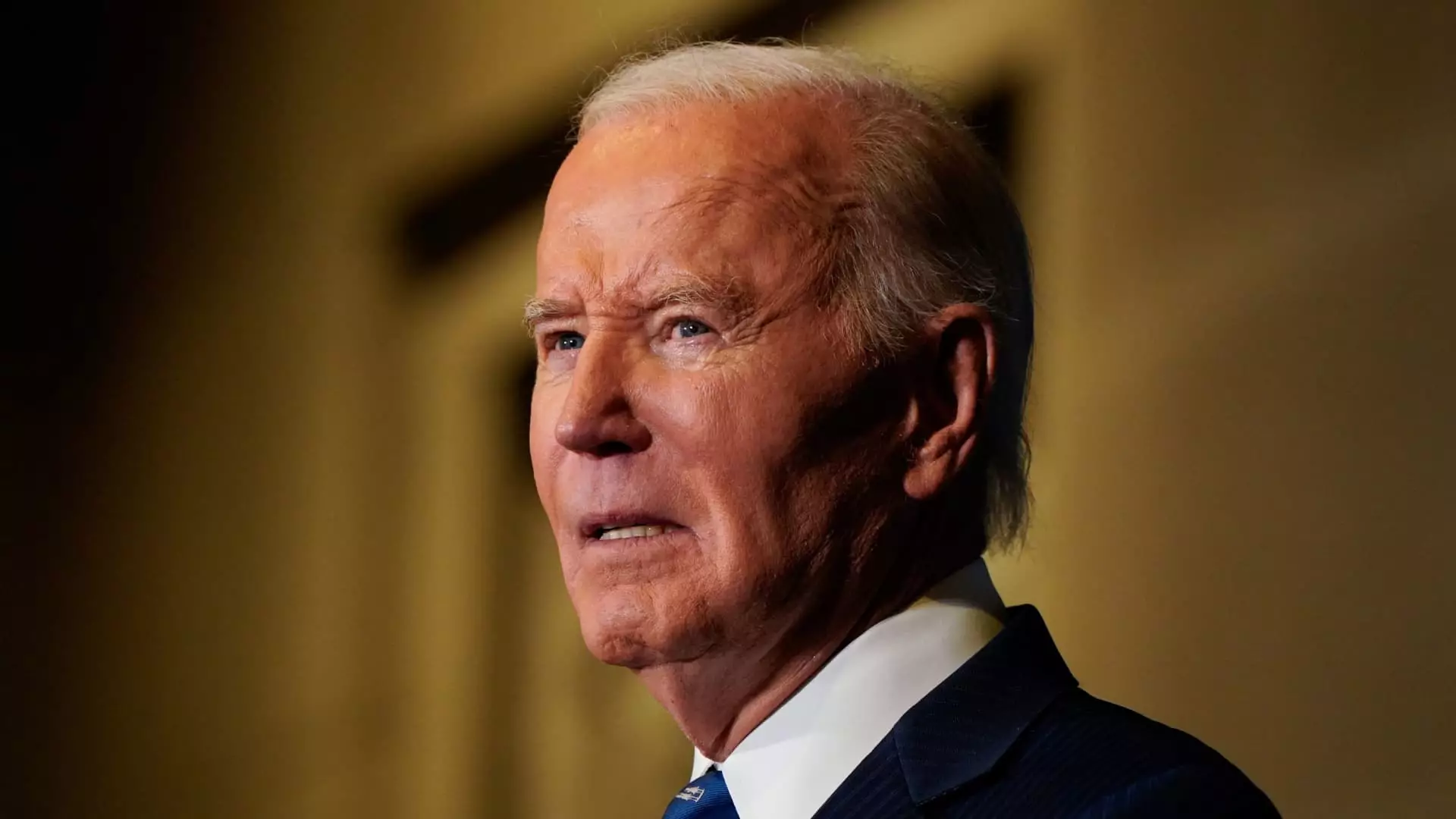

In a significant turn of events, the Biden administration has withdrawn two crucial proposals aimed at alleviating the burden of student loans for many Americans. As we analyze this decision, it is essential to recognize its wide-ranging implications for borrowers across the nation. The potential policies aimed at forgiving loans for those in long-term repayment and those facing financial challenges have been nixed just ahead of a changing political landscape, which poses questions on the future of student debt relief in the United States.

The initial intention behind the Biden administration’s plans was to empower the U.S. Department of Education to eliminate student loans for specific borrower categories. This move would have potentially liberated millions from the shackles of educational debt, which has become an increasingly pressing issue in America. The proposals represented a proactive attempt to provide relief to individuals who have been in debt for decades and whom financial hardships have significantly affected.

However, the Department of Education announced the termination of these proposals citing “operational challenges” as the primary reason. The urgency of responding to the needs of at-risk borrowers during the transition to a new administration seemed to take precedence over ambitious reform efforts. As such, the administration chose to focus its limited resources on helping borrowers navigate their repayment options rather than pushing forward with potentially contentious rule-making processes.

This withdrawal comes at a precarious time in U.S. politics, with President-elect Donald Trump poised to take office. His staunch opposition to student loan forgiveness is well-documented, having labeled Biden’s previous attempts as “vile” and legally unsound. Higher education specialists, such as Mark Kantrowitz, argue that the administration was aware that its ambitious plans were unlikely to survive under the Trump administration due to the marked difference in educational policy approaches.

The implications of this strategic withdrawal extend beyond mere politics; they touch on economic mobility for millions of Americans. With student debt often crippling individuals and families financially, the absence of tangible debt relief measures casts a shadow over the prospects of economic recovery for a generation facing mounting educational expenses.

Reactions to the withdrawal have been swift and pointed. Consumer advocates have expressed profound disappointment, recognizing the missed opportunity for widespread debt relief that could have fundamentally altered the American financial landscape. Persis Yu, deputy executive director of the Student Borrower Protection Center, condemned the reversal, highlighting that Biden’s proposals could have emancipated millions from the persistent burden of student loans.

Elaine Rubin, a spokesperson for Edvisors, brings a personal angle to the discourse by emphasizing the growing concerns among borrowers regarding their financial futures in light of this policy pullback. Many are left pondering the ramifications of a transition to an administration that seemingly favors austerity over expansive support measures.

Despite the withdrawal of the comprehensive student loan forgiveness proposals, the Department of Education continues to offer various alternatives aimed at providing relief to borrowers. Programs like the Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF) remain operational. PSLF allows qualifying public service employees to have their loans forgiven after a decade of on-time payments. For teachers in low-income areas, TLF offers potential forgiveness up to $17,500 after five years of dedicated service.

Moreover, on Friday, the administration announced an additional $4.28 billion in debt forgiveness for nearly 55,000 public service workers through PSLF, indicating that some avenues for relief still exist, albeit under different circumstances.

As borrowers search for viable pathways to debt relief, organizations like the Institute of Student Loan Advisors serve as beacons of hope, maintaining databases on available forgiveness programs tailored to each state. Nevertheless, the larger question remains: What will happen to the broader prospects for student loan forgiveness once the new administration assumes power?

In light of recent developments, the education landscape in America appears uncertain. As advocates for change mobilize to seek solutions, the future of student loan forgiveness remains a critical matter that deserves continued public discourse and action. With a polarized political environment and varying levels of support for debt relief initiatives, borrowers may need to rely on both advocacy and legislative efforts to navigate these turbulent waters effectively.

Leave a Reply