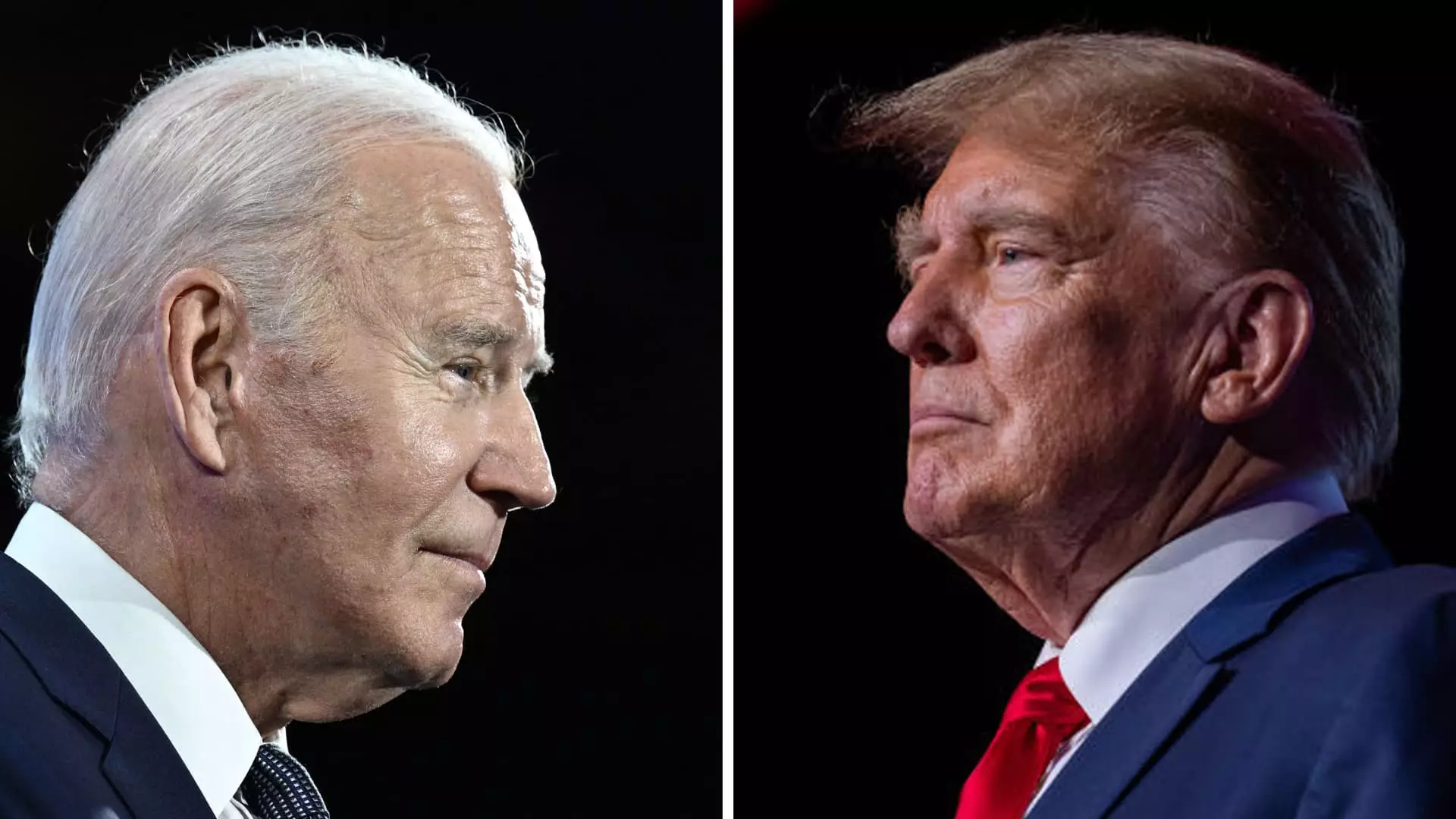

As the 2025 deadline for the expiration of the tax breaks enacted by former President Donald Trump via the Tax Cuts and Jobs Act of 2017 approaches, both President Joe Biden and Trump have promised to extend these tax breaks for the majority of Americans. These tax breaks include lower federal income brackets, higher standard deductions, and a more generous child tax credit, among others. However, the expiration of these provisions would result in increased taxes for over 60% of filers, according to the Tax Foundation.

While the idea of extending these tax breaks may seem appealing to many, the federal budget deficit remains a significant concern. Fully extending the provisions of the TCJA could potentially add a staggering $4.6 trillion to the deficit over the next decade, as reported by the Congressional Budget Office. This amount represents a 50% increase from the initial estimates made in 2018 by the Committee for a Responsible Federal Budget.

In 2018, the Congressional Budget Office predicted that the economic growth resulting from the TCJA would cover approximately 20% of the cost of the tax cuts. However, subsequent studies have shown that the effects were not as significant as initially anticipated. There is a consensus among economists that the Tax Cuts and Jobs Act did not come close to paying for itself, and the same skepticism applies to the idea of extending or making it permanent.

President Biden’s proposal includes extending tax breaks for taxpayers making less than $400,000, which encompasses the majority of Americans. His top economic advisor, Lael Brainard, has suggested higher taxes on the ultra-wealthy and corporations to help fund these extensions for the middle class. On the other hand, President Trump aims to extend all provisions of the TCJA, with a renewed emphasis on tariffs as a means of generating revenue.

Despite the promises made by both candidates, the future of these tax breaks and how they will be funded remain uncertain. The success of extending these provisions may hinge on various factors, including economic growth, revenue from taxes on the wealthy and corporations, and potential policy shifts depending on which party controls the White House and Congress.

The debate over extending expiring tax breaks is complex and multifaceted. While both President Biden and Trump have articulated their plans to address this issue, the challenges of funding these extensions, the impact on the federal budget deficit, and the uncertainty surrounding policy proposals underscore the need for a thoughtful and careful approach to tax policy in the coming years.

Leave a Reply