Berkshire Hathaway, known for its investments in a wide range of companies, including its early stake in BYD, has once again decided to trim its holding in China’s biggest electric vehicle maker. This move comes after the conglomerate, led by Warren Buffet, recently sold an additional 1.3 million shares of BYD for $39.8 million. This sale has reduced Berkshire’s stake in BYD to 6.9%, down from 7%.

Back in 2008, Berkshire first made a bet on BYD by purchasing around 225 million shares for approximately $230 million. This investment proved to be highly lucrative as the electric vehicle market experienced significant growth, not only in China but also in other parts of the world. With BYD’s stock price skyrocketing nearly 600% to a record high in April 2022, Berkshire decided to capitalize on the opportunity by offloading half of its holding through sales in 2022 and 2023.

BYD, founded by Wang Chuanfu, initially started by manufacturing batteries for mobile phones in the 1990s. However, by 2003, the company shifted its focus to automobiles and has since established itself as the leading car brand in China. Additionally, BYD has become a significant player in the electric vehicle battery market. In the fourth quarter of 2023, BYD surpassed Tesla to become the world’s top electric vehicle maker, selling more battery-powered vehicles than its U.S. counterpart.

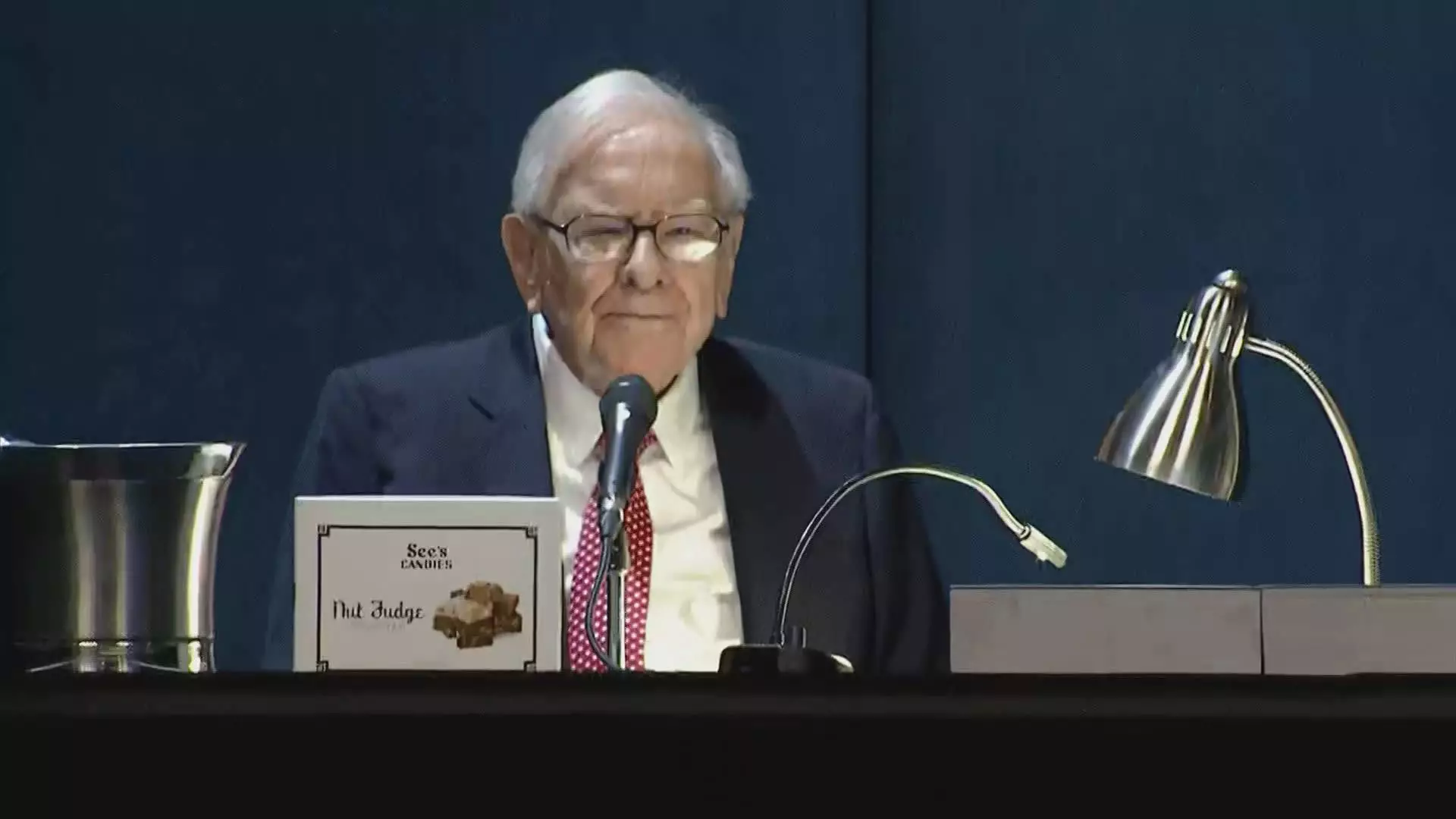

Warren Buffet credited the late vice chairman of Berkshire, Charlie Munger, for bringing BYD to their attention. Munger, who was introduced to BYD by his friend Li Lu, played a crucial role in the initial investment in the company. Buffett acknowledged Munger’s contribution by stating that he “deserves 100 percent of the credit for BYD.”

Berkshire Hathaway’s decision to reduce its stake in BYD reflects its dynamic investment strategy and ability to capitalize on profitable opportunities in the market. The ongoing evolution of the electric vehicle industry, coupled with the influence of key figures like Charlie Munger, continues to shape Berkshire’s investment decisions.

Leave a Reply