihood of such a move almost guaranteed during the upcoming official meeting. This comes following the release of minutes from the last Fed policy meeting, which indicated a forthcoming cut as officials become more assured about the direction of inflation and seek to preempt any potential weaknesses in the labor market.

In his interview with CNBC, Harker emphasized the importance of initiating the process of reducing rates in September. He stressed the necessity of a methodical approach to easing and giving clear signals well in advance to stakeholders. Despite market expectations of a 25 basis point reduction being at 100%, with a 50 basis point cut also being considered, Harker remains cautious. He stated that his position on the magnitude of the cut is undecided and will require more data in the upcoming weeks before making a firm decision.

The Federal Reserve has maintained its benchmark overnight borrowing rate within a range of 5.25%-5.5% since 2023 in response to persistent inflation concerns. After the July Fed meeting, there was a brief market turmoil caused by officials signaling a lack of evidence to support rate reductions. However, subsequent statements from policymakers have signified an imminent shift towards easing. Harker underscored the independence of monetary policy decisions from political considerations, particularly with the looming presidential election in the backdrop. As he highlighted, the primary focus of the Fed is data-driven decision-making to ensure an appropriate response to prevailing economic conditions.

While Harker’s stance leans towards a decisive rate cut, Kansas City Fed President Jeffrey Schmid offered a somewhat indirect view on future policy direction. Schmid pointed to the rising unemployment rate as a key factor influencing the Fed’s decision-making process. He noted that a mismatch in labor market supply and demand had previously contributed to inflationary pressures, which are now showing signs of easing. Despite acknowledging the need for further policy adjustments, Schmid expressed confidence in the resilience of banks under the current high-rate environment and dismissed concerns about policy being overly restrictive.

The statements from Philadelphia Fed President Patrick Harker and Kansas City Fed President Jeffrey Schmid shed light on the evolving consensus within the Federal Reserve regarding the necessity of an interest rate cut. While Harker advocates for a prompt and clear action in September, Schmid’s observations underscore the importance of considering various economic indicators, particularly the labor market dynamics. As the Fed prepares to reconvene for its next official meeting, the financial markets remain vigilant for any signals that might indicate the future trajectory of monetary policy. The path ahead is fraught with economic uncertainties, but the Fed’s commitment to data-driven decision-making is likely to guide its actions in the coming months.

Leave a Reply