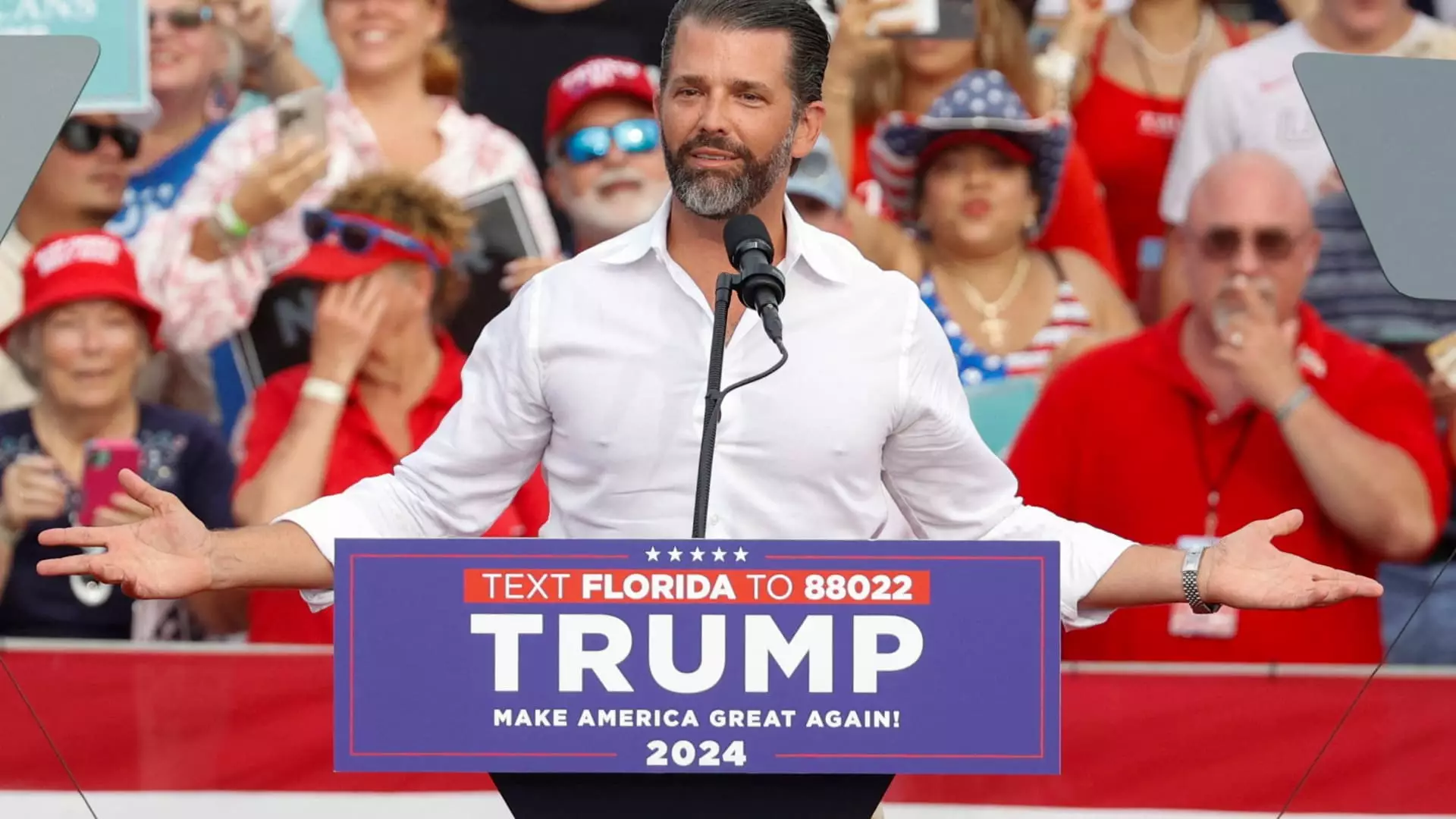

In recent days, the financial community has seen a notable phenomenon regarding microcap stocks—an impact so pronounced that it has raised eyebrows across various trading floors. This past Tuesday, shares of PSQ Holdings, a company centered around the online marketplace PublicSquare, skyrocketed by 185% following the announcement that Donald Trump Jr. would join its board of directors. This incident serves as a quintessential case study, illustrating the dynamics between celebrity endorsements and stock performance in the microcap sector.

The surge in PSQ’s stock value was not merely coincidental; it was the result of strategic positioning and brand alignment. In a statement, Michael Seifert, the CEO of PublicSquare, highlighted Trump Jr.’s previous investment in the company, noting that Don had been involved prior to its initial public offering (IPO). This pre-existing relationship suggests that Trump Jr.’s participation is not a fleeting gimmick, but rather a calculated move with the potential to foster growth and innovation. His commitment to creating a “cancel-proof” economy resonates with a specific demographic, thereby solidifying PublicSquare’s market position amid rising cultural tensions.

The financial landscape of PublicSquare prior to the announcement encapsulates the dual-edged reality faced by many microcap stocks. With a market capitalization of just $72 million and an operating loss greater than $14 million against net revenues of only $6.5 million, the company was grappling with realizable growth and operational stability. However, Trump Jr.’s entry could signal a shift in trajectory, asserting that alliances with prominent figures can rejuvenate investor confidence.

This is not the first instance where Trump Jr.’s affiliations have caused significant fluctuations in stock valuations. His recent appointment to the board of Unusual Machines also resulted in a robust 100% share price increase on the date of the announcement. Such patterns raise questions about the sustainability of this effect; do celebrity board members provide long-term value, or is their influence ephemeral? The answer may lie in the public perceptions and market sentiments surrounding giant personalities in the current socio-political climate.

Worth noting is the broader context in which Trump Jr. operates, including his involvement in venture capital with firms like 1789 Capital, which focuses on pro-conservative investments. His strategic partnerships and shared brand ideologies align with his family’s political atmosphere, presenting him as an ambassador for conservative market movements.

As PSQ Holdings takes steps forward with its newly appointed board member, it raises important questions for potential investors. Will the surge in stock price reflect genuine business growth, or will it face a retraction once the novelty of the celebrity affiliation fades? Investors must tread carefully; market conditions can shift dramatically based on external forces, and microcap stocks are particularly susceptible to volatility due to low trading volumes and market attention.

While celebrity affiliations can dramatically impact stock valuations in the short term, astute investors must critically analyze the underlying business fundamentals and potential pathways for sustainable growth to avoid the pitfalls of speculative trading. As PSQ Holdings navigates its new chapter with Trump Jr. on the board, industry watchers will undoubtedly keep a close eye on its performance and market positioning moving forward.

Leave a Reply