On Wednesday, the U.S. stock market saw a positive trend following a three-day losing streak. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all experienced gains, with percentages ranging from 1% to 1.9%. Jim Cramer described the day as a “good day” after Monday’s decline, attributing the sell-off to the unwinding of the “yen carry trade” and concerns about a U.S. recession due to a disappointing jobs report.

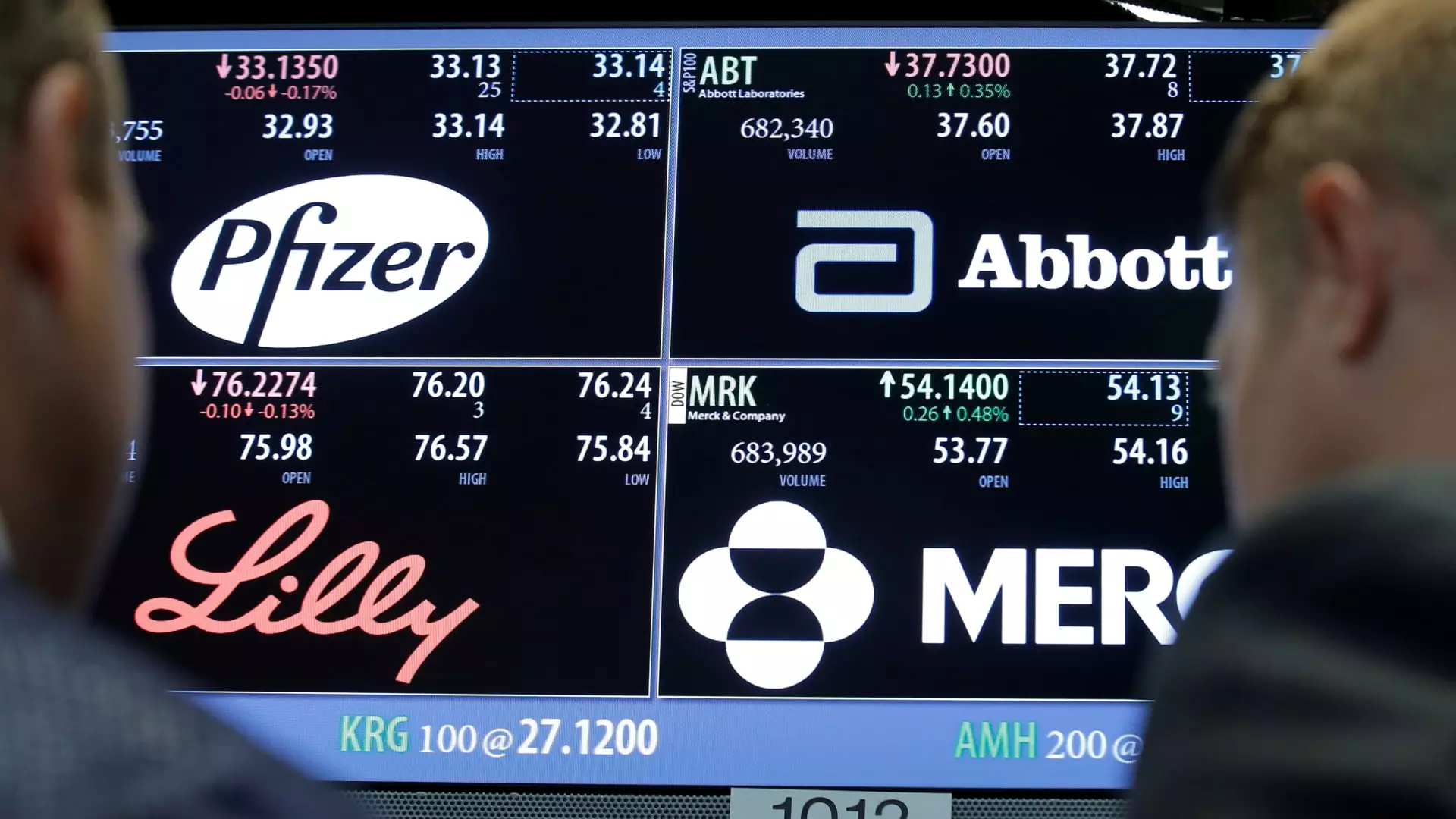

Eli Lilly’s shares took a hit of 1.7% after Novo Nordisk’s underwhelming earnings results. Novo Nordisk reported a weaker-than-expected net profit in the second quarter and missed sales expectations for its weight-loss drug Wegovy. Investors are now speculating about the performance of Eli Lilly and its GLP-1 drugs Zepbound and Mounjaro. Despite Novo Nordisk’s sales miss being attributed to higher-than-expected concessions, Jim Cramer suggested that Eli Lilly’s shares could decline further after the release of its own quarterly results.

Amazon received positive news regarding its e-commerce business after CVS Health’s earnings announcement. The decision to close 900 retail drug stores by the end of the year in a restructuring effort created a favorable environment for Amazon’s platform. Consumers are increasingly turning to Amazon for everyday essential items, resulting in a nearly 3% increase in the company’s shares.

CNBC Investing Club Protocol

As a subscriber to the CNBC Investing Club with Jim Cramer, members receive trade alerts before Jim makes a trade. There is a waiting period of 45 minutes after the alert before any buying or selling activity takes place in the charitable trust’s portfolio. Additionally, if Jim discusses a stock on CNBC TV, there is a 72-hour waiting period before executing a trade. It is important to note that the information provided by the investing club is subject to terms and conditions, privacy policy, and disclaimer. Members should be aware that no specific outcome or profit is guaranteed.

This analysis of the CNBC Investing Club with Jim Cramer’s recent activities highlights the volatility and unpredictability of the stock market. While positive trends and potential opportunities exist, investors must remain cautious and well-informed to navigate the ever-changing landscape of the financial world. It is crucial to consider all factors, both internal and external, that may impact stock performance and make sound investment decisions based on thorough research and analysis.

Leave a Reply