Reservoir Media has carved a unique niche in the ever-evolving music industry, boasting a multifaceted business model that encompasses music publishing, recorded music, management, and rights management, particularly within the Middle Eastern market. With a robust portfolio that includes catalogues from renowned artists like Joni Mitchell, John Denver, and The Isley Brothers, the company offers a compelling study of how music can drive sustainable revenue streams and attract investor interest.

The company primarily operates through two segments: Music Publishing and Recorded Music. The Music Publishing arm is engaged in acquiring interests in influential music catalogs, generating royalties that form the backbone of its financial performance. Additionally, the segment works to sign talented songwriters, thus augmenting its catalog diversity with fresh talent. Meanwhile, the Recorded Music segment is tasked with acquiring sound recording catalogs and discovering new recording artists. This segment also oversees the marketing, distribution, and licensing of these musical works.

As of late 2023, Reservoir Medial holds an impressive catalog comprising over 150,000 copyrights and 36,000 master recordings, positioning itself as a significant player in the industry. This diversity not only strengthens its revenue streams but also mitigates risks associated with the music market’s inherently unpredictable nature.

Despite some challenges, Reservoir Media’s financial trajectory has illustrated resilience and growth. The company reported year-over-year growth in gross profit, nearly doubling from $47.39 million to $89.38 million. Earnings before interest, taxes, depreciation, and amortization (EBITDA) similarly reflect favorable improvements, rising from $33.8 million to $54.4 million during the same period.

The company’s revenue composition is noteworthy; with the Music Publishing segment accounting for approximately 66.41% of total revenue and Recorded Music contributing 29.25%, the various streams have demonstrated consistent growth. Subscription streaming, a primary revenue generator, has shown an increase of 11.2% across the industry in 2023, which bolsters Reservoir’s earnings potential significantly. However, despite the company’s robust metrics, its stock performance has not reflected this optimism, suffering a decline of 22.24% since its SPAC IPO in 2021.

A notable player in Reservoir Media’s landscape is Irenic Capital, an activist investment firm advocating for a strategic reassessment of the company’s direction. Founded by seasoned financial experts from the investment management sector, Irenic has pushed for the establishment of a special committee to review strategies and consider potential opportunities for sales or spinoffs. Their involvement highlights a significant intersection of corporate governance and shareholder activism, which can create pressure for management to rethink the company’s trajectory.

While critics often view activist strategies as inherently short-sighted, in Reservoir’s case, there may be merit in reassessing its operational posture. The notion of viewing the company as a collector of royalties rather than a traditional operating enterprise invites consideration of alternative ownership structures that might unlock additional value for shareholders.

Historically, the thesis behind Reservoir Media’s public offering was predicated upon utilizing the inflated valuations of SPAC-executed deals to acquire other music rights portfolios. However, with the public market climate shifting, acquiring further assets at lower multiples becomes more complex. The current trading multiples of 8 to 9 times the net publisher’s share (NPS) present an obstacle, especially when compared to competitors trading in the mid-to-high teens.

Given its substantial catalog and growing revenue streams, Reservoir could still attract strategic buyers interested in capturing its diverse music rights portfolio. In the larger context, recent acquisitions in the space, such as the purchase of Hipgnosis by Blackstone at approximately 18 times NPS, point towards a potentially lucrative exit strategy for Reservoir.

As Reservoir Media navigates its course through complex market dynamics, the interplay between its robust catalog, financial health, and strategic oversight will ultimately dictate its future trajectory. The ongoing dialogue surrounding its strategic review underscores the importance of governance aligned with shareholder interests in maximizing value.

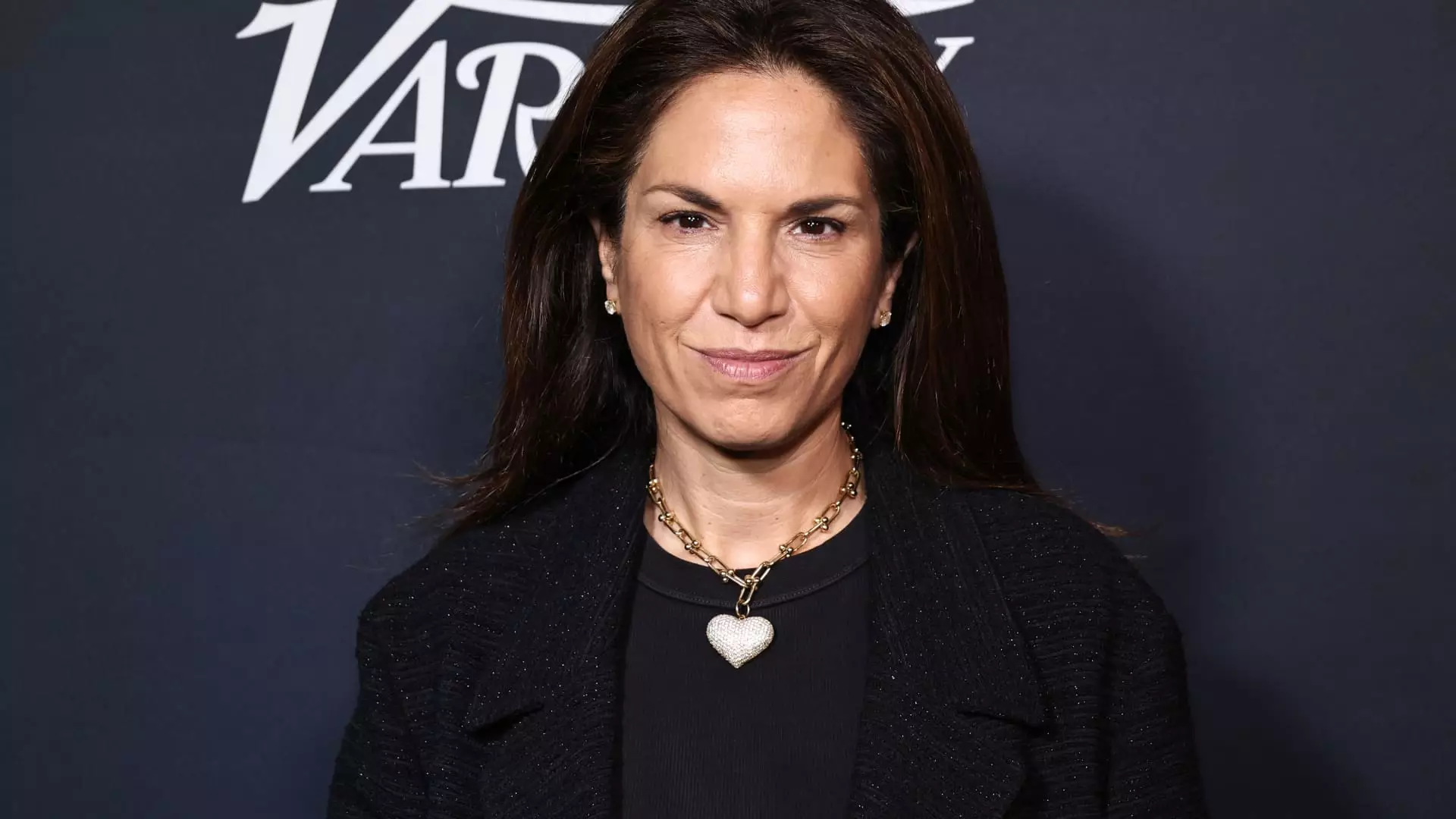

The combination of mature assets ripe for consistent royalty streams, an experienced management team led by capable executives like CEO Golnar Khosrowshahi, and active investor engagement positions Reservoir Media uniquely within the music landscape. Future developments will depend on how well the company can capitalize on its existing strengths while adapting to external pressures from activist investors and shifting market expectations.

Leave a Reply