The core narrative surrounding the Federal Reserve’s independence has long been that it operates free from political interference, anchoring economic stability and confidence. However, recent discussions reveal this independence is more myth than reality. When Treasury Secretary Scott Bessent emphasizes the need for internal review yet stresses that the Fed’s monetary policy, especially interest rate decisions, should remain insulated from political sway, he inadvertently exposes a fragile veneer. The underlying truth is that the supposed separation of monetary policy from politics is perpetually tested by external pressures, most notably from the executive branch. The Trump administration’s vocal calls for aggressive rate cuts and criticism of Fed leadership underscore an uncomfortable reality: political influence can, and does, seep into monetary decision-making.

This persistent tension questions whether the independence claimed by the Fed is a safeguard or a convenient shield for policymakers reluctant to face accountability. The push for a comprehensive review of Fed operations, motivated by concerns over bloated projects such as the $2.5 billion building renovation, seems, on the surface, innocent. Yet, closer analysis suggests it’s a gateway for broader oversight—one that could erode the institution’s autonomy. It’s a classic case of how seemingly technical issues, like budget overruns, can be leveraged to justify unpacking the autonomy that keeps the Fed from constantly being caught in the crossfire of partisan politics. Such narratives threaten to reframe the central bank as just another political pawn, weakening its legitimacy and risking policy volatility driven by short-term political gains rather than long-term stability.

The Dangerous Overreach of Political Powers

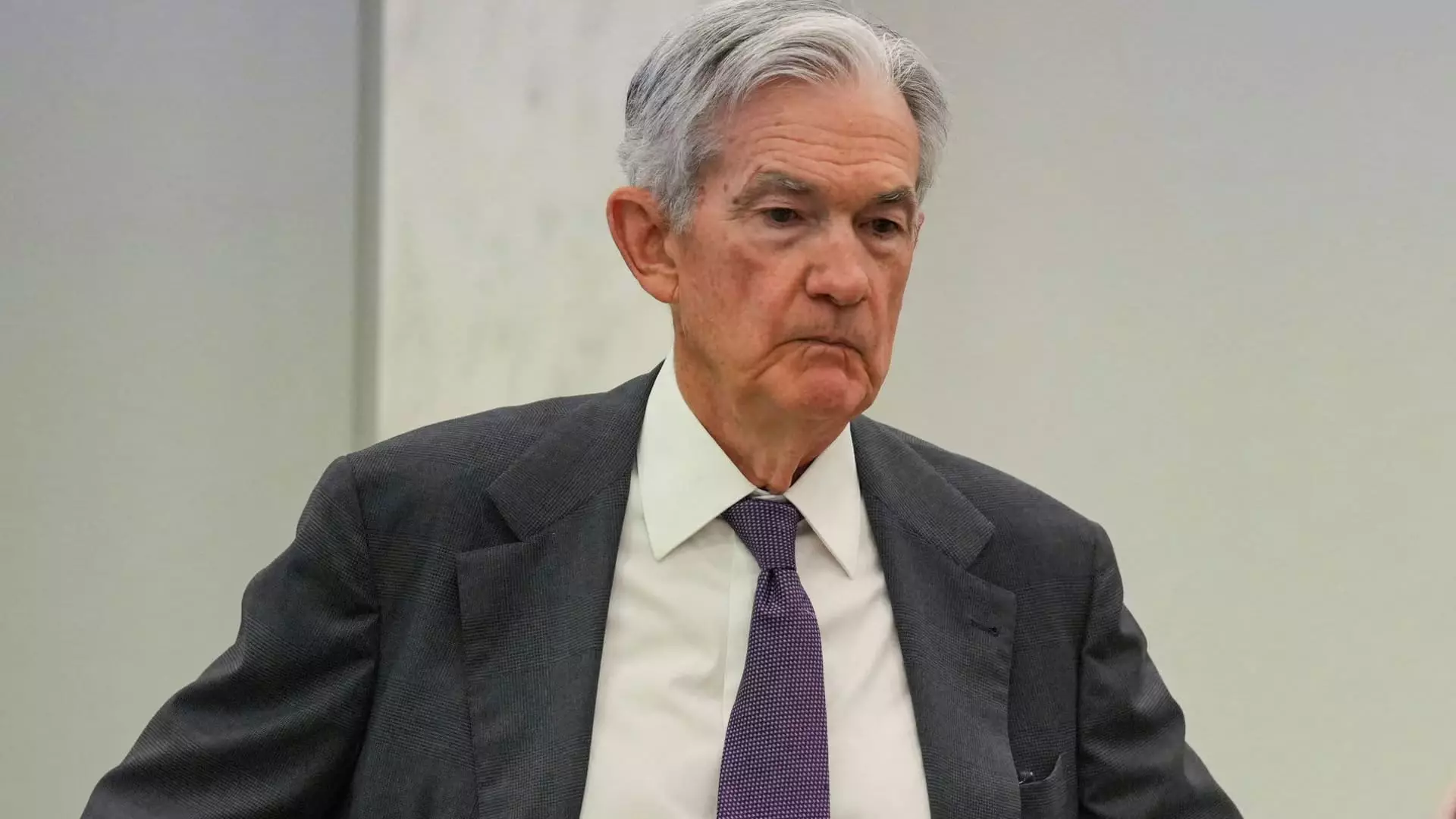

President Trump’s outright call for Jerome Powell’s resignation serves as both a symptom and a catalyst of the deeper issue: the politicization of central banking. While Powell’s leadership has been scrutinized for its cautious approach amid turbulent times, the politicization risks destabilizing the very foundations of the economy. When a sitting president openly questions the integrity of the Fed, it creates a chilling effect that hampers the institution’s ability to craft careful, data-driven policies. Moreover, the bid for lower interest rates, albeit popular with certain segments, reveals a broader appetite to manipulate monetary policy for electoral or political expediency.

The danger here lies in sacrificing the credibility and stability that central banking is tasked with ensuring. True independence is not just a matter of preserving institutional prestige; it’s fundamental to maintaining an economic environment where markets can operate with confidence. When political actors try to influence rate decisions or push for agendas that conflict with economic realities—like Trump’s insistence on rate reductions despite mounting economic signs—the risk of oscillating policies and economic uncertainty increases exponentially. The independence of the Fed, in this context, is not merely a bureaucratic ideal but a bulwark against impulsive political meddling that could lead us down a perilous path of economic volatility.

Balancing Accountability Without Undermining Autonomy

The debate surrounding the Fed’s role highlights a pressing dilemma: how to hold the central bank accountable without stripping away its independence. Some voices, like those of policymakers such as Michelle Bowman, advocate for transparency and accountability—principles that provide democratic legitimacy to the institution’s actions. Yet, there’s a perilous line between oversight and control. Overreach threatens to politicize decisions that necessitate insulation from immediate political pressures.

In a center-left liberal context, it is essential to recognize that accountability does not mean surrendering independence to the whims of political powers. It involves establishing robust frameworks for oversight—transparent reporting, clear mandates, and checks that prevent erosion of institutional integrity—while preserving the core autonomy that allows the Fed to act in the long-term interest of the economy. This delicate balance is vital. Without it, the danger looms that the central bank becomes just another façade for political agendas, sacrificing the stability and credibility vital for economic resilience.

The ongoing debates around Fed oversight underscore a fundamental challenge: safeguarding the independence of monetary policy while ensuring responsible governance. It’s a debate that transcends technicalities, touching on the very heart of democracy, stability, and economic integrity. As public discourse intensifies, it becomes increasingly clear that the future of the Fed’s independence is not just a matter of bureaucratic protocol but a defining factor in the health of our democracy and economy.

Leave a Reply