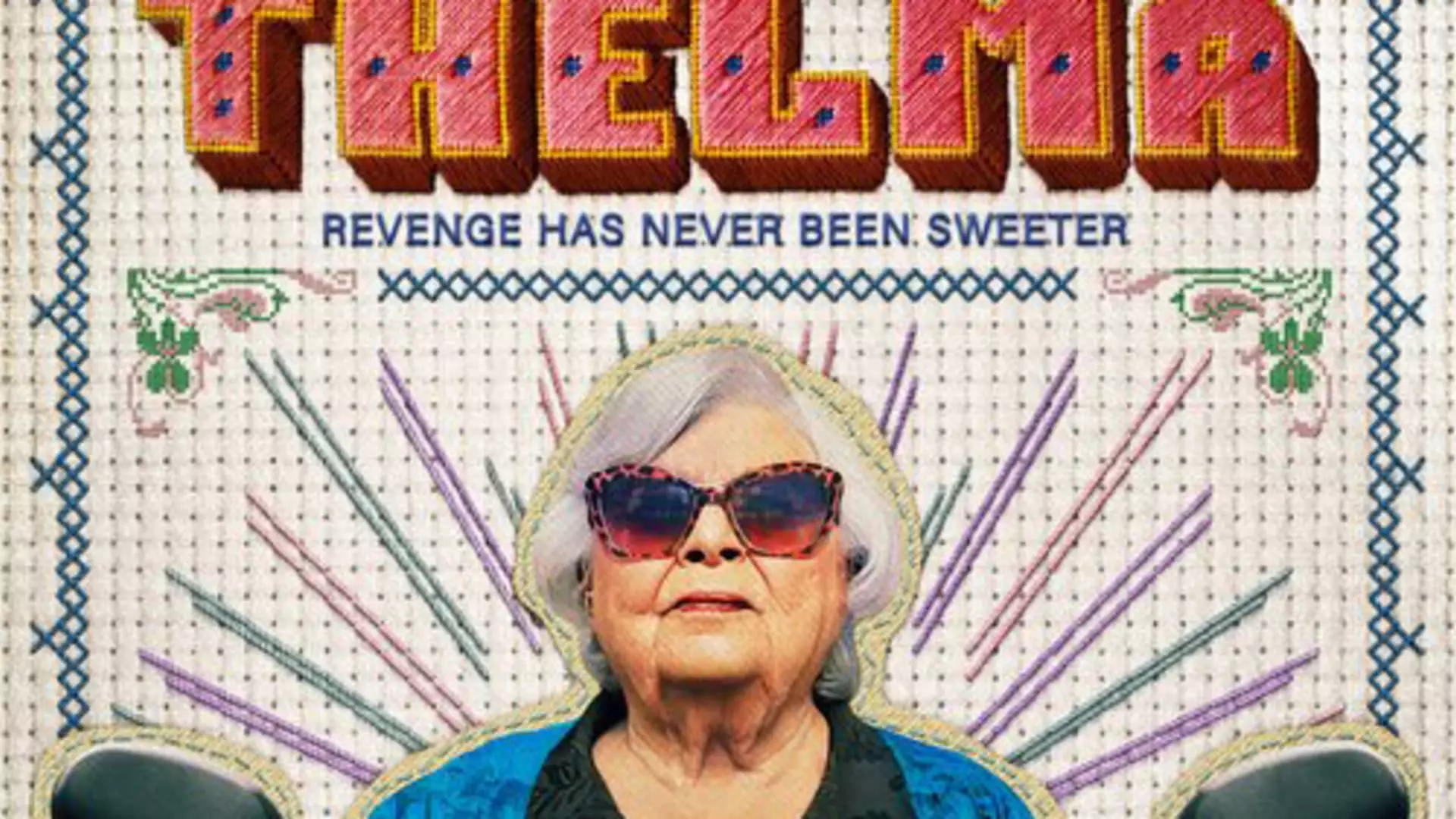

The movie “Thelma” portrays the story of a 93-year-old Thelma Post who falls victim to a fraudulent call from a scammer pretending to be her grandson in desperate need of money. While this story was fictionalized for Hollywood, the threat of such scam calls, also known as grandparents’ scams or family emergency scams, is unfortunately very real. According to the U.S. Federal Trade Commission, total losses from imposter fraud reached nearly $2.7 billion last year. These scams are becoming more prevalent in the age of artificial intelligence, making it easier for scammers to manipulate individuals, especially vulnerable populations like the elderly.

Imposter fraud, like the one experienced by the real Thelma, is a common type of fraud reported to the FTC, with an increase in reports of business and government impersonators. Scammers are using social media platforms to harvest content for their fraudulent schemes, taking advantage of advancements in generative AI to create deep fake audio and mimic distress calls. This tactic preys on people’s emotions, creating situations that require immediate action, such as someone claiming to be stuck on the side of the road or in jail in need of bail money.

While older adults are often targeted due to cognitive decline and slower decision-making processes, younger individuals who spend more time online are also at risk. Gen Z and young millennials, in particular, are vulnerable to scams due to their extensive online presence. It is crucial to have conversations with loved ones about the risks of being scammed and to establish proactive measures to protect oneself and others from falling victim to these schemes.

Establishing an aging plan in your late 50s or early 60s can be beneficial in preventing financial exploitation later in life. By involving family members in these conversations, you can designate a financial surrogate to act on your behalf if needed. Basic security practices, such as freezing credit, setting up multifactor authentication, and purchasing identity theft insurance, can also serve as barriers against scammers seeking to compromise personal information.

The rise of AI voice scams and imposter fraud poses a significant threat to individuals of all ages. By staying vigilant, having open conversations with loved ones, and implementing proactive security measures, you can better protect yourself and your family from falling victim to these increasingly sophisticated scams. Remember, it is crucial to be critical of any unexpected or urgent requests for money, especially when they come from unfamiliar sources.

Leave a Reply