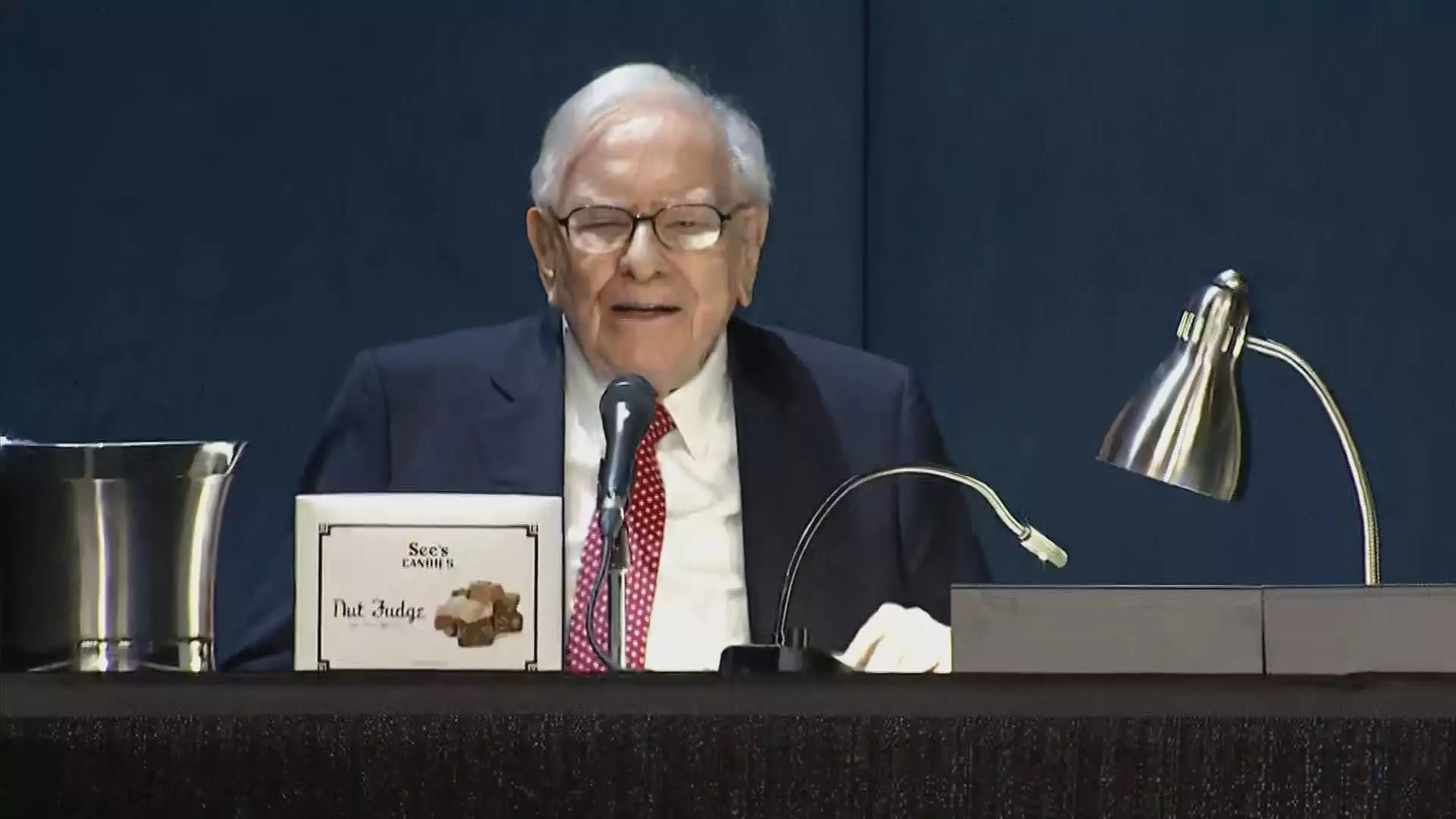

In a notable shift in portfolio management, Warren Buffett’s Berkshire Hathaway has recently reduced its stake in Bank of America (BofA), offloading more than $7 billion worth of shares since mid-July. This decision reflects broader market dynamics and possibly a strategic pivot for Berkshire’s investment focus. Understanding the implications of this decision requires an analytical lens on Buffett’s historical investment strategy and the current state of both Berkshire and BofA.

Warren Buffett, often referred to as the “Oracle of Omaha,” made a significant investment in Bank of America in 2011, during a time when the banking industry was grappling with the aftereffects of the financial crisis. His initial investment consisted of $5 billion in preferred stock and warrants, which, upon conversion in 2017, positioned Berkshire as BofA’s largest shareholder. This investment was not just an act of faith in a struggling lender but a calculated risk that ultimately paid off, as BofA has performed strongly in recent years.

Berkshire Hathaway’s involvement in BofA has been emblematic of Buffett’s investment philosophy: purchasing fundamentally sound companies during periods of distress to capitalize on long-term value creation. The addition of 300 million shares to its holdings around 2018 and 2019 reinforced Buffett’s confidence in BofA’s recovery and growth prospects. However, recent market developments have prompted a reevaluation of this investment, leading to a streak of sales that raises questions about Buffett’s long-term strategy.

Berkshire Hathaway’s gradual divestment, characterized by the sale of 5.8 million BofA shares over multiple trading days, demonstrates a systematic approach to reducing exposure. The average selling price of approximately $39.45 per share highlights not only a successful exit strategy but also reflects BofA’s valuation at a time when the broader financial sector is experiencing volatility.

With over 174.7 million shares sold and remaining holdings of approximately 858.2 million shares, Berkshire’s reduced stake has now aligned with 11.1% of BofA’s outstanding shares. This shift in shareholding hierarchy is significant; BofA has now fallen to the third spot among Berkshire’s top investments, trailing behind tech giant Apple and credit card company American Express. This realignment can be interpreted as a strategic decision to reposition capital into more promising or stable investments, moving away from financial services that may be seen as vulnerable in the current market climate.

BofA’s stock performance has been relatively stable, showing an increase of 16.7% year-to-date, which slightly outpaces the S&P 500. However, the bank’s stock has witnessed a slight decline of about 1% since early July, sparking discussions about its market resilience and potential future performance. BofA CEO Brian Moynihan’s remarks regarding Buffett’s decision to sell indicate that while the market appears to be absorbing the influx of shares, there is an underlying uncertainty about investor sentiment and market conditions.

Moynihan reflected on Buffett’s critical role during BofA’s difficult years, recognizing his significant contribution to restoring confidence in the institution. The impressive return on investment from Buffett’s original purchase underscores the financial acumen associated with Berkshire’s initiatives. Yet, the question remains: what does Buffett anticipate for BofA’s future that necessitates this offloading of assets?

Ultimately, by critically assessing these developments, it becomes evident that Buffett’s decision to pare back his holdings in BofA does not signal a loss of faith in the bank’s prospects. Instead, it may reflect a recalibration of his investment strategy to adapt to changing market conditions, consumer behavior, or sectoral challenges.

The dynamic world of investing requires agility, and Berkshire Hathaway’s maneuvers in processing this significant change serve as a reminder that even seasoned investors, such as Warren Buffett, are not impervious to the shifts in economic tides. Whether this trend continues or whether Buffett decides to reinvest in BofA at a later stage will certainly be something to watch as the financial landscape evolves.

Leave a Reply