As the trading world shifts gears into 2025, a palpable sense of exuberance has gripped investors, reminiscent of previous market euphoria. Following the S&P 500’s notable performance over the past two years—its best since 1998—speculative fervor appears to be on the rise. The recent spike in various segments of the stock market not only highlights this trend but also raises essential questions about the sustainability of such movements in an unpredictable economic environment.

The Crypto Resurgence

At the forefront of this renewed enthusiasm is the cryptocurrency market, which has dramatically impacted stock prices beyond its native realm. Bitcoin recently surged past the $96,000 mark, invigorating related stocks: Microstrategy, for instance, experienced a staggering 360% increase in 2024, supported by a further 3% rise on the first trading day of the new year. Other significant players like Coinbase, Robinhood, Mara Holdings, and Riot Platforms have also seen their stocks climb as a result of heightened investor interest in blockchain technologies. Intriguingly, even niche tokens like “fartcoin” have emerged, highlighting the bizarre yet real phenomena of digital currencies—with a startling rise of 45% giving it a substantial market cap.

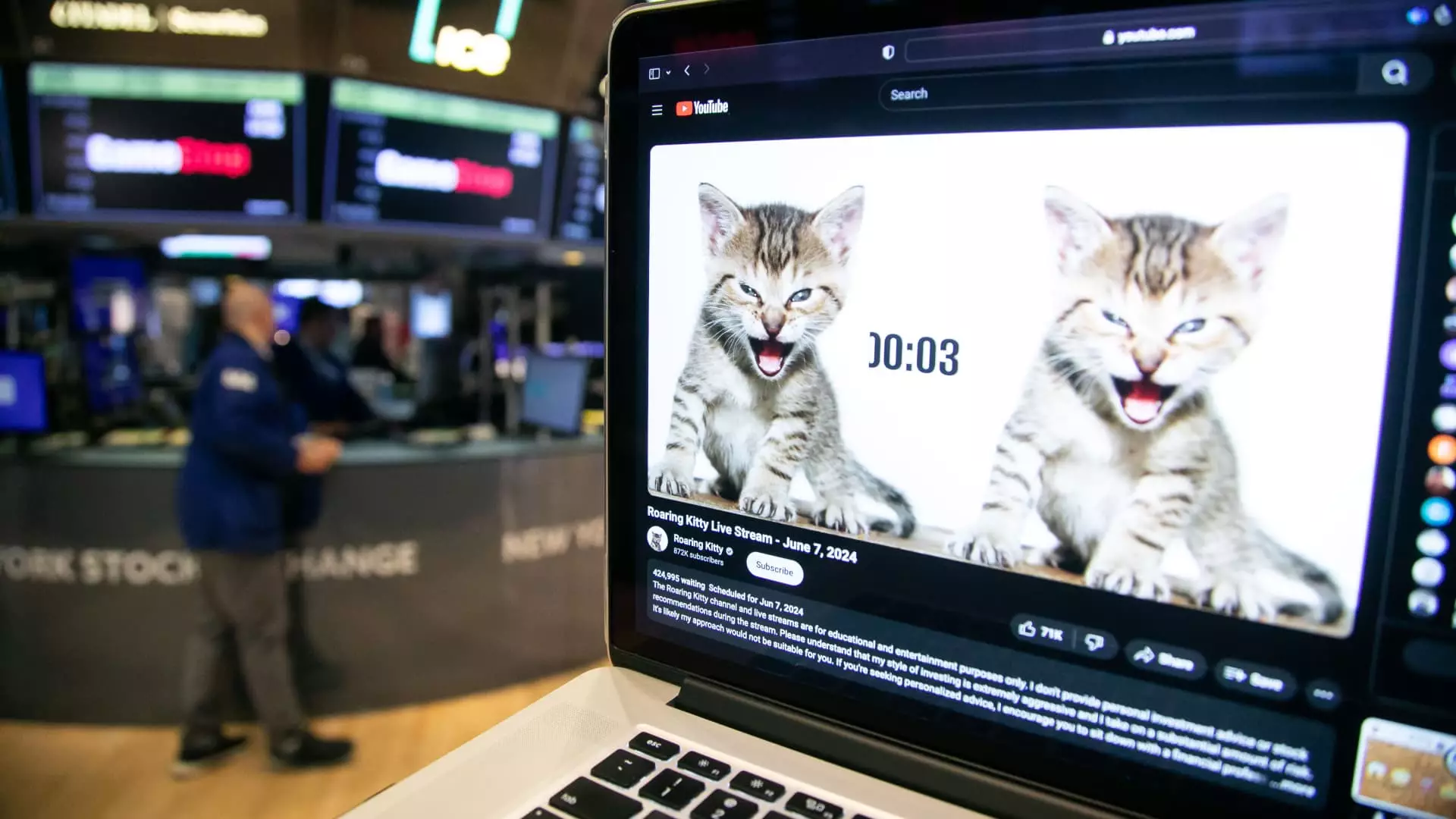

Another significant player in the current market narrative is the phenomenon of meme stocks, driven largely by social media communities and influencers. Keith Gill, popularly known as “Roaring Kitty,” continues to engender speculation among retail investors. His recent cryptic posts have sparked wild theories about which stocks he is endorsing, causing Unity Software’s stock price to leap 11%. Such dynamics illustrate a shifting paradigm where social media not only influences stock prices but also reveals a broader trend of collective retail speculation reminiscent of the GameStop saga.

The Shift in Semiconductor Stocks

Simultaneously, the semiconductor sector, which dominated trading in 2024, remains strong. Companies like Broadcom and Nvidia are pivotal, with Broadcom recording a 2% increase and Nvidia not far behind with a 1.6% gain. This continued interest signals a recognition of the indispensable role that technology plays in modern economies, especially in an era marked by AI-driven innovations. However, there are concerns that the AI investment wave may be losing its momentum, which could impact future performance.

The broader indices like the Dow and S&P 500 commenced 2025 with promising upticks, marked by early gains that race ahead before ultimately losing steam—indicative of a volatile market landscape. The Dow saw fluctuations of up to 300 points, showcasing a market grappling with its trajectory. Despite earlier optimism tied to policy shifts under the new administration, caution remains critical as signs of potential protectionism surface, raising questions about inflationary pressures and the Fed’s interest rate policy.

Lisa Shalett, Morgan Stanley’s Chief Investment Officer, comments on the expectations surrounding deregulation under the new administration, indicating that this could bolster “animal spirits” in the market. However, this raises a counterpoint: is such speculation sustainable or merely a fleeting moment in a more complicated economic reality?

As 2025 unfolds, the market’s speculative ascent may reflect broader trends in technology, cryptocurrency, and social media influence alongside traditional fundamentals. While the exuberance surrounding these segments is palpable, investors must tread carefully, recognizing that rapid gains can quickly reverse in the face of changing economic signals and potential regulatory shifts. As history has demonstrated, what goes up can also come down—making it imperative for investors to balance excitement with a prudent assessment of underlying values and market conditions.

Leave a Reply