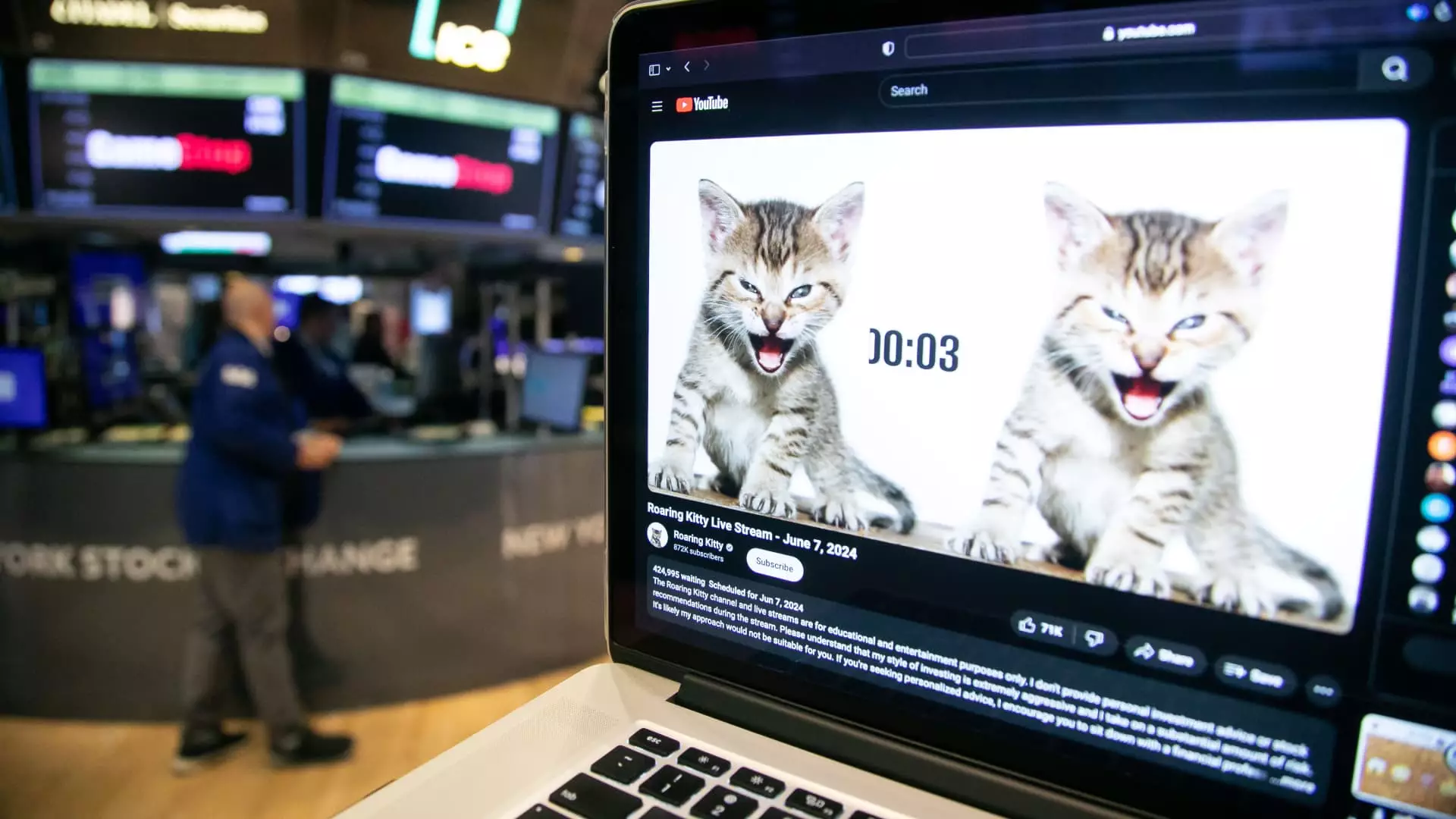

GameStop, a meme stock that has captured the attention of Wall Street and individual investors alike, faced a significant sell-off in its shares on Wednesday. This sell-off coincided with a surge in trading volume in call options owned by the infamous “Roaring Kitty”, whose real name is Keith Gill. Gill still holds 120,000 call options contracts with a strike price of $20 and an expiration date of June 21. However, the trading volume in GameStop calls with the exact strike price and expiration skyrocketed to 93,266 contracts on Wednesday, far surpassing the 30-day average volume. The price of these contracts plummeted by over 40% during the session, while the stock itself plunged by 16.5%.

Options traders have been speculating on Gill’s next move. It is uncertain whether he was responsible for the surge in trading volume, but given his significant holdings in these contracts, many believe he could be involved. There are theories that Gill may have to sell his calls before the expiration date or roll them into another call option in order to avoid having to come up with a large amount of cash to exercise them on June 21. If Gill were to exercise the calls, he would need $240 million to acquire 12 million shares at $20 each, an amount that surpasses what he has disclosed in his E-Trade account publicly.

The market is keeping a close eye on any signals that Gill may be liquidating his position in GameStop, as this could have a significant impact on the stock price. If he were to start selling off his call options, it could potentially drive down the price of the stock, triggering further selling pressure. This situation highlights the complexities and risks involved in options trading, especially when dealing with large positions held by prominent investors like Roaring Kitty.

The GameStop dilemma with Roaring Kitty and the options market underscores the volatile and unpredictable nature of meme stocks and speculative trading. The actions of key players like Gill can have far-reaching consequences on stock prices and market dynamics, making it crucial for investors to closely monitor such developments and assess the potential risks involved in such high-stakes trading scenarios.

Leave a Reply