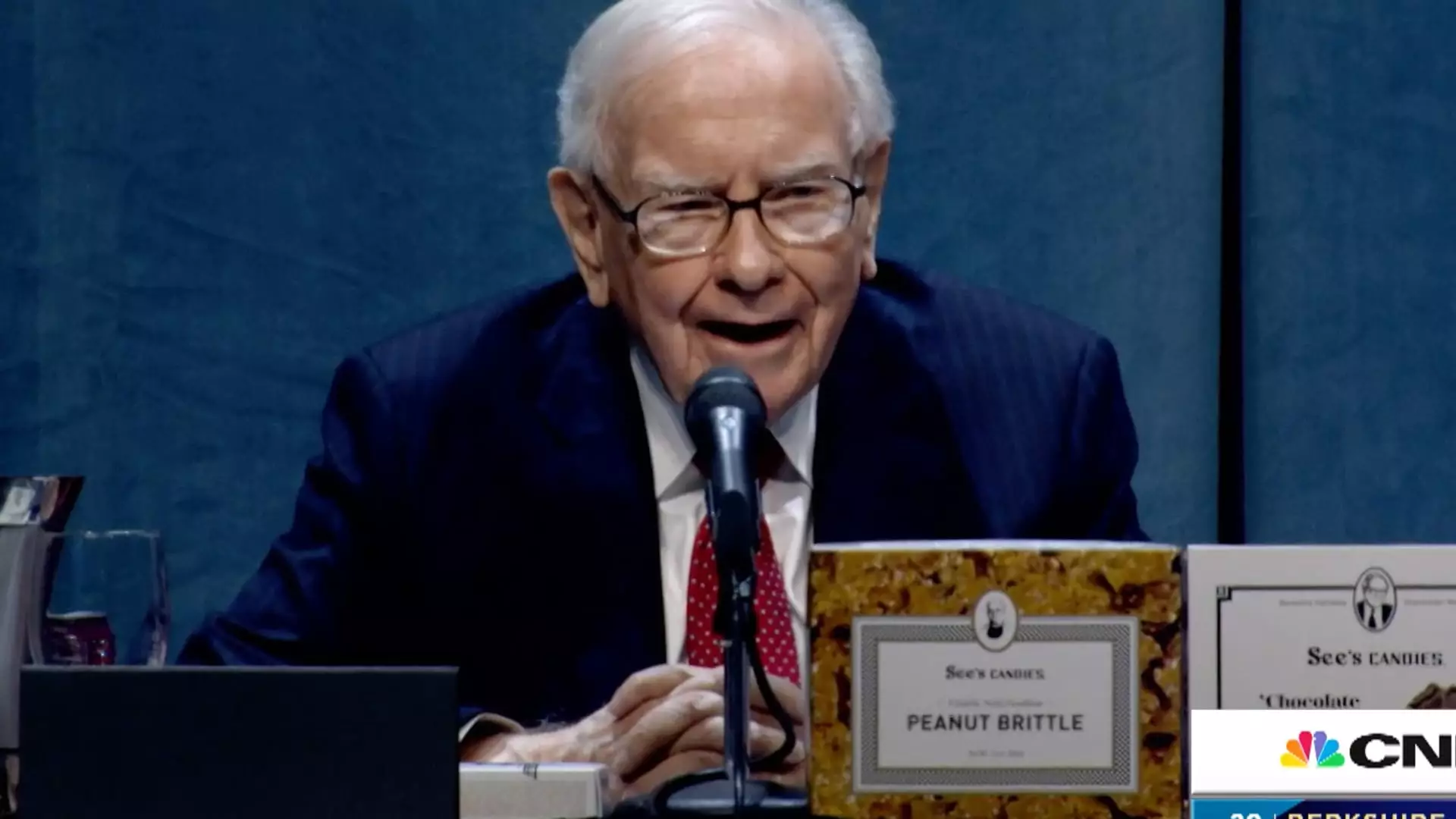

Warren Buffett, the legendary investor renowned for his value-driven investment philosophy, recently made headlines by sharing his insights about President Donald Trump’s proposed tariffs on international imports. During an interview with CBS News’ Norah O’Donnell, Buffett expressed his concerns that these protective duties could lead to inflationary pressures that would adversely affect consumers. He succinctly identified the essence of tariffs as being “an act of war” in economic terms, hinting at their disruptive potential on the global trading system. According to Buffett, tariffs impose a hidden tax on goods, making them progressively more expensive for consumers, and humorously remarked, “The Tooth Fairy doesn’t pay ’em!” illustrating his strong views on the policy’s implications.

Buffett’s comments shed light on the broader ramifications of tariff implementation, advocating for a thorough examination of the subsequent effects on both domestic and international markets. Historically, tariffs have been wielded as tools for political leverage, sparking trade conflicts that can spiral into unanticipated consequences. The investor emphasized the importance of asking, “And then what?”—a reminder to consider the cascading implications of such economic decisions. With the impending 25% tariffs on imports from countries like Mexico and Canada, as well as an additional levy on China, the potential for retaliatory actions cannot be ignored. Countries embroiled in trade disputes often look to counterbalance tariffs, complicating the international landscape even further.

Despite being reticent to comment directly on the current state of the economy, Buffett’s cautious stance has been evident in his investment strategies. In recent months, he has disposed of several stock positions and accumulated a record amount of cash—actions interpreted by analysts as indicative of either bearish market sentiments or strategic positioning for his eventual successor. Such moves illustrate Buffett’s acute awareness of market fluctuations and emerging economic challenges. This strategic shift coincides with broader concerns regarding stock valuations, as the S&P 500 has seen modest gains in a volatile environment, underscoring uncertainties within an economy facing slowdowns.

Buffett’s reflections on tariffs and their effects provide a critical overview of how economic policies can inadvertently impact the consumer landscape. As trade wars intensify and tariffs disrupt market equilibrium, it becomes increasingly urgent for policymakers to examine the long-term ramifications of their decisions. The implications of Buffett’s insights extend beyond individual businesses; they underscore the interconnectedness of global economies and the delicate balance that must be managed to maintain harmony within trade relationships. As this situation continues to evolve, stakeholders across the economic spectrum must remain vigilant in understanding how tariffs affect not only their bottom lines but also the consumers they ultimately serve.

Warren Buffett’s commentary serves as a cautionary tale on the risks associated with protective trade measures, urging thoughtful discourse on economic policies that foster growth rather than hinder it.

Leave a Reply