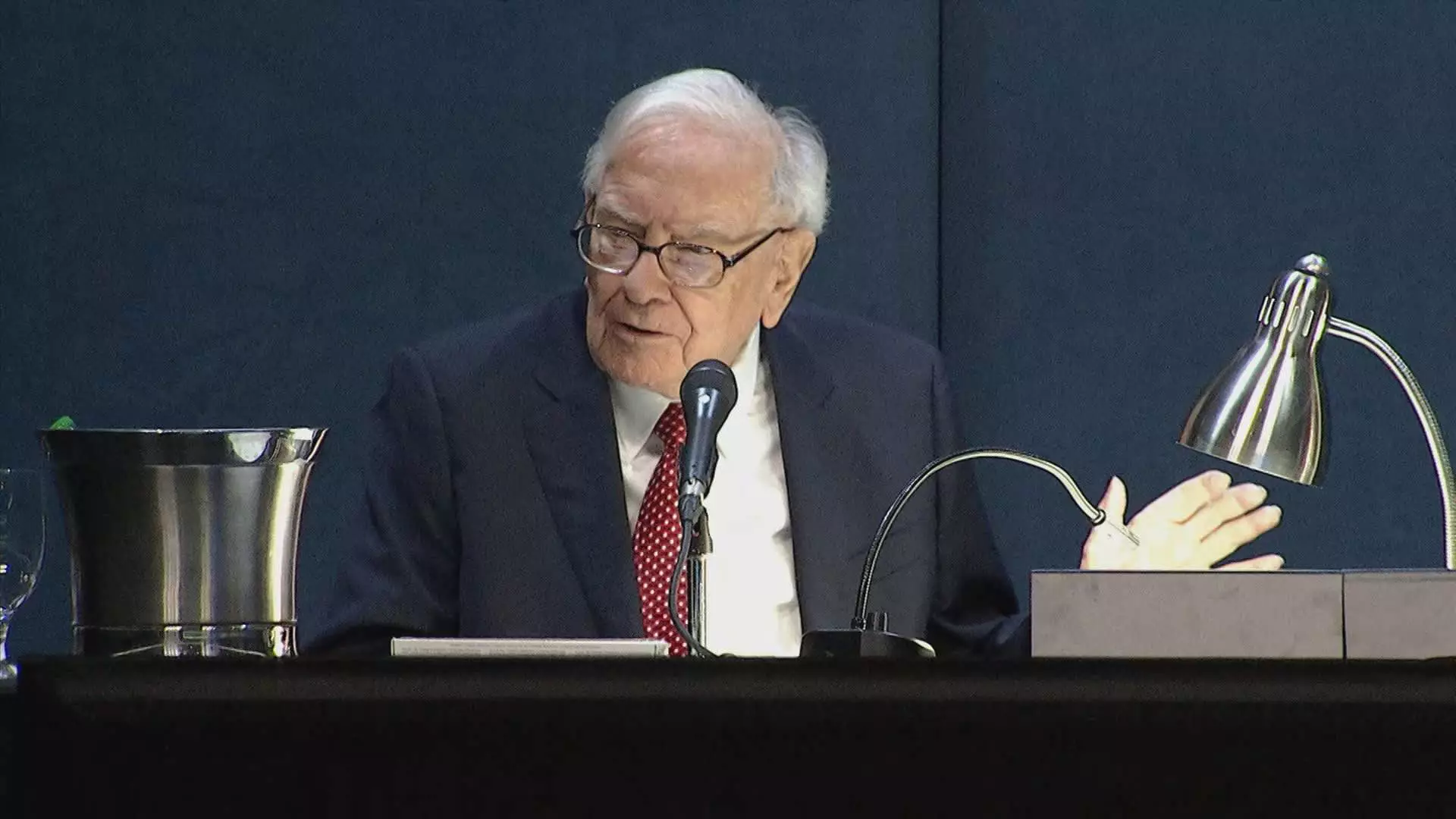

Warren Buffett, also known as the “Oracle of Omaha,” has made a thought-provoking move in his investment portfolio. Recently, it was revealed that Buffett now owns the exact same number of shares of Apple as he does Coca-Cola. This surprising revelation came after Berkshire Hathaway’s equity holdings were disclosed in a regulatory “13-F” filing. The fact that Buffett holds an identical 400 million share count in both Apple and Coca-Cola has left many investors puzzled but intrigued. It raises the question of whether this is just a coincidence or part of Buffett’s master investment plan.

Buffett’s relationship with Coca-Cola dates back to 1988 when he first bought 14,172,500 shares of the company. Over the years, he increased his stake to 100 million shares by 1994 and has since kept it steady at a round-number share count. Buffett’s attachment to Coca-Cola is evident from his long-term commitment to the company, treating it as a “permanent” holding in his portfolio. The sentimental value he associates with Coca-Cola goes back to his childhood when he discovered the product’s consumer appeal and commercial potential at a young age.

Despite being primarily known for his value investing principles, Buffett’s approach to tech giant Apple has been unconventional. He views Apple as a consumer products company rather than a pure technology investment, emphasizing the loyal customer base of the iPhone. Buffett’s admiration for Apple’s business model and market position led him to increase his stake in the company over the years. However, the recent decision to slash Berkshire’s holding in Apple by more than 49% raised eyebrows among investors.

The significant reduction in Berkshire’s stake in Apple triggered speculation about Buffett’s rationale behind the move. Some attributed it to portfolio management or a broader market view rather than a reflection of Apple’s future prospects. The decrease in Apple’s weighting in Berkshire’s portfolio from nearly 50% to about 30% has sparked debate among investors. While some believe it could be a strategic decision by Buffett, others dismiss it as a mere coincidence.

Despite the fluctuations in Berkshire’s holdings and the market reactions to his investment decisions, Buffett remains steadfast in his investment philosophy. The comparison between Coca-Cola and Apple as long-standing investments reflects Buffett’s belief in the lasting value of strong, consumer-focused companies. Whether it’s the iconic soft drink or the innovative tech giant, Buffett’s approach to investing revolves around identifying businesses with enduring consumer appeal and commercial success.

Warren Buffett’s equal holdings in Apple and Coca-Cola reveal an intriguing aspect of his investment strategy. The juxtaposition of two seemingly different companies in his portfolio underscores Buffett’s unique approach to investing. Whether it’s a coincidence or part of a grand plan, Buffett’s investment decisions continue to captivate the investment community and offer valuable insights into the world of finance.

Leave a Reply