Investors in the K-pop sector have had a rocky start to the year with lower fourth-quarter sales, profit declines, and dating scandals affecting stock prices. However, despite these setbacks, Goldman Sachs expressed optimism for the industry in a recent report, claiming that the K-pop sector is often misunderstood. The report highlights the potential for a valuation re-rating due to the companies’ continued delivery of multi-year earnings growth. While the “big four” K-pop companies have experienced stock declines, Goldman Sachs challenges the mainstream mindset by arguing that offline concert attendance is a superior metric for measuring the industry’s reach compared to album sales.

One of the significant points raised in the report is the overlooked growth opportunity for K-pop companies in Japan. Japan has been a substantial overseas fanbase for K-pop, yet market analysts believe it has not received the attention it deserves. With Japan’s top talent agency Johnny & Associates embroiled in a scandal, the industry has become more favorable to K-pop artists. The report emphasizes the growth potential in Japan’s live music market, estimating a 24% compounded annual growth rate for concert audiences from 2023 to 2026. This growth could double the combined share of K-pop companies in the Japanese market from 7% to 14%.

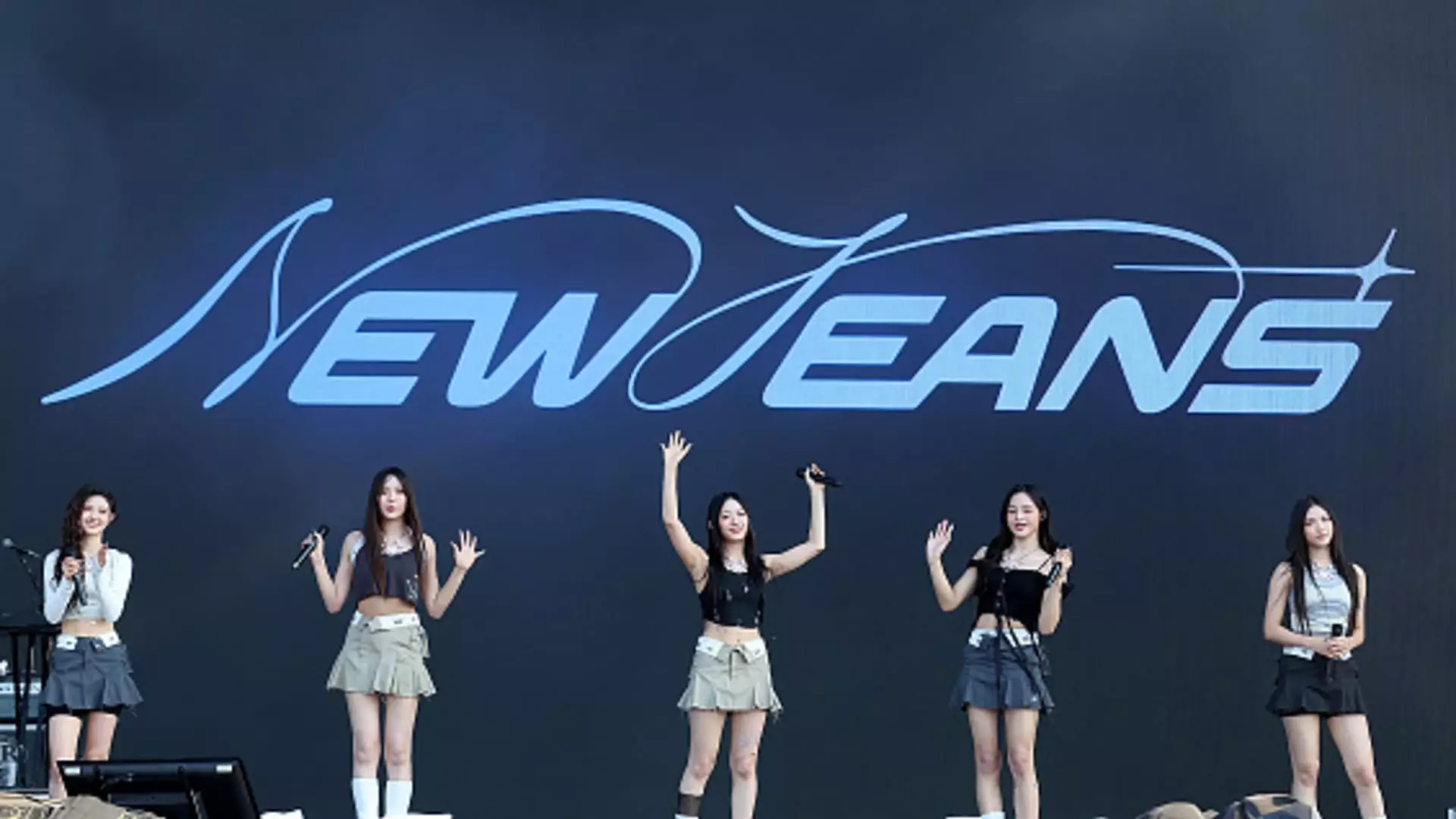

Goldman Sachs also underlines the global fanbase growth potential for K-pop, particularly in markets like the United States. The report cites the success of Hybe-managed girl group NewJeans on the U.S. charts, with their most recent album reaching No. 1 on the Billboard 200. NewJeans’ lead single, “Super Shy,” even charted at No. 2 on the Billboard Global 200, demonstrating the group’s international appeal. Additionally, K-pop’s presence at music festivals like Lollapalooza and Coachella signifies a growing acceptance of the genre on a global scale. The article mentions that Hybe’s expanded partnership with Universal Music Group will further solidify K-pop’s mainstream position, giving artists more bargaining power in the industry.

Despite the challenges faced by the K-pop industry in the beginning of the year, there are promising signs of growth and potential for valuation re-rating in the near future. By looking beyond traditional metrics like album sales and focusing on factors like offline concert attendance and global fanbase expansion, K-pop companies can tap into new opportunities for growth. The industry’s ability to adapt to changing market dynamics and leverage international markets like Japan and the U.S. will be crucial in sustaining its long-term success. As K-pop continues to make its mark on the global music scene, investors may do well to take a closer look at the industry and its future prospects.

Leave a Reply