Nvidia’s dominance in the graphics processing unit (GPU) market has been nothing short of astonishing, with the firm riding a wave of unprecedented demand driven primarily by the surging interest in artificial intelligence (AI). The company’s meteoric rise in sales signifies not just its prowess in semiconductor technology but also the broader shift in industry dynamics as AI becomes an irreplaceable facet of numerous sectors. However, as enticing and promising as this narrative may be, a cloud looms over Nvidia’s towering ambitions—one that threatens to erode its gains and reshape its market strategy: the geopolitical landscape, particularly in relation to China.

As Nvidia prepares to announce its earnings this Wednesday, there is an apparent shift in sentiment compared to previous quarters. Whatever excitement is generated from robust revenue growth is now juxtaposed against complex challenges, primarily driven by U.S. government restrictions. These measures, reifying the tensions inherent in U.S.-China relations, pose significant obstacles for Nvidia as it wrestles with new export regulations that could alter its trajectory.

The Shadows of Regulation

The recent letter from the Trump administration demanding an export license for Nvidia’s newly designed H20 chip underlines the growing caution within the U.S. regarding its technological assets. In an era where advancements in AI could pivotally influence military capabilities, the government’s stance becomes a double-edged sword. While it aims to protect national security interests, it also stifles the competitive edge that U.S. companies like Nvidia have enjoyed on the global stage.

The ramifications of these restrictions are staggering—Nvidia anticipates a $5.5 billion write-down in inventory as a direct result of lost access to the Chinese market. Analysts have labeled this the largest write-off in the chip industry’s history, illustrating just how provocatively impactful government intervention can be. As David O’Connor of BNP Paribas articulated, the inventory write-off implies a staggering $15 billion revenue hit on a rolling twelve-month basis. What’s more debilitating for investors is that, while 66% growth is forecasted, this figure pales compared to the preceding year’s explosive 250% growth. This stark deceleration might not only concern shareholders but also cast shadows over Nvidia’s long-term strategies.

The Risk of Losing Ground

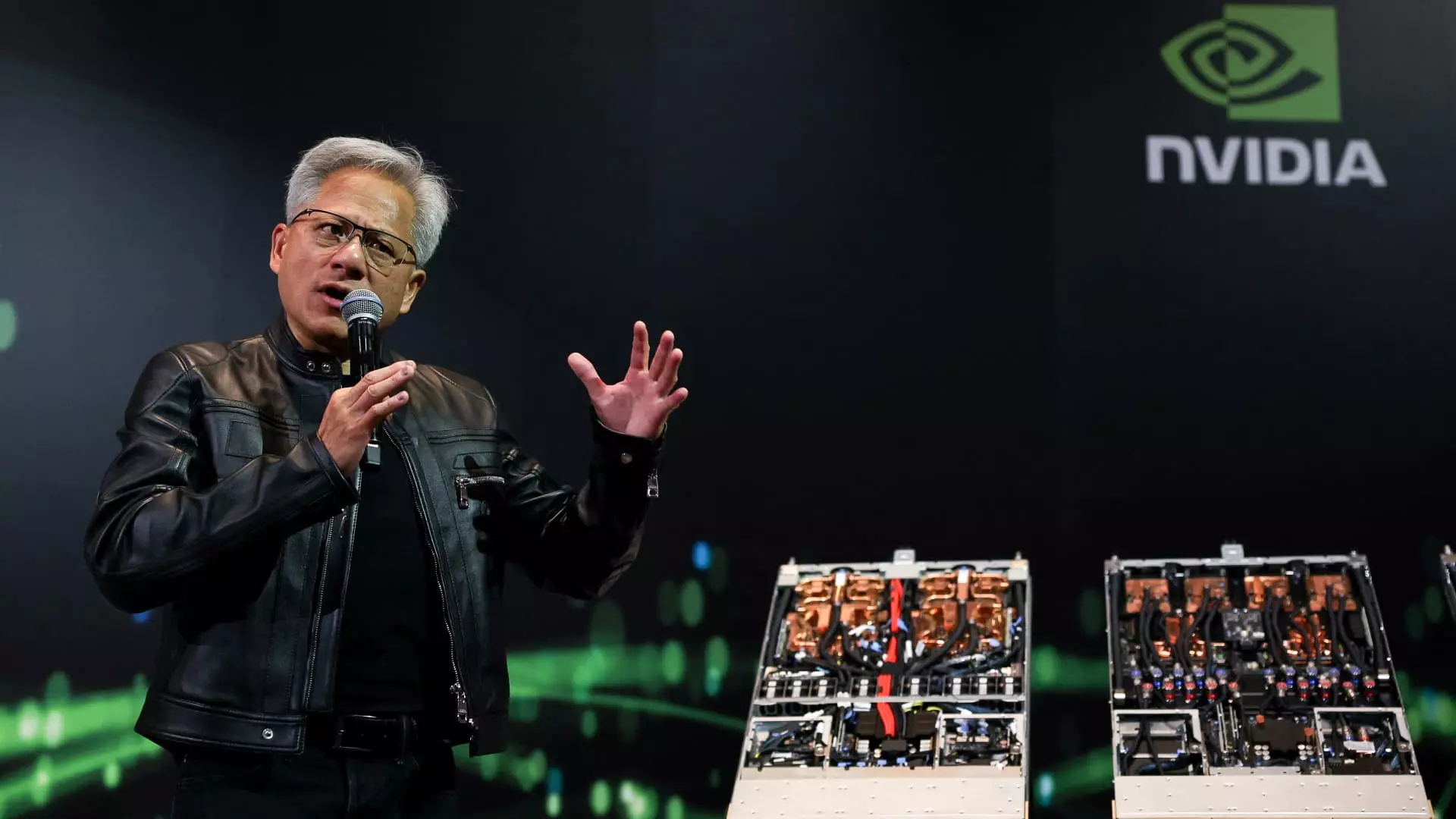

The export restrictions beg the question: what is the ultimate cost of innovation stifled by politics? Nvidia’s CEO, Jensen Huang, underscored a crucial point—while the U.S. may attempt to inhibit China’s access to advanced technology, such restrictions could catalyze a domestic push in China toward self-reliance. After all, in a fiercely competitive tech landscape, any void left by an American corporation could easily breed homegrown alternatives, closing the gap that the U.S. aims to maintain. It’s a precarious gamble, with stakes that extend far beyond Nvidia’s balance sheet; this could accelerate the development of a robust AI semiconductor ecosystem in China that could, in the long run, erode U.S. technological leadership rather than fortify it.

Furthermore, while there may have been brief glimmers of optimism with the U.S. administration’s retraction of certain restrictions in May, these measures are not indicative of a complete thaw in relations. The impending discussions about what a simplified export regime might look like only serve to amplify uncertainty. As Morgan Stanley analysts noted, questions about the H20 chip’s fate and its broader implications for the Chinese market are likely to linger beyond Nvidia’s earnings report, creating anxiety amongst investors and stakeholders alike.

Nvidia’s Tug of War with Market Dynamics

Despite the turbulence caused by geopolitical tensions, Nvidia remains a player with significant muscle in the tech sector. Recent performance reflects resilience, with shares having rallied modestly after an initial rough start in early 2025, at least relative to the broader Nasdaq index. This recovery suggests that investors are still interested, albeit cautiously, in Nvidia’s long-term potential. Such intrigue grounds itself in the company’s continued innovation and exceptional ability to capture market share, even as that share has halved within China.

However, as we consider the implications of these export regulations, one cannot help but feel that Nvidia’s growth is caught in a precarious balancing act. It is a complex intersection where corporate ambitions meet legislative scrutiny, and where the ambitions of a nation clash with those of another. As we stand at this crossroads, the narrative surrounding Nvidia is not simply one of growth; it is an acute reminder of how global interrelations can shape, distort, and ultimately redefine the trajectories of industries and innovations that were once thought to be impervious to outside influences.

Leave a Reply