Super Micro shares experienced a significant decline of up to 15% in after-hours trading following the release of its fiscal third-quarter results. Despite providing a positive outlook for its top-line growth, the server maker’s revenue fell slightly below expectations. The company reported an adjusted earnings per share of $6.65, surpassing the $5.78 expected by analysts. However, its revenue of $3.85 billion was lower than the anticipated $3.95 billion.

Super Micro recorded a remarkable 200% year-over-year increase in revenue for the quarter ending on March 31, a substantial improvement from the 103% growth reported in the previous quarter. The net income of $402.5 million translated to $6.56 per share, compared to $85.8 million or $1.53 per share in the corresponding period last year. The company revised its fiscal 2024 revenue guidance to $14.7 billion to $15.1 billion, up from the initial range of $14.3 billion to $14.7 billion, surpassing the analysts’ projection of $14.60 billion.

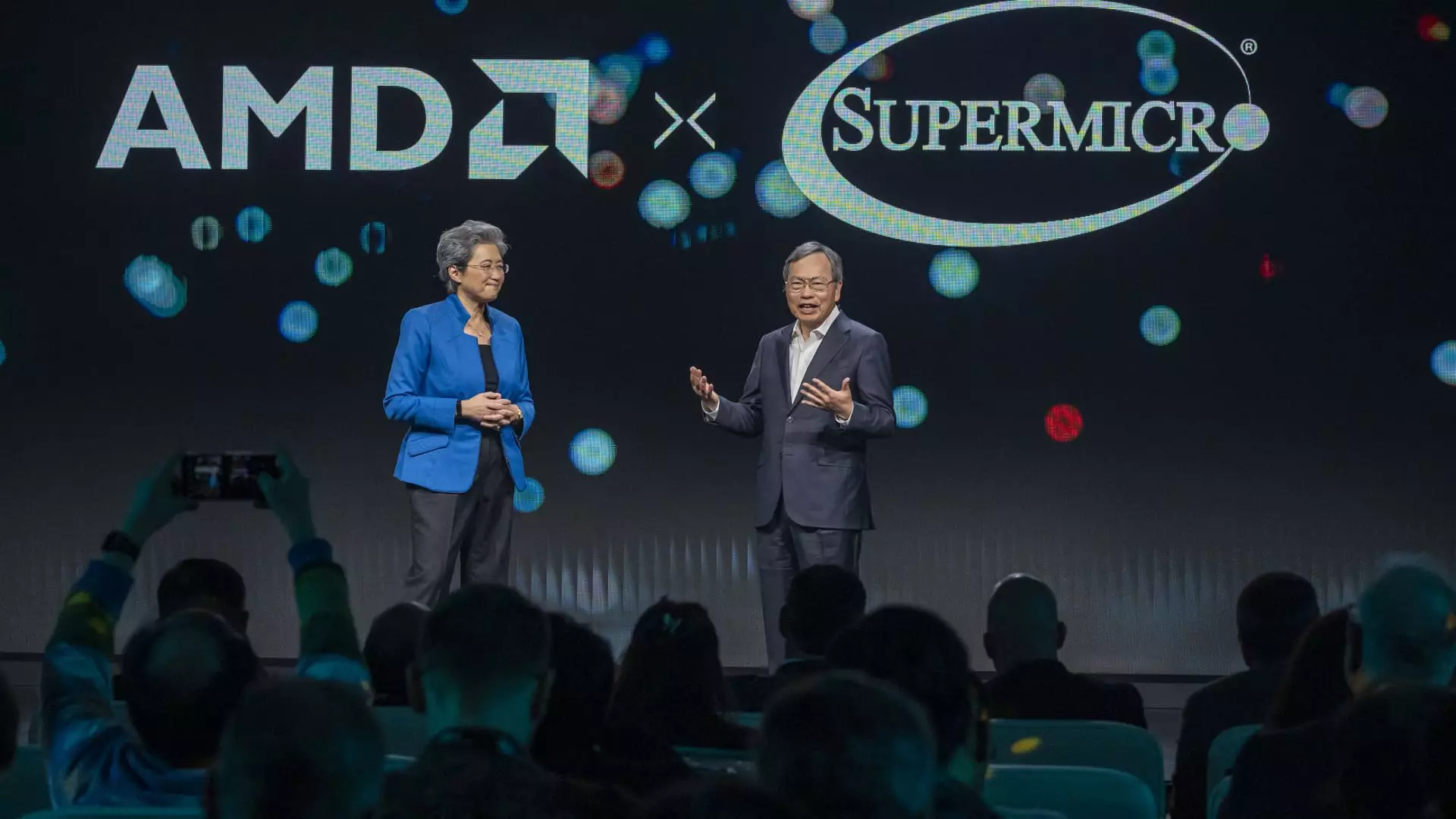

During a conference call with analysts, Super Micro’s CEO, Charles Liang, emphasized the company’s robust customer base growth. Despite the recent stock dip, Super Micro has seen a remarkable 205% increase this year, outperforming the S&P 500 index. The company faces competition from established IT providers like Hewlett Packard Enterprise but has gained traction as a key server supplier for artificial intelligence applications, particularly those involving Nvidia graphics processing units.

Liang acknowledged that component shortages had impacted Super Micro’s performance in the quarter, indicating that the company could have achieved more robust results under different circumstances. However, he expressed confidence in the sustained growth of the AI segment for several upcoming quarters. To fuel its expansion, Super Micro conducted a secondary offering to raise capital and enhance its supply chain efficiency.

Super Micro is keen on introducing liquid-cooled servers to the market, aiming to offer energy-efficient solutions compared to traditional air-cooled alternatives. The company’s finance chief, David Weigand, highlighted ongoing improvements in the supply chain, suggesting a positive outlook for operational efficiency. Looking ahead, Super Micro is positioned to capitalize on the increasing demand for AI-driven technologies and strengthen its market presence in the server manufacturing industry.

Leave a Reply