Nvidia’s recent surge has caused a major shake-up in the Technology Select Sector SPDR Fund (XLK), forcing it to make some significant changes in its portfolio. The fund, which tracks the Technology Select Sector Index, is now in the process of rebalancing its holdings based on market cap values. As a result, Nvidia will soon take second place in the index, just behind Microsoft, while Apple will see a significant decrease in its weighting.

The newly adjusted market cap values have put Microsoft at the top spot, with Nvidia closely behind and Apple falling to third place. All three stocks would have had a weight of over 20% in the index if not for the diversification rules that cap the cumulative weight of stocks with at least a 5% share. This means that Microsoft and Nvidia will likely have a weight of around 21%, while Apple’s weight will plummet to about 4.5%.

The competition to secure the top two spots in the index was intense, with all three companies boasting market caps of over $3.2 trillion and being within a hair’s breadth of each other. However, the final calculations used in the index slightly differed from the market cap data from FactSet. With the XLK managing about $71 billion in assets, a 15-percentage-point change in the fund equates to a massive $10 billion shift.

The significant changes in the XLK underscore how even passive index funds can diverge, particularly when focusing on specific sectors of the market. Understanding the weighting and allocation of assets in these funds is crucial, as different funds can have varying exposures and performance outcomes. The fund follows the Technology Select Sector Index from S&P Dow Jones Indices, which employs a float-adjusted calculation for market cap.

The rebalance of the XLK will officially take effect at the end of the week and will be in effect for one quarter. This adjustment aims to ensure that the index accurately reflects the market cap values of its constituent companies. The free-float adjustment for market cap accounts for large holders of individual stocks, such as Warren Buffett’s Berkshire Hathaway, which could impact the weighting of certain companies in the index.

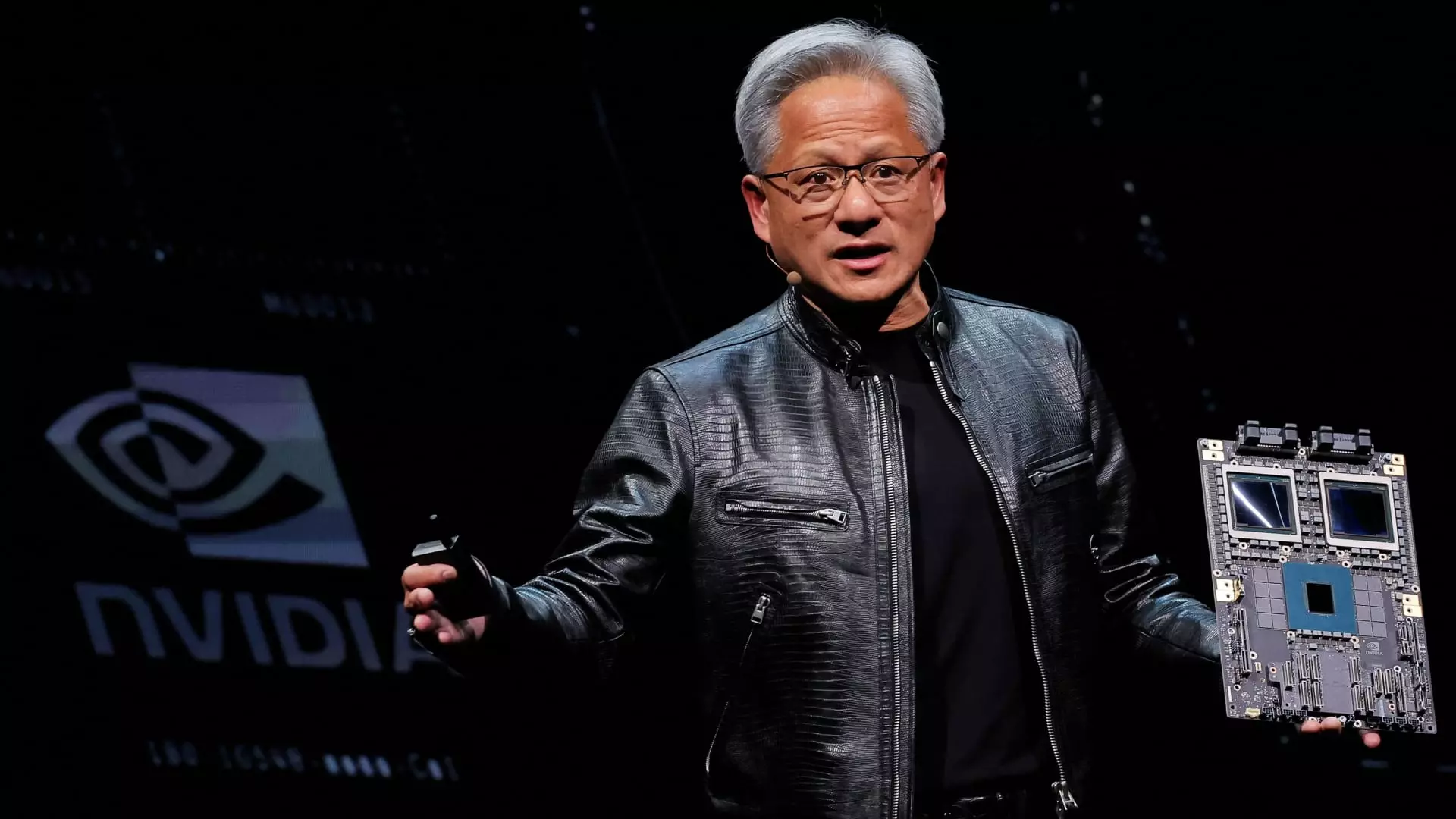

As the tech landscape continues to evolve, investors will need to closely monitor these rebalancing acts to stay informed about the changing composition of major tech indices. Nvidia’s ascendancy in the XLK highlights the dynamic nature of the technology sector and the importance of staying agile in response to market shifts. In a market where change is constant, adaptability is key to navigating the evolving tech landscape successfully.

Leave a Reply