In recent weeks, the saga surrounding the Federal Reserve’s lavish renovation has morphed from a bureaucratic inconvenience into a symbol of broader systemic mismanagement and questionable priorities. Far from being a mere construction project, this debacle exposes the flaws and contradictions within our financial oversight mechanisms. At its core, it reflects a government apparatus that, under the guise of stability and fiscal discipline, often indulges in displays of excess that threaten public trust and economic prudence.

What is especially disturbing is the spectacle of a “palace” rising on the nation’s mall, boasting a price tag of over $2.5 billion. This figure is not merely a number; it’s a symbolic insult to taxpayers and citizens who are increasingly skeptical of government spending that appears disconnected from their economic realities. The Democratic critique of wasteful spending often gets overshadowed by partisan rhetoric, but in this instance, the issue transcends politics and taps into fundamental questions about accountability and responsible governance in the financial sector.

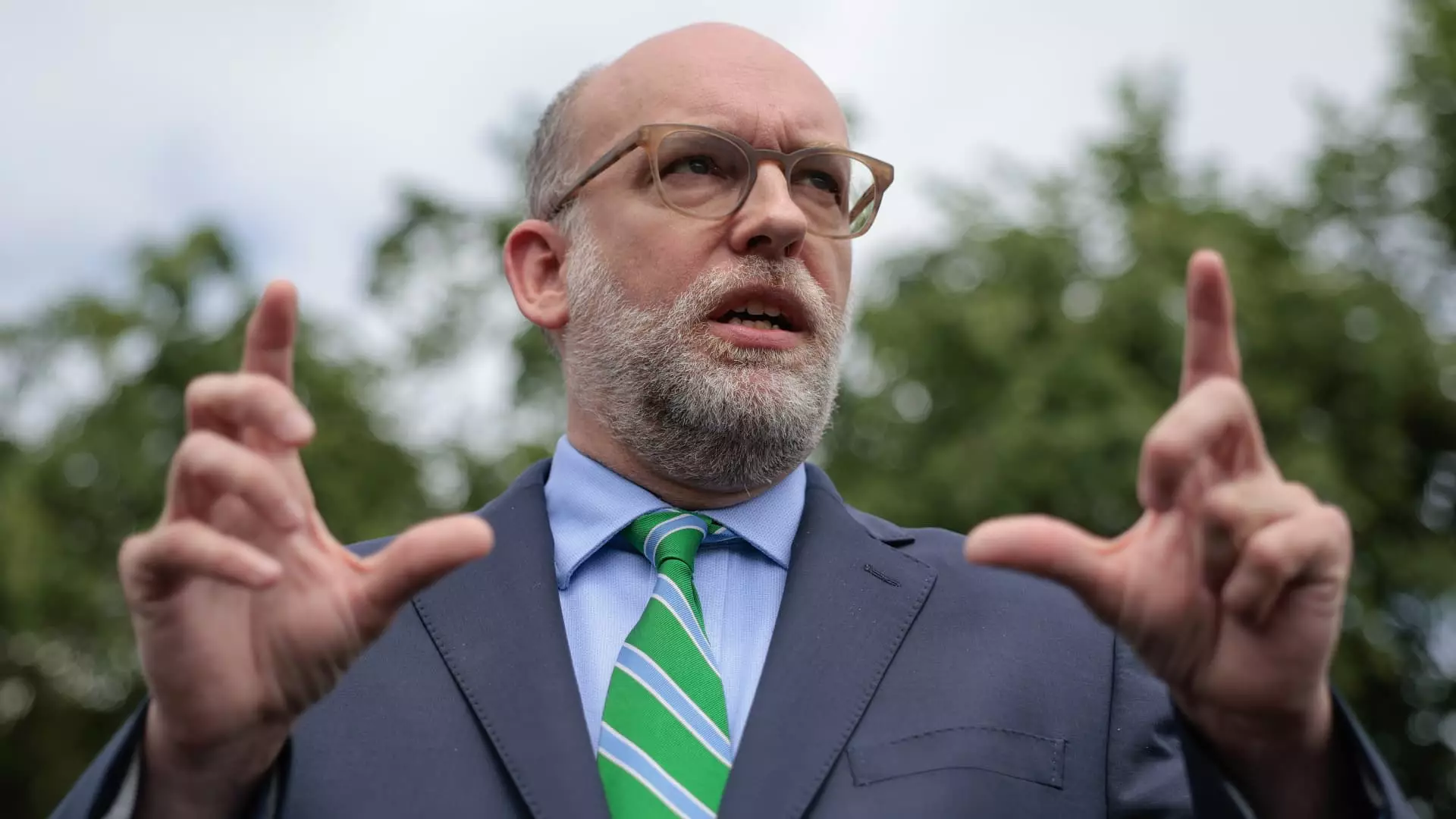

The ongoing investigation, spearheaded by officials like Office of Management and Budget Director Russell Vought, suggests a grave concern: how did a project of such magnitude spiral into what many perceive as fiscal excess? Is this a case of deliberate mismanagement, or systemic complacency? Either way, the human tendency toward oversight failures and the prioritization of aesthetic grandeur over function and necessity has once again reared its head, highlighting how institutions can sometimes serve as monuments of hubris rather than hubs of accountability.

Political Intrigue and Power Plays Mask a Deeper Crisis

Tensions between the Trump administration and the Federal Reserve have long been palpable, but the recent focus on the building renovation elevates these conflicts into a broader debate about control, influence, and legitimacy. The accusations that Fed Chair Jerome Powell misled Congress about the true scope of the renovation are not merely about misreporting; they threaten to undermine the very credibility of an institution that is central to economic stability.

This controversy also underscores the precarious balance of power between the executive branch and the Federal Reserve. The appointment of new members with explicit White House ties raises legitimate concerns about the independence of the Fed. If political motives influence appointments and oversight, the risk isn’t just of mismanaging a building project but of politicizing monetary policy itself. The fact that President Trump has publicly questioned Powell’s rate decisions and suggested possible dismissal for perceived mismanagement indicates an unsettling trend: the erosion of institutional independence in favor of personal political agendas.

The narrative of a “monstrosity” on the National Mall no longer remains a simple matter of fiscal oversight; it becomes a battleground where political actors leverage economic narratives to justify their agendas. The accusation that Powell’s refusal to cut interest rates is politically motivated dovetails with the broader theme of a presidency eager to exert more control over an institution seen as resistant to executive influence.

The Real Cost of Symbolism Versus Substance

Beyond the political theater, there is a profound question about priorities. Should a central bank’s headquarters resemble Versailles, or should it be a modest, functional space that reflects sound fiscal management? The answer seems obvious in our current climate of economic uncertainty and growing public distrust. Excessive spending on an opulent building, regardless of its necessity, signals a disconnect — an institutional arrogance that dismisses the austerity demanded by our times.

The controversy also reflects a critical misunderstanding—or perhaps an deliberate misrepresentation—of what constitutes management failure. Budget overruns and project scope creep are common in government and large-scale projects; what’s disturbing here is the narrative framing that paints this as a symptom of systemic mismanagement. Are these overruns a reflection of actual incompetence, or a manipulation of facts to serve a political narrative? Given the allegations of misleading Congress and the involvement of figures with direct White House ties, skepticism is warranted.

Meanwhile, the Fed’s role as a quasi-governmental institution complicates public perception. Although it operates independently of direct taxpayer funding, the trust placed in it by the public hinges on transparency and perceived integrity. When the leadership appears embroiled in controversy—be it over opulent renovations or political interference—those perceptions threaten to erode the foundation of public confidence. This erosion is dangerous; a lack of faith in the Fed destabilizes markets, fuels volatility, and ultimately undermines the broader economic stability it seeks to safeguard.

The Broader Implications: A Crisis of Credibility and Control

Ultimately, the controversy over the Fed’s renovation is symptomatic of a deeper crisis: the struggle to maintain institutional integrity amidst increasing politicization. Beneath the surface, there are serious questions about oversight, independence, and the ethical boundaries of governmental influence. The actions of the Trump administration, whether through appointments or rhetoric, reflect a broader pattern of attempting to sway institutions that traditionally operate with a level of independence beneficial to economic health.

This clash also reveals a disturbing willingness to use fiscal issues as political leverage. The accusations of mismanagement serve as tools to justify dismissals or influence policy decisions, further eroding the foundational principles of independent monetary policy. The fact that the project’s cost and scope are now entangled with political narratives means that what should be a technical issue has become a battleground for authority and legitimacy.

In such an environment, trust becomes a casualty. Citizens, investors, and international partners begin questioning whether the central bank’s decisions are rooted in expertise or political expediency. When institutions become battlegrounds rather than pillars of stability, the entire system risks becoming fragile—vulnerable to manipulation and decline. The question remains whether the fixation on a lavish “palace” is merely a symbol of institutional failure, or an ominous indicator of a deeper vulnerability within America’s financial architecture.

Leave a Reply